AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

If you wish to Partner with the S.E.A.R. Hub contact us at helloATsearhubDOTcom (replace AT and DOT with @ and .) and let us know what you do and which category of service you provide i.e. RegTech, Professional Services and/or Training and details of your track record working in the field of regulated financial services.

Board directors & senior executives at regulated institutions in Ireland, big news today. 76 pages of big news! Central Bank (Individual Accountability Framework) Bill 2022 (Bill 75 of 2022) has been published - DOWNLOAD THE BILL HERE What is the Bill about? Go to read SEAR Hub's blog. Other ways to stay in contact include:

If you wish to Partner with the SEAR Hub contact us at helloATsearhubDOTcom. Let us know what you do & which category of service you provide i.e. RegTech, Professional Services and/or Training and & details of your track record working in the field of regulated financial services. Read the LinkedIN Post here

0 Comments

Read More

Back to Blog

Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information

If you are are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Hope you like the Map (Version 2.0)! Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. Welcome to the second edition (version 2.0) of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map. There are now 35 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at Monday 18th July 2022. The first 5 of these firms were registered in 2020. According to the FCA's records, the first registered Cryptoasset firm was Archax on 18 August 2020. Then in 2021, the FCA registered 22 crypto firms. Thus far in 2022, the FCA has registered 8 crypto firms. The most recent to be registered is DRW (7 June 2021). As we pointed out when we released Version 1.0 of the Map, 2021 saw a flurry of activity and especially in the last quarter of 2021 when 16 firms received their Cryptoasset registration from the FCA - that was a whopping 60% of the total pool of registered firms at that time. At the current rate, the number of firms registered in 2022 may be less than that in 2021, unless the FCA registers a large pile of crypto firms in the second half of 2022. As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. At the time we released Version 1, there were 218 (thereabouts) unregistered cryptoasset business listed on the UK FCA's website that appear, to the FCA, to be carrying on cryptoasset activity, that are not registered with the FCA for anti-money laundering purposes. As of today, that number has increased to 248. The firms thus far registered by the FCA include: 2020: Archax Ltd, Gemini Europe Ltd, Gemini Europe Services Ltd, Ziglu Limited, Digivault Limited, 2021: Fibermode Limited, Zodia Custody Limited, Ramp Swaps Limited, Solidi Ltd, Coinpass Limited, CoinJar UK Limited, Trustology Limited, Commercial Rapid Payment Technologies Limited, Iconomi Ltd, Skrill Limited, Paysafe Financial Services Limited, Crypto Facilities Ltd, Fidelity Digital Assets LTD, Payward Limited, Galaxy Digital UK Limited, BABB Platform Ltd, BCP Technologies Limited, Zumo Financial Services Limited, Baanx.com Ltd, Bottlepay Ltd, Genesis Custody Limited, Altalix Ltd, 2022: X Capital Group Limited, Enigma Securities Ltd, Light Technology Limited, eToro (UK) Ltd, Uphold Europe Limited, Wintermute Trading LTD, Rubicon Digital UK Limited and DRW Global Markets Ltd When we released Version 1 we noted that there were 37 firms Cryptoasset firms with Temporary Registration. You will see 39 on the previous list, but two of those firms were in fact registered - thus there seemed to be a timing issue of the records at the FCA. Regardless, some of the 37 achieved FCA registration in 2022 and others have dropped of the current list. Revolut Ltd, as of today, is the only firm listed on the Temporary Registration list and it was listed on December 2021 list too. Interestingly, in addition to a cryptoasset registration, the Revolut group hasn't achieved the obtaining of its much talked about bank authorisation in the UK either. We are looking forward to seeing how many more will be registered before the end of the year. This post also appears at:

Back to Blog

Any surprises here?

In the same week that Bank of England, Deputy Governor for Financial Stability (John Cunliffe) said “Financial assets with no intrinsic value … are only worth what the next buyer will pay. They are therefore inherently volatile, very vulnerable to sentiment and prone to collapse,” we learn of yet another crypto firm filing for bankruptcy and the protection it affords.. Put another way: technology can’t remove all financial risks. Celsius Network, one of the world’s largest cryptocurrency lenders, filed for bankruptcy, following a wave of digital asset companies that have frozen assets and entered restructuring amid a sharp sell-off in cryptocurrencies thus far in 2022. Its business model was simple old-fashioned lending. Celsius took in customer deposits and lent out the funds at higher interest rates, making a profit from the difference. There is nothing innovative here, just as there is nothing innovative about Buy-Now-Pay-Later (laybuy on an app). In both cases it is simply technology putting a new spin on an old play. To lure investors, Celsius offered high-interest rates and claimed its risks were small. Yet according to a Financial Times investigation, Celsius took on increased financial risks in recent months as demand for loans from institutional investors waned. This is classic behaviour by financial firms when they finally see the writing on the wall. What do we learn from the filing?

A rather ironic outcome of the Celsius failure is that Alvarez & Marsal, a consultancy best known for unwinding failed investment bank Lehman Brothers after the 2008 financial crisis, is Celsius’s restructuring adviser. Cunliffe is also reported saying "Cryptocurrencies may not be “integrated enough” into the rest of the financial system to be an “immediate systemic risk,” but he suspects the boundaries between the crypto world and the traditional financial system will “increasingly become blurred.”. Now Celsius is not alone. We have also seen the implosion of a highly leveraged crypto hedge fund, Three Arrows Capital, which filed for bankruptcy in July 2022 too. Crypto lender Voyager Digital also filed for bankruptcy recently while other companies narrowly averted a similar fate by taking in emergency cash at fire sale prices. BlockFi agreed to a rescue deal with crypto trading exchange FTX on July 1 that valued the lender at up to $240mn, far below an earlier valuation of $4bn. What about investors? I don't mean the customers but the backers. Celsius’s failure is poised to leave venture capital backers nursing large losses. In late 2021, it raised $750mn from WestCap and Quebec-based pension fund Caisse de dépôt et placement du Québec at a valuation of more than $3bn. Ouch - especially for current and future retirees of the pension fund. Did they sign up their money for such illiquid investments? Further Reading:

Back to Blog

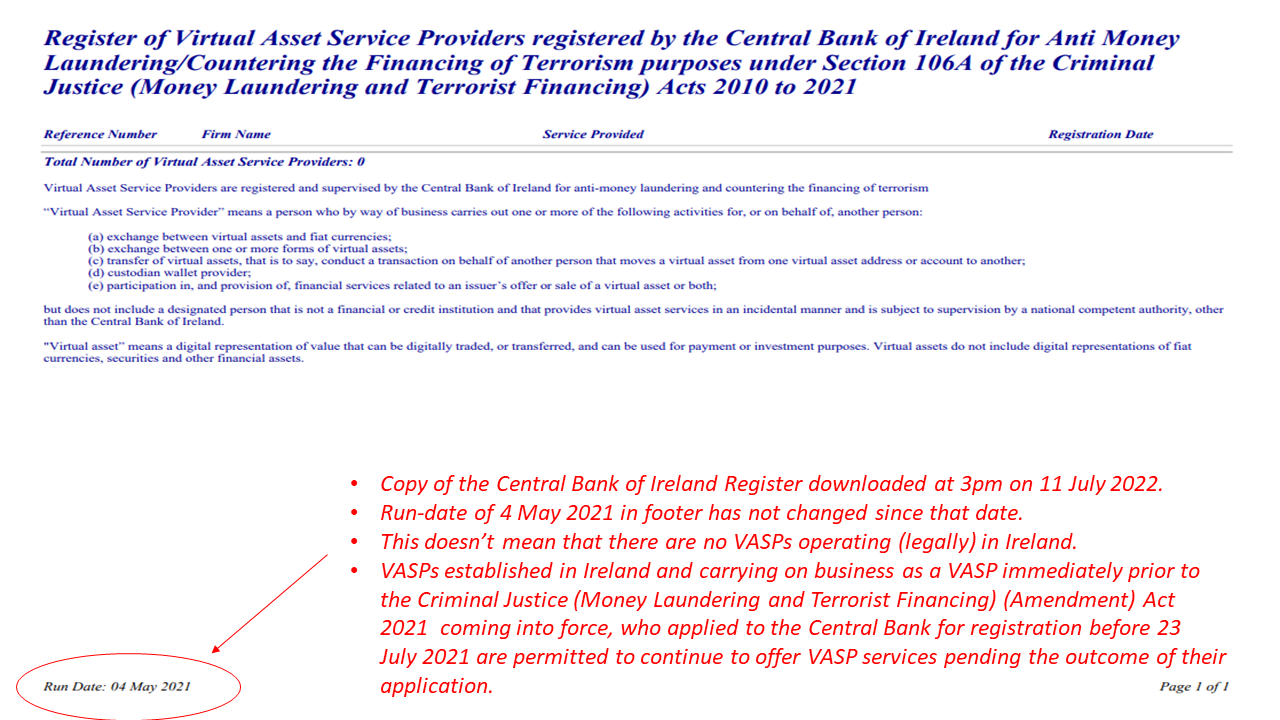

“All current and potential VASP applicants should review the content of the bulletin and take actions to rectify weaknesses, as relevant. Firms undertaking VASP activities are also reminded that a failure to register may result in significant criminal and/or administrative sanctions." Central Bank of Ireland If you need assistance with your Virtual Asset Service Provider registration application, or other regulatory authorisation application such as emoney, payment services or MiFID, get in touch with Peter Oakes at CompliReg by CLICKING HERE. Read more about the Virtual Asset Service Provider registration, emoney authorisation, payment institution authorisation and MiFID authorisation CLICK HERE. Today (Monday 11 July 2022) the Central Bank of Ireland issued a press release highlighting weaknesses in Virtual Asset Service Providers’ (VASP) AML/CFT Frameworks. As of today, according to the Central Bank's website, the total number of VASPs registered in Ireland is ZERO. See image below. Question: If there are no firms appearing on the register, does that mean that there are no VASPs operating lawfully in Ireland? Answer: No. VASPs established in Ireland and carrying on business as a VASP immediately prior to the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2021 coming into force, who applied to the Central Bank for registration before 23 July 2021 are permitted to continue to offer VASP services pending the outcome of their application ('transitional period'). While we have heard stories of firms operating as VASPs in Ireland in circumstances where they do not fall under the transitional period, such firms should be subject - if they came to the attention of the Central Bank - to criminal and/or regulatory investigation. Accompanying today's press release is a bulletin in relation to Virtual Asset Service Providers (VASPs), seeking to assist applicant firms to strengthen both their applications for registration and their Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Frameworks. The Central Bank says while it seeks to anticipate and support innovation in the financial services industry, firms operating in novel areas must ensure their businesses will not be used to launder the proceeds of crime or to finance terrorism. The Central Bank issued the bulletin to VASPs to assist them in strengthening their applications and frameworks. Background: Since 23 April 2021, VASPs are required to comply with the relevant AML/CFT obligations under the Criminal Justice Act 2010 to 2021. Any firm wishing to conduct business as a VASP must apply to the Central Bank for registration. The Central Bank says it is currently progressing the assessment of registration applications, and has provided feedback to 90% of applicants on their proposed AML/CFT frameworks. Findings: The Central Bank identified, in the vast majority of applications:

See below for further details on the Central Bank's 'findings' observations. The Central Bank reported that the lack of compliance, coupled with control weaknesses, resulted in a significant number of the applicant firms not being able to demonstrate that they could meet their AML/CFT obligations. Actions: The Central Bank has reconfirmed that it will only register a firm when it is satisfied that the firm can meet its AML/CFT obligations on an ongoing basis. It has said that all current and potential VASP applicants should:

The Central Bank also too the opportunity to remind that:

Key Central Bank observations on registrations received and assessed to dateIncomplete Applications: A number of registration applications did not contain the required information and documentation and consequently such applications did not progress to the assessment phase.

Assessment Phase: In undertaking its assessment of registration applications, the Central Bank noted recurring fundamental issues preventing approving of registration applications as the applicants could not meet their AML/CFT legislative obligations or the Central Bank’s expectations. The Central Bank communicated its concerns and expectations to the applicants for further consideration. The Central Bank helpfully provided a couple of pages in its bulletin (pages 4 - 6) giving an overview of recurring issues identified during the assessment of VASP registration applications. These are repeated below. Money Laundering and Terrorist Financing (ML/TF) Risk Assessment: An effective AML/CFT control framework is built on an appropriate ML/TF risk assessment that focuses on the specific ML/TF risks arising from the firm’s business model. This risk assessment should drive the firm’s AML/CFT control framework such that it ensures there are robust controls in place to mitigate and manage the specific risks identified through the risk assessment. The Central Bank identified a significant number of issues with the ML/TF risk assessments conducted by VASP applicant firms, including:

Policies and Procedures: When developing AML/CFT policies, controls and procedures (“AML/CFT P&Ps”), firms should maintain a detailed documented suite of AML/CFT P&Ps, which are:

The Central Bank identified a number of recurring issues with the AML/CFT P&Ps submitted by applicant firms including;

Customer Due Diligence (“CDD”): CDD involves more than just verifying the identity of a customer. Firms should collect and assess all relevant information in order to ensure that the firm:

The Central Bank identified a number of recurring issues with the CDD AML/CFT P&Ps submitted by applicant firms including;

Financial Sanctions Screening: The Central Bank’s expectation is that firms have an effective screening system in place, appropriate to the nature, size and risk of their business. In addition to this, firms should have clear escalation procedures in place to be followed in the event of a positive match.

Outsourcing: A firm can outsource certain AML/CFT Functions, but are reminded that the firm remains ultimately responsible for compliance with its obligations under CJA 2010 to 2021. It is expected that, where firms outsource AML/CFT functions, a documented agreement is in place that clearly defines the obligations of the outsource service provider. Firms should also evidence that sufficient oversight is conducted on the outsourced activity. A number of VASP applicant firms outsource certain AML/CFT functions to group-related parties and/or non-group related parties.

Individual Questionnaires for proposed Pre-Approval Controlled Function role holders: A number of firms have failed to or delayed in submitting Individual Questionnaires (IQs) for each of their proposed Pre-Approval Controlled Function (PCF) role holders. IQs should be submitted for each individual proposed to hold a PCF role as soon as practical. The Central Bank’s expectation on a firm’s presence in Ireland. In line with the principle of territoriality enshrined in the EU AML Directives and Section 25 of the CJA 2010 to 2021, the Central Bank expects a physical presence located in Ireland and for there to be at least one employee in a senior management role located physically in Ireland, to act as the contact person for engagement with the Central Bank. In addition, in accordance with Section 106 H of the CJA 2010 to 20212 , the Central Bank may refuse an application where the applicant is so structured, or the business of the applicant is so organised, that the applicant is not capable of being regulated to the satisfaction of the Central Bank. Further Reading: Press Release - Central Bank highlights weaknesses in Virtual Asset Service Providers’ AML/CFT Frameworks 11 July 2022

Back to Blog

AIB fined €83.3mn and EBS fined €13,4mnJust shy of €100mn, a total amount of fines of €96.7mn, were imposed by the Central Bank of Ireland against AIB and EBS for regulatory breaches affecting tracker mortgage customers.

In the case of:

Both fines are net of of a settlement discount procedure scheme, otherwise AIB's fine would have stood at €119,000,000 and EBS's fine at €19,143,000. The Central Bank’s Director of Enforcement and Anti-Money Laundering, Seána Cunningham said:

CBI Enforcement Publicity Statements:

Back to Blog

Not often, in fact exceptionally rare, that there is news of insider dealing cases being brought in Ireland. But that is a topic for another day.

For today (1 May 2022), a Panel of Assessors has, according to reports in both the Sunday Business Post and The Sunday Times [see links #1 & #2 below] concluded that Philip Lynch had indeed traded on insider information, but that there were mitigating factors in the case. The independent and expert panel concluded that Mr Lynch should receive a public caution, a penalty of €75,000; a disqualification for five years from being involved in any financial services provider; and that he should pay the Central Bank’s legal costs of €37,500. It is reported that Mr Lynch — who has been chief executive of two publicly listed companies in Ireland, One51 and IAWS — has accepted this outcome as punishment for contravening market abuse regulations while he was a director of C&C, which makes Bulmers cider. The case relates to a ten plus year investigation / inquiry into Mr Lynch buying 200,000 shares in C&C in 2008, when it was searching for a new chief executive. John Dunsmore, who was previously the chief executive of Scottish & Newcastle, became CEO in November 2008. The news sent shares in the company up over 26 per cent to €1.45. [see link #3 below] Last week, the Central Bank lodged High Court proceedings against the businessman as part of the enforcement process of its findings. The Central Bank issued its finding on December 22 last year and told Mr Lynch it would apply to the High Court to confirm the sanctions. The case is listed for hearing on the advance warning list under Ms Justice Mary Irvine on 23 May 2022 according to court records. Before the Panel of Assessor, the Central Bank had argued that Lynch ought to face a penalty of between €250,000 and €500,000, a public reprimand, and a period of disqualification for five years, because it argued the infringement was within the moderately serious range. The Central Bank's enforcement division argued that it was “beyond a reasonable doubt” that Mr Lynch was in possession of “inside information” when he bought shares in C&C on October 21, 2008. He was aware Dunsmore’s appointment would provide a “wow” factor in relation to the company’s share price. Lynch’s lawyers argued the sanctions were disproportionate, saying while he was aware of negotiations with Dunsmore, he was not certain of his appointment when buying the shares. His lawyers argued that there was no possibility of him making a short-term gain due to a one-year embargo on directors selling shares. Back in 2013 C&C was fined € 90,000 by the Central Bank for failing to keep up-to-date records on its “insider” list, the second time the financial regulator has taken action against a non-financial services firm. Between January 2nd, 2008 and January 29th, 2009, the Dublin- and London-listed firm was found to be in breach of the insider list requirements of the Market Abuse Directive. It failed to “regularly and promptly” update its insider list with the identity of people working for C&C who had access to inside information. It also failed to state on the list the date of each and every occasion on which it was updated. [see link #4]. If you are interested in reading about insider dealing case history in Ireland, although it is seven years old, see link #5, 'Lose lips and share flips'. Links below to source material:

Back to Blog

CompliReg is a leading provider of consultancy services to MiFID, Payments and Emoney firms. Our founder, Peter Oakes is an independent non-executive director of two Central Bank regulated MiFID firms, an emoney firm and a payments firm. Peter is a member of the Audit, Risk, Nomination, Remuneration and Internal Audit Committees of a number of firms. Read more about Peter's NED services and CompliReg's services. If below post on the marketing of complex investment products is of interest, then you should also look at our post of 1 December 2021 on the Central Bank's review findings on firms providing investment services. The Central Bank's found that there is a need to improve suitability assessments. Central Bank reviews identify issues in marketing of complex investment productsCentral Bank reviews identify issues in marketing of complex investment products

The Central Bank of Ireland has written to MiFID investment firms, outlining the findings from a series of targeted reviews of Structured Retail Products (SRPs). These reviews examined SRPs manufactured and distributed by investment firms in the MiFID investment sector. A number of areas were identified where further action is needed by firms to ensure their governance and oversight of SRPs keeps pace with an increasingly complex retail investment market, so that investors are appropriately protected. The reviews found a number of poor practices and weaknesses in firms’ processes, which increase risks to investors. This includes failure by firms to consider potential difficulties investors may have in understanding the complex features involved in some SRPs; failing to present past performance information in a fair and balanced manner; and not including prominent capital at risk warnings in marketing materials. Director of Consumer Protection, Colm Kincaid, said: “The retail investment market is changing rapidly, with an increasing shift away from traditional, capital protected products to more complex, capital at risk products. As complexity increases, so too do the risks to investors and the responsibilities regulated firms have to protect those investors’ best interests. Our recently published Outlook Report highlighted a number of risks for consumers from changing business practices and ineffective disclosures on investment products, as well as what we expect regulated firms to do to deal with those risks. The work we are publishing today builds on that Report. “We carried out these reviews because we want to see that regulated firms meet high standards in how they design, manufacture and distribute complex investment products to retail investors. In particular, we want to see that complex investment products are designed with real investment needs in mind, that they are targeted only at investors with those needs and that the risks are properly explained. We are requiring firms to take action to improve their performance on each of these fronts, as well as highlighting good practices which we want to see emulated across the sector.” The letter requires regulated firms to take action to identify a sufficiently granular target market for SRPs and to drive improvements in the quality and transparency of disclosures to investors of the risks relating to these products. In particular:

The Central Bank expects firms to adhere to high standards of investor protection, acting in the best interests of investors at all times. We continue to monitor developments in the retail investment market, and the findings of these reviews and the expectations set out in today’s letter will be considered as part of future supervisory engagements. ENDS Notes to Editors

Source: Central Bank of Ireland, 22 April 2022

Back to Blog

This blog by Peter Oakes, Founder of Fintech Ireland and CompliReg. Peter qualified as a lawyer in Australia, the UK and Ireland. He is a director of a number of regulated innovative fintech and adviser to fintech and crypto firms and their professional service providers. Contact him here and follow him on Linkedin and Twitter (Fintech Ireland Twitter). A summary of this material appears at Linkedin here The first Irish regulated funds to take exposure to crypto-assets have been approved by the Central Bank of Ireland (CBI). The funds, both Qualifying Investor AIFs (QIAIF), will obtain indirect exposure to Bitcoin, by acquiring cash-settled Bitcoin Futures traded on the Chicago Mercantile Exchange (CME). Before you get too excited looking to by some of the digital asset via the QIAIFs note that this channel of exposure is RESTRICTED TO PROFESSIONAL INVESTORS. [NB: As recently as March 2022 the the Central Bank has issued a warning on the risks of investing in crypto assets]. We have provided further details about the regulatory crypto investing landscape in Ireland under 'Further Reading' below. Last month the CBI informed industry bodies that it had approved in principle at least one QIAIF with a low level of exposure to cash settled Bitcoin futures traded on the CME. The two unnamed QIAIFs are the first type of such funds to provide indirect crypto exposure and approved by the CBI. If you want your existing QIAIFs or you wish to establish a new QIAIF to obtain exposure to crypto assets, get in touch (details above). I am asked on a regular basis by institutional investors and professional investors how they can get exposure to cryptocurrencies and other digitalassets via regulated products. Unless you are able to gain direct exposure via a virtual asset service provider (VASP), the Irish QIAIF model (non-UCITS) might be your avenue. Note however that the CBI has said it is highly unlikely to approve a UCITS proposing any exposure (either direct or indirect) to crypto assets. Thus retail investors wanting crypto exposure in Ireland need to turn to VASPs/Exchanges direct. Through Fintech Ireland, CompliReg and the industry experts network, we know the lawyers, ManCos and depositories / custodians who can assist institutional/professional firms and funds promoters looking to gain exposure to the crypto markets. Further, if you are seeking a registration as a virtual service asset provider or authorisation as a MiFID, emoney institution or payments institution to provide services to institutional, professional and retail clients, check out our Authorisation Page. Further reading:

Question. Can a RIAIF or a QIAIF invest either directly or indirectly in crypto-assets? Answer. Crypto-assets are generally considered to be private digital assets that depend primarily on cryptography and distributed ledger or similar technology. However, the nature and characteristics of crypto-assets vary considerably. For example, crypto-assets that are tokenised traditional assets (whose value is linked to an underlying traditional asset or a pool of traditional assets (such as financial instruments or commodities)) may have a different risk profile when compared to other crypto-assets that are based on an intangible or non-traditional underlying. For the purposes of this Q&A “crypto-asset” is used to refer to the latter type of crypto-asset. The Central Bank must be satisfied that direct or indirect exposure to crypto-assets is capable of being appropriately risk managed. As of the date of publication of this Q&A, the Central Bank has not seen information which would satisfy it that direct or indirect exposure to crypto-assets is capable of being appropriately risk managed. Though crypto-assets do not all have uniform characteristics, the Central Bank has noted that they can present significant risks, including liquidity risk; credit risk; market risk; operational risk (including fraud and cyber risks); money laundering / terrorist financing risk; and legal and reputation risks. Taking into account the specific risks attached to crypto-assets and the potential that retail investors will not be able to appropriately assess the risks of making an investment in a fund which gives such exposures, the Central Bank is highly unlikely to approve a RIAIF proposing any exposure (either direct or indirect) to crypto assets. In the case of a QIAIF seeking to gain exposure to crypto-assets, the relevant QIAIF would need to make a submission to the Central Bank outlining how the risks associated with such exposures could be managed effectively by the AIFM. The Central Bank’s approach in relation to crypto-assets will be kept under review, continue to be informed by European regulatory discussions on the topic and may change should new information or developments emerge in the future.

Question. Can a UCITS invest either directly or indirectly in crypto-assets? Answer. Crypto-assets are generally considered to be private digital assets that depend primarily on cryptography and distributed ledger or similar technology. However, the nature and characteristics of crypto-assets vary considerably. For example, crypto-assets that are tokenised traditional assets (whose value is linked to an underlying traditional asset or a pool of traditional assets (such as financial instruments or commodities)) may have a different risk profile when compared to other crypto-assets that are based on an intangible or non-traditional underlying. For the purposes of this Q&A “crypto-asset” is used to refer to the latter type of crypto-asset. The Central Bank must be satisfied that assets in which a UCITS invests are capable of meeting the eligible asset criteria for UCITS and that indirect exposure to the assets is capable of being appropriately risk managed. As of the date of publication of this Q&A, the Central Bank has not seen information which would satisfy it that crypto-assets are capable of meeting the eligible asset criteria for UCITS or that indirect exposure to crypto-assets is capable of being appropriately risk managed. Though crypto-assets do not all have uniform characteristics, the Central Bank has noted that they can present significant risks, including liquidity risk; credit risk; market risk; operational risk (including fraud and cyber risks); money laundering / terrorist financing risk; and legal and reputation risks. Taking into account the specific risks attached to crypto-assets and the potential that retail investors will not be able to appropriately assess the risks of making an investment in a fund which gives such exposures, the Central Bank is highly unlikely to approve a UCITS proposing any exposure (either direct or indirect) to crypto assets. The Central Bank’s approach in relation to crypto-assets will be kept under review, continue to be informed by European regulatory discussions on the topic and may change should new information or developments emerge in the future.

Back to Blog

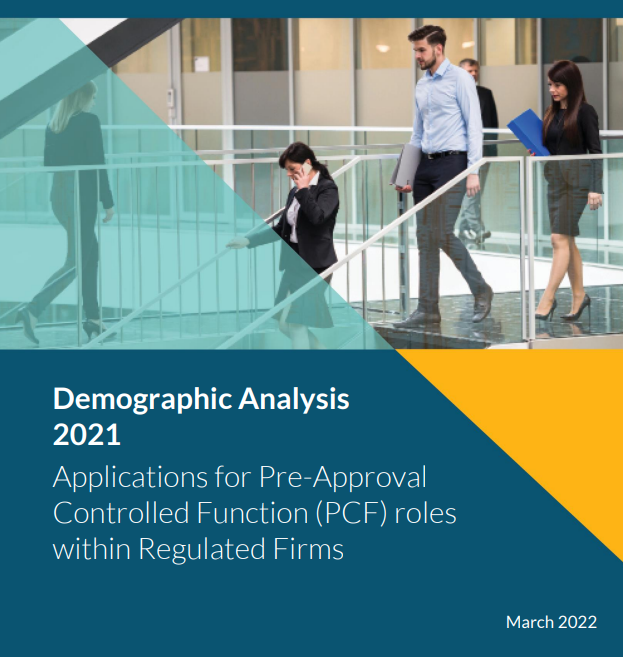

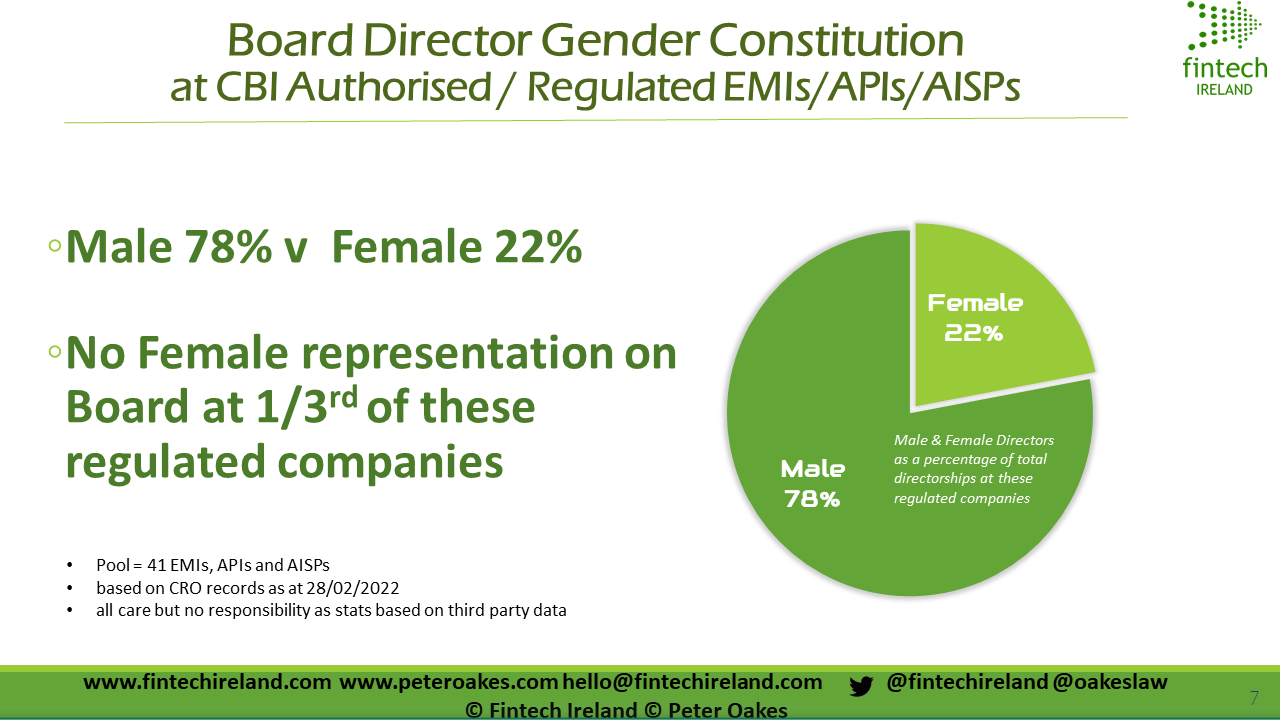

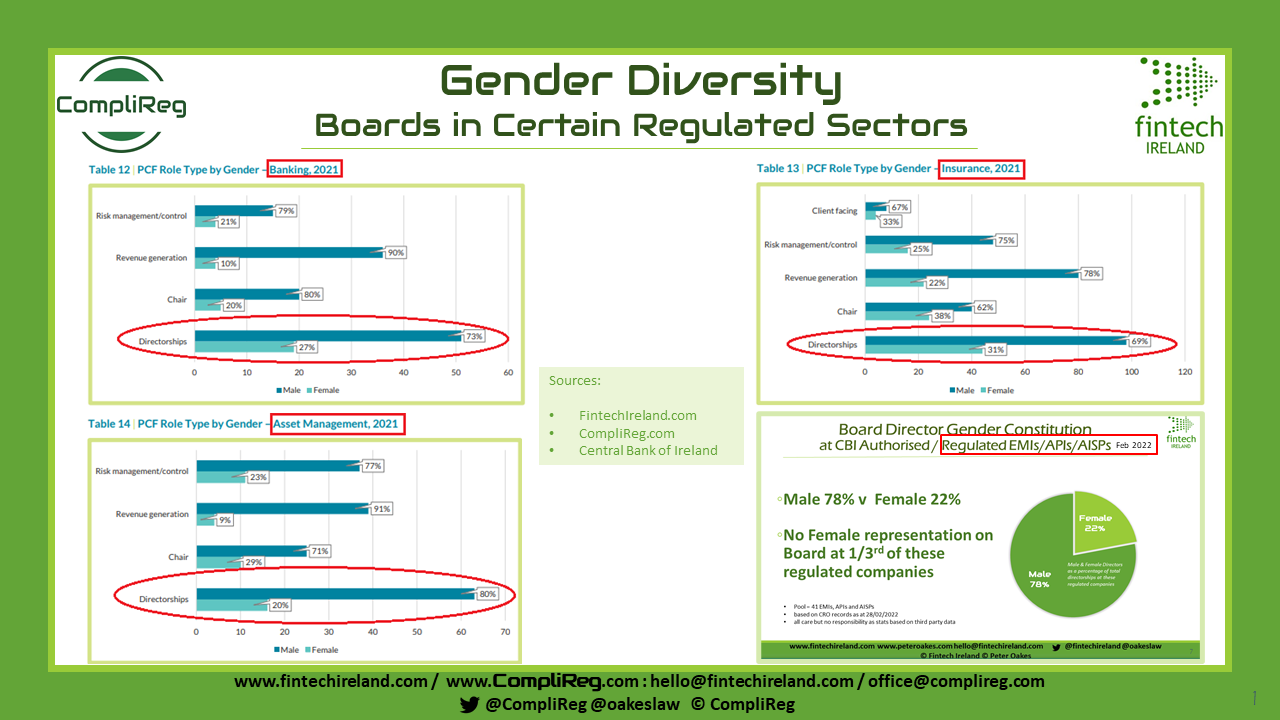

DOWNLOAD THE REPORT HERE “Regulated firms must prioritise diversity at senior levels to prevent groupthink, promote internal challenge, and protect consumers and investors” - Derville Rowland, Director General, Financial Conduct Editor: According to the Central Bank of Ireland (see pages 21-23 of the Report), the male v female percentage split at Board director level in 2021 is: * Banking sector - 73% male v 27% female (table 12 of CBI report) * Insurance sector - 69% male v 31% female (table 13 of CBI report) * Asset Management sector - 80% male v 20% female (table 14 of CBI report) According to Fintech Ireland, the male v female percentage split at Board director level in February 2022 for authorised emoney and payments firms and registered account information service providers sector is 78% male v 22% female. The above image is a curation of the Fintech Ireland and Central Bank of Ireland data. Gender diversity at senior levels in the regulated financial services sector is increasing but remains insufficient, according to the latest Central Bank of Ireland Demographic Analysis Report.

The annual publication analyses applications to hold certain senior roles within regulated firms that require the Central Bank’s prior approval under the Fitness & Probity Regime. The Central Bank received more than 3,500 such applications for Pre-Approval Control Function (PCF) roles in 2021. [NB: There are 53 Pre-Approval Controlled Functions, covering both board and management level appointments]. This is the sixth annual Demographic Analysis Report which breaks down the applications for regulatory approval by gender, age, and nationality. In addition to the 2021 analysis, today’s report also looks back at 10 years of PCF applications since the Fitness and Probity Regime took effect in 2012. Key developments outlined in the report include:

The analysis is primarily focused on gender diversity based on the data available. While this is only one form of diversity, it is a critically important one and also strongly indicative of wider diversity trends. Derville Rowland, Director General, Financial Conduct, said: “Whilst it is encouraging to see progress, it has been incremental over a decade, and firms simply must speed up. We remain of the view that a lack of diversity at senior management and board level is a leading indicator of heightened behaviour and culture risks. “Diversity extends beyond gender. Diversity, including age, ethnicity, educational and professional background, amongst other characteristics, is critical to developing an effective culture. Higher levels of diversity of thought can mitigate the risk of groupthink, improve decision-making, and increase the effectiveness of internal challenge and openness to change within firms. This is vital in terms of firms acting in the best interests of consumers and investors. “Given that diversity is so interconnected with risk, resilience and financial performance, it will continue to be a priority for the Central Bank.” Source: Central Bank of Ireland (08 March 2022)

Back to Blog

Key Findings of Cyprus National Risk Assessment with respect to Virtual Assets and Virtual Asset Service Providers (November 2021)Key Findings:

Recommended Actions:

|

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]