AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

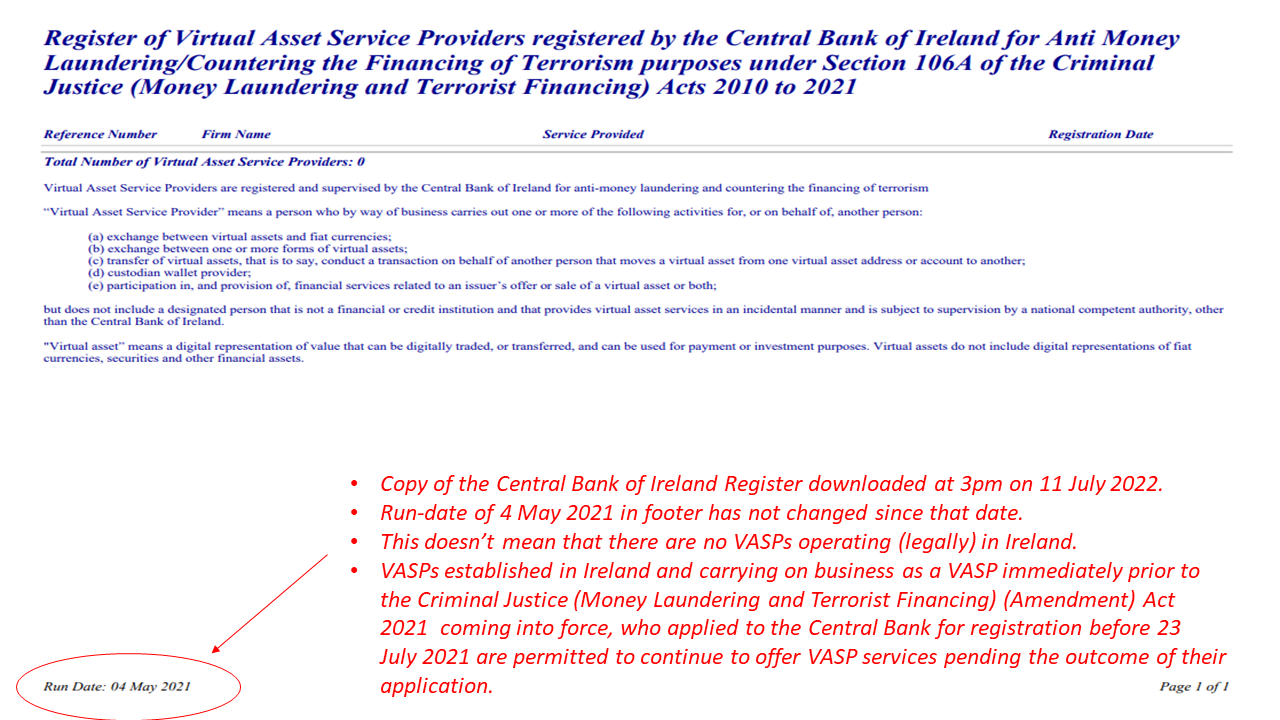

“All current and potential VASP applicants should review the content of the bulletin and take actions to rectify weaknesses, as relevant. Firms undertaking VASP activities are also reminded that a failure to register may result in significant criminal and/or administrative sanctions." Central Bank of Ireland If you need assistance with your Virtual Asset Service Provider registration application, or other regulatory authorisation application such as emoney, payment services or MiFID, get in touch with Peter Oakes at CompliReg by CLICKING HERE. Read more about the Virtual Asset Service Provider registration, emoney authorisation, payment institution authorisation and MiFID authorisation CLICK HERE. Today (Monday 11 July 2022) the Central Bank of Ireland issued a press release highlighting weaknesses in Virtual Asset Service Providers’ (VASP) AML/CFT Frameworks. As of today, according to the Central Bank's website, the total number of VASPs registered in Ireland is ZERO. See image below. Question: If there are no firms appearing on the register, does that mean that there are no VASPs operating lawfully in Ireland? Answer: No. VASPs established in Ireland and carrying on business as a VASP immediately prior to the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2021 coming into force, who applied to the Central Bank for registration before 23 July 2021 are permitted to continue to offer VASP services pending the outcome of their application ('transitional period'). While we have heard stories of firms operating as VASPs in Ireland in circumstances where they do not fall under the transitional period, such firms should be subject - if they came to the attention of the Central Bank - to criminal and/or regulatory investigation. Accompanying today's press release is a bulletin in relation to Virtual Asset Service Providers (VASPs), seeking to assist applicant firms to strengthen both their applications for registration and their Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Frameworks. The Central Bank says while it seeks to anticipate and support innovation in the financial services industry, firms operating in novel areas must ensure their businesses will not be used to launder the proceeds of crime or to finance terrorism. The Central Bank issued the bulletin to VASPs to assist them in strengthening their applications and frameworks. Background: Since 23 April 2021, VASPs are required to comply with the relevant AML/CFT obligations under the Criminal Justice Act 2010 to 2021. Any firm wishing to conduct business as a VASP must apply to the Central Bank for registration. The Central Bank says it is currently progressing the assessment of registration applications, and has provided feedback to 90% of applicants on their proposed AML/CFT frameworks. Findings: The Central Bank identified, in the vast majority of applications:

See below for further details on the Central Bank's 'findings' observations. The Central Bank reported that the lack of compliance, coupled with control weaknesses, resulted in a significant number of the applicant firms not being able to demonstrate that they could meet their AML/CFT obligations. Actions: The Central Bank has reconfirmed that it will only register a firm when it is satisfied that the firm can meet its AML/CFT obligations on an ongoing basis. It has said that all current and potential VASP applicants should:

The Central Bank also too the opportunity to remind that:

Key Central Bank observations on registrations received and assessed to dateIncomplete Applications: A number of registration applications did not contain the required information and documentation and consequently such applications did not progress to the assessment phase.

Assessment Phase: In undertaking its assessment of registration applications, the Central Bank noted recurring fundamental issues preventing approving of registration applications as the applicants could not meet their AML/CFT legislative obligations or the Central Bank’s expectations. The Central Bank communicated its concerns and expectations to the applicants for further consideration. The Central Bank helpfully provided a couple of pages in its bulletin (pages 4 - 6) giving an overview of recurring issues identified during the assessment of VASP registration applications. These are repeated below. Money Laundering and Terrorist Financing (ML/TF) Risk Assessment: An effective AML/CFT control framework is built on an appropriate ML/TF risk assessment that focuses on the specific ML/TF risks arising from the firm’s business model. This risk assessment should drive the firm’s AML/CFT control framework such that it ensures there are robust controls in place to mitigate and manage the specific risks identified through the risk assessment. The Central Bank identified a significant number of issues with the ML/TF risk assessments conducted by VASP applicant firms, including:

Policies and Procedures: When developing AML/CFT policies, controls and procedures (“AML/CFT P&Ps”), firms should maintain a detailed documented suite of AML/CFT P&Ps, which are:

The Central Bank identified a number of recurring issues with the AML/CFT P&Ps submitted by applicant firms including;

Customer Due Diligence (“CDD”): CDD involves more than just verifying the identity of a customer. Firms should collect and assess all relevant information in order to ensure that the firm:

The Central Bank identified a number of recurring issues with the CDD AML/CFT P&Ps submitted by applicant firms including;

Financial Sanctions Screening: The Central Bank’s expectation is that firms have an effective screening system in place, appropriate to the nature, size and risk of their business. In addition to this, firms should have clear escalation procedures in place to be followed in the event of a positive match.

Outsourcing: A firm can outsource certain AML/CFT Functions, but are reminded that the firm remains ultimately responsible for compliance with its obligations under CJA 2010 to 2021. It is expected that, where firms outsource AML/CFT functions, a documented agreement is in place that clearly defines the obligations of the outsource service provider. Firms should also evidence that sufficient oversight is conducted on the outsourced activity. A number of VASP applicant firms outsource certain AML/CFT functions to group-related parties and/or non-group related parties.

Individual Questionnaires for proposed Pre-Approval Controlled Function role holders: A number of firms have failed to or delayed in submitting Individual Questionnaires (IQs) for each of their proposed Pre-Approval Controlled Function (PCF) role holders. IQs should be submitted for each individual proposed to hold a PCF role as soon as practical. The Central Bank’s expectation on a firm’s presence in Ireland. In line with the principle of territoriality enshrined in the EU AML Directives and Section 25 of the CJA 2010 to 2021, the Central Bank expects a physical presence located in Ireland and for there to be at least one employee in a senior management role located physically in Ireland, to act as the contact person for engagement with the Central Bank. In addition, in accordance with Section 106 H of the CJA 2010 to 20212 , the Central Bank may refuse an application where the applicant is so structured, or the business of the applicant is so organised, that the applicant is not capable of being regulated to the satisfaction of the Central Bank. Further Reading: Press Release - Central Bank highlights weaknesses in Virtual Asset Service Providers’ AML/CFT Frameworks 11 July 2022

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]