AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

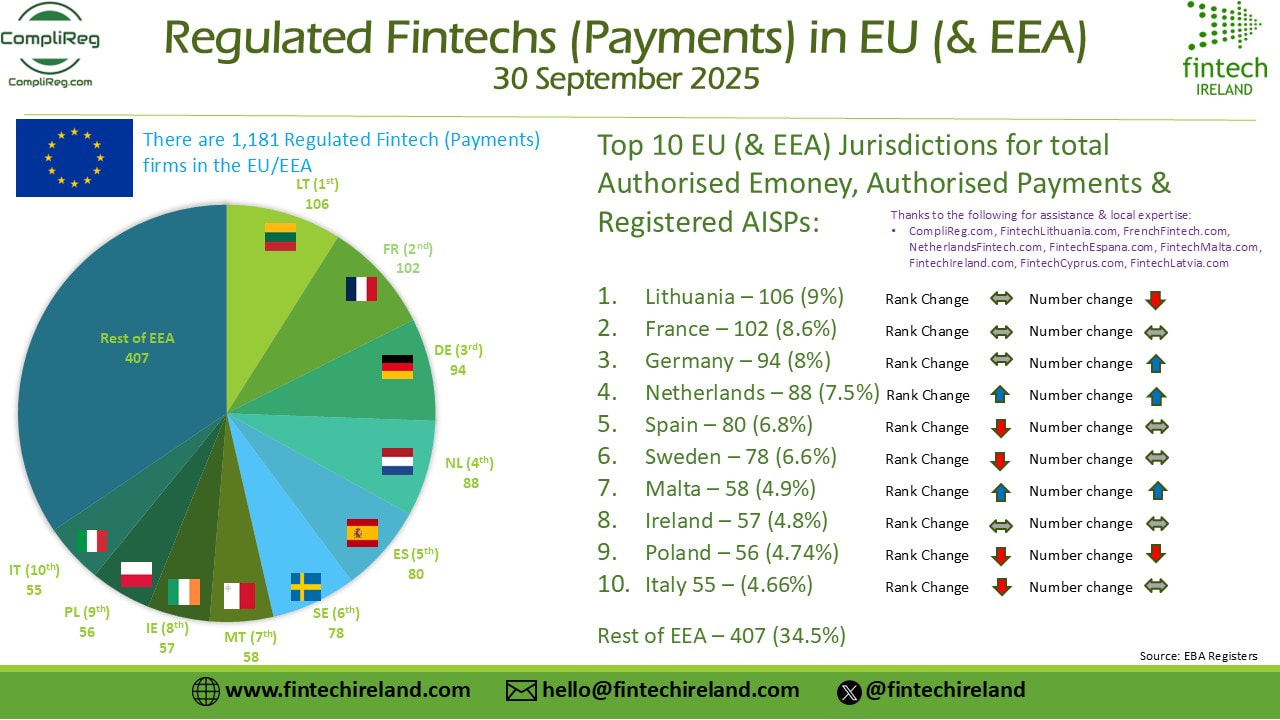

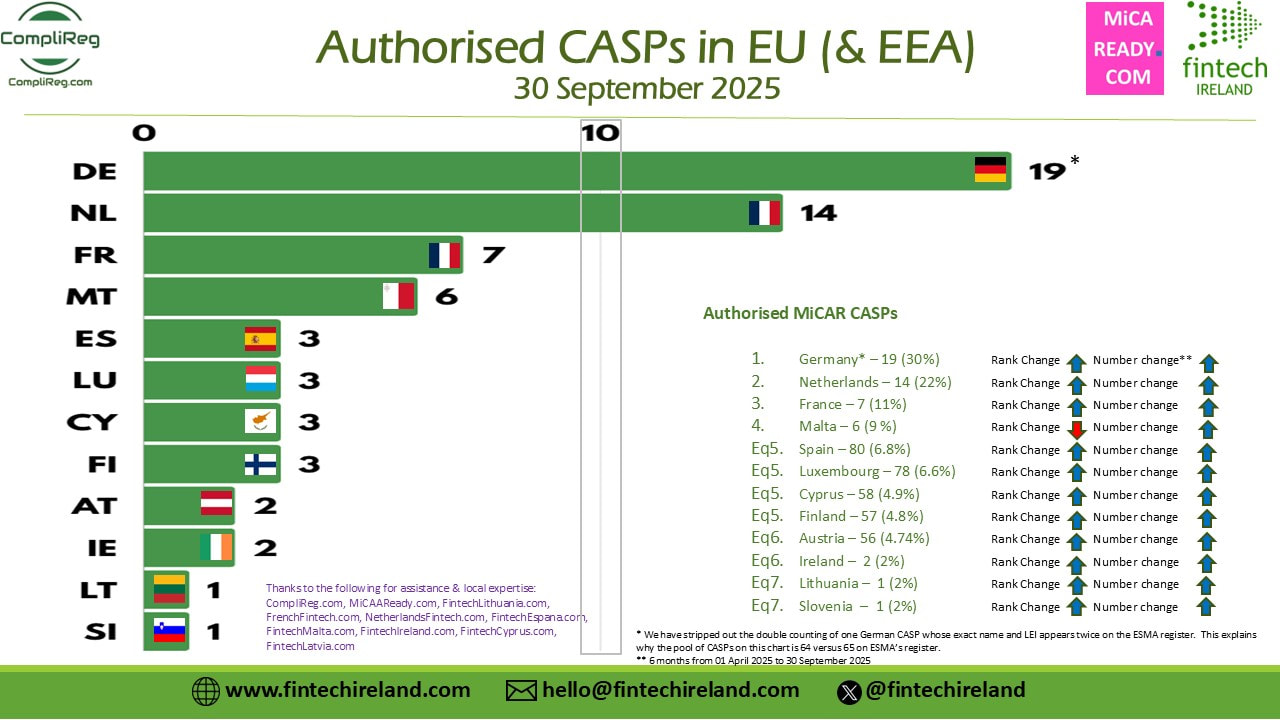

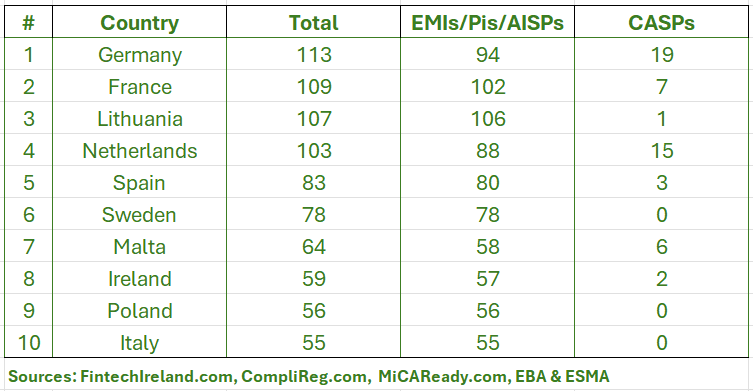

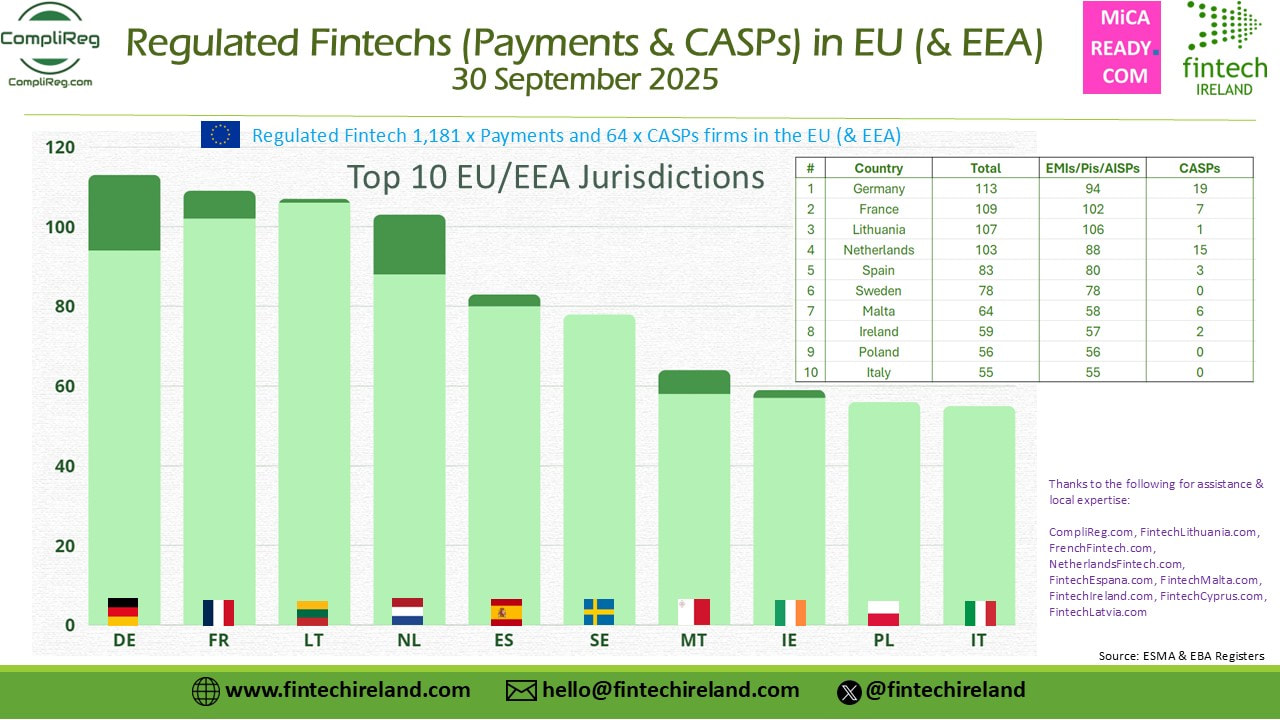

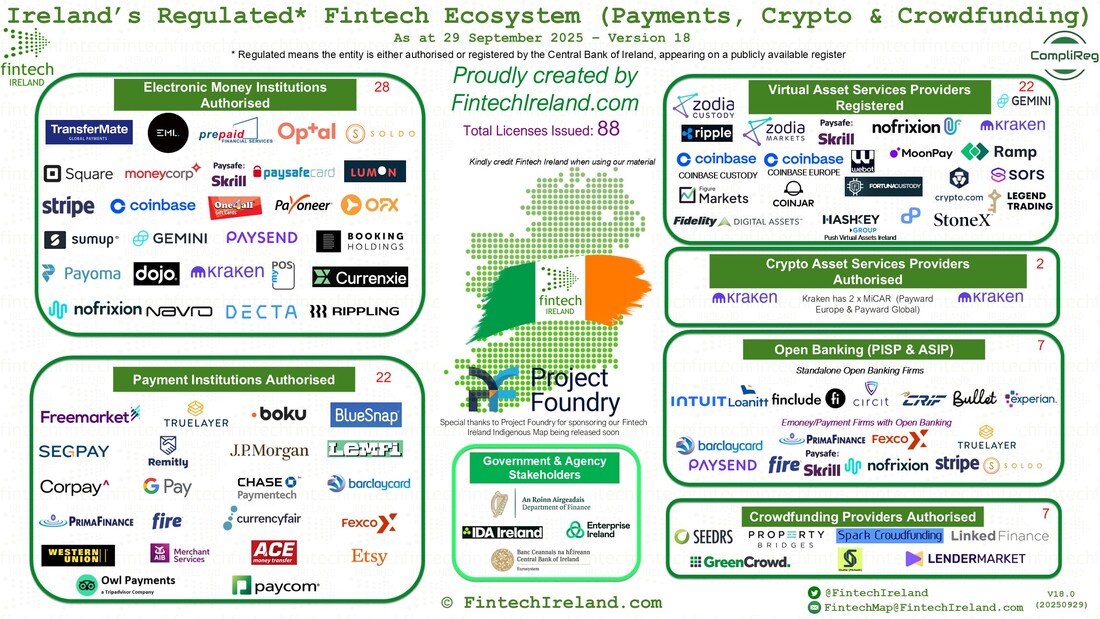

We appreciate when people and companies use the information we produce. Thank you. What we ask is that when doing so, you ensure that we are credited in a prominent part of your post or visual (not in a comment or at the end of the post). Yesterday we blogged about the release by Fintech Ireland of its Regulated Fintechs (EMoney, Payments & AISPs) in EEA Visual (repeated below). That Visual presented the top 10 EEA jurisdictions for regulated payment services as at 30 September 2025 and comprised of authorised emoney institutions, authorised payments institutions and registered account information services providers (but not CASPs/VASPs). In yesterday's post we promised to publish more information including data on the number of crypto-asset service providers authorised in the EU (& EEA) and also a combination of the two datasets to give a clear picture of the Top 10 EU Jurisdictions for the licensing of these innovative firms. Firstly, here is a reminder of yesterday's Visual to set the context: From the Visual above we see that the top 10 jurisdictions for Regulated Fintech (being authorised emoney, authorised payments and registered AISPs) are: Lithuania (106), France (102), Germany (94), The Netherlands (88), Spain (80), Sweden (78), Malta (58), Ireland (57), Poland (56) and Italy (55). You can find yesterday's blog here and the associated Linkedin Post here. Number of CASPs authorised in the EU (and EEA) The total number of authorised crypto-asset services providers in the EU (and the EEA) is 64 as at 29 September 2025 spread across 12 member states. The eagle-eyed amongst you may note that ESMA's register contains 65 entries. However on closer inspection, when one looks at the data recorded for German CASPs, one will note the name and LEI of one entity being repeated (i.e. Crypto Finance (Deutschland) GmbH). When stripped out that means that Germany (BaFIN) has authorised 19 entities as CASPs (not 20). In the next Visual immediately below one will see the EU (and EEA) jurisdictions where a CASP is authorised. Germany sets the pace with 19 CASP authorisations and is immediately followed by The Netherlands with 14. These two countries are the only ones where there are more than 10 CASPs authorised and they represent more than 50% of total authorised CASPs. Thereafter we have France with 7, Malta with 6 and 3 each in Spain, Cyprus Luxembourg and Finland. The final 4 countries making up list are Ireland and Austria with 2 CASPs each and Lithuania and Slovenia with 1 each. Since the last time we examined the number of authorised CASPs in the EU - back on 1 April - the number of authorisations reported to ESMA by NCAs increased 400% (albeit from a low base 😉 ). And Ireland authorised two CASPs in that period - both being entities within the Kraken crypto group (not a duplication!). A special blog is needed to examine the present position in Lithuania. Lithuania is home to literally hundreds of virtual asset services providers (VASPs). Is it not thus surprising that only one CASP has been authorised in Lithuania despite a massive VASP base? What happens to the Top 10 Jurisdictions when MiCAR authorisations and Payments authorisations are combined? If we combined the number of CASP authorisations with Payments authorisations (i.e. authorised emoney, authorised payments and AISP registrations) we land at the following table. From the table above, by combining both payments and CASPs into one dataset produces a new Top 10 of EU Jurisdictions. Germany comes out as the clear leader with a combined number of 113. Lithuania, which is in No. 1 for payments & emoney drops to 3rd place with a combined tally of 107. France comes in at No. 2 with 109. The larger number of authorised CASPs in Germany and France, 19 and 7 respectively, far exceeding the single CASP authorisation in Lithuania. The Netherlands has also accelerated its authorisation of CASPs, hitting 15 such authorisations bringing its combined total up to 103. Spain and Sweden come in at 5th and 6th place with 83 and 78 respectively. As we head down the chart, we find that Malta continues to cement its place as a leading fintech hub with a combined total of 64. Since the last time we examined in detail ESMA's CASP authorisation data back on 1 April 2025, Malta has only increased by (net) one authorisation. After Malta we find Ireland in 8th place at 59, then Poland with 56 in 9th place and closing the Top 10 with a respectable figure of 55 is Italy. You probably noted that Sweden, Poland and Italy make-up the Top 10 without a single CASP between them. Other interesting insights In the past 6 months (from 1 April to 30 September 2025) ESMA's records of authorised CASPs jumped 400% from 16 to 64. Back on 1 April the only countries that had notified ESMA of having authorised a CASP were Malta, the Netherlands, Cyprus, Luxembourg, Spain and Germany. In the past 6 months the following countries commenced authorising CASPs France, Lithuania, Ireland, Finland, Austria, Slovenia. As we head closer to the end of transitional periods in Europe through which VASPs seek to become authorised CASPs, we should expect to see dozens of new CASPs being authorised in Europe. If you found this information useful, you know what to do. Please go visit the Likedin Post and like the post, reshare the post and/or comment.

0 Comments

Read More

Back to Blog

We appreciate when people and companies use the information we produce. Thank you. What we ask is that when doing so, you ensure that we are credited in a prominent part of your post or visual (not in a comment or at the end of the post). Introduction Fintech Ireland is delighted to present the top ten EEA for regulated payment services (“Regulated Fintech”) as at 30 September 2025. To be more specific, this definition captures authorised emoney institutions, authorised payments institutions and registered account information services providers (but not CASPs/VASPs). Over the coming days we will be releasing more data on fintech authorisations/licences in the EEA, but for today we concentrate on the traditional payment services market. We like to thank CompliReg a leading provider of advice to firms seeking emoney, payments and MiCAR authorisations for helping pull this information together. Its extensive experience working across Europe and the UK is a big help in finding people to discuss our reports before they are released. Read the full blog at https://complireg.com/blogs--insights.html The last occasion we looked at the top 10 Regulated Fintechs was back on the 1 April this year. It was very interesting to look at developments in the EEA market over the past six months. What we have seen is static growth - just a 1% increase from 1,169 in April to 1,181 in September. The net difference of 12 Regulated Fintechs comprises of a net increase of 3 x emoney, 12 x payments and decrease of 3 x AISPs. This leaves us with 337 authorised emoney firms, 747 authorised payments firms and 97 registered AISPs. Who makes up the top 10? The top 10 jurisdictions based on the number of Regulated Fintech in order are: Lithuania (106), France (102), Germany (94), The Netherlands (88), Spain (80), Sweden (78), Malta (58), Ireland (57), Poland (56) and Italy (55). These countries comprise circa 65.5% of the total number of Regulated Fintechs in the EEA. While the countries comprising the top 10 remains the same, the rankings within the 10 has changed. Lithuania, France and Germany stay at #1, #2 and #3 respectively. The Netherlands has leapfrogged Spain taking the #4 position. The biggest mover within the top 10 is Malta, which rose from #10 position to #7. If you are reading this post and saying to yourself that you know you read of certain countries announcing new authorisations/registrations in the past 6 months, don’t forget that some firms also have their authorisations revoked or voluntarily withdrawn. Without analysing too much detail, one reason why Poland slipped from 7th to 9th is because of the large number of AISPs which were de-registered there in the past half year. Is there any threat to the current status quo of the Top 10? Sitting outside the top 10 and not quite within striking distance are Finland #11 (44), Cyprus #12 (41), Norway #13 (38), Belgium #14 (37) and in equal 15th both Czech Republic and Denmark with 33 each. We like to thank CompliReg a leading provider of advice to firms seeking emoney, payments and MiCAR authorisations for helping pull this information together and our friends at our Family of Fintech Nations for supporting this initiative (FintechLithuania.com, FrenchFintech.com, NetherlandsFintech.com, FintechEspana.com, FintechMalta.com, FintechIreland.com, FintechCyprus.com, FintechLatvia.com. No doubt over the coming days each of these will promote their own jurisdictions based on this report and again when we release some new MiCAR Authorisation facts and figures. If you found this useful, you know what to do. Please go https://www.linkedin.com/posts/peteroakes_fintech-micar-activity-7379541156264566784-mdPy and like the post, reshare the post and/or comment. The spread of emoney versus payments institutions Of Lithuania’s total of 106 Regulated Fintechs 70% (71) comprises emoney firms, with 32 payments firms and just 3 AISPs. In the past 6 months Lithuania’s population of emoney firms and payments firms has decreased by (net) 3 and 1 respectively. Meanwhile France’s bevy of Regulated Fintechs is skewered towards payments institutions. These make up 67% (68) of its total of 102. While Lithuania has the largest number of emoney firms authorised, Germany has the largest number of payments firms at 83, representing 88% of its total of 94. It is difficult to see the logic of why there is a somewhat less evenness of the emoney and payments firm split across all member states. There appears to be a lack of consistency across the EEA on defining when a company should be an emoney firm versus a payments firms. Malta Malta certainly stands out as a jurisdiction growing its Regulated Fintech base. It now sits at position #7. Yet while jumping three places from number 10 in the past 6 months it did so by merely increasing the number of net emoney firms from 34 to 37 – that’s right, by authorising 3 firms. When one throws in the number of MiCAR authorised firms into the definition of ‘Regulated Fintech’ expect to see Malta reach far loftier heights. Fintech Malta is working on a new Map for issue shortly. See www.FintechMalta.com and check out the event planned for 23 October 2025! Cyprus Cyprus saw a net increase of one firm. Fintech Cyprus is working on a new Map for issue shortly. www.FintechCyprus.com The Netherlands The Netherlands increase the number of Regulated Fintech by a net increase of 4 x emoney firms and 5 payments firms. Its website will be updated shortly with its first Fintech Map. Keep an eye on it. www.NetherlandsFintech.com Luxembourg Luxembourg’s overall net number of Regulated Fintech stayed steady 25. However it has commenced to authorise crypto-asset service providers. It is updating it Fintech Luxembourg Map, so keep an eye on www.FintechLuxembourg.com Ireland Ireland has arguably been viewed as one of the toughest jurisdictions within the EEA to obtain a fintech licence. Its regulator makes no apology for that and is arguably concerned about regulatory arbitrage across the EEA and in the past a race to the bottom by certain Member States in their approach to authorisations. Fintech Ireland recently released its Map of 88 fintechs which have a licence in Ireland. That Map includes emoney, payments, crowdfunding, VASPs and CASPs. Find that Map at https://fintechireland.com/news-insights/irelands-central-bank-has-issued-88-fintechs-licences-new-map-released-thanks-to-compliregcom. And don’t forget Fintech Ireland is hosting its 2nd Annual Fintech Ireland Summit on Thursday 27th November 2025. It is a great opportunity for the indigenous and international fintechs to gather under one roof. Get your tickets at www.fintechirelandsummit.com Fintech Region Family Our Fintech Region Family also comprises of - Lithuania (www.fintechlithuania.com), Croatia (www.fintechcroatia.com), Latvia (www.FintechLatvia.com), France (www.FrenchFintech.com), and Spain (www.FintechMalaga.com and www.FintechEspana.com)

Back to Blog

Friday 20th January 2023: Central Bank of Ireland (CBI) issued a Dear CEO letter to the fintech industries of electronic money institutions and payments institutions. The purpose is to reaffirm the CBI's supervisory expectations built on its supervisory experiences, both firm specific and sector wide, and enhance transparency around its approach to, and judgements around, regulation and supervision.

If you are looking to get authorised as an electronic money or payments institution in Ireland, contact us. We are working with a number of such applicants and we advise those already authorised on their on-going regulatory obligations, business models and strategy. See our Authorisation Page with links to useful Authorisation Guides. Busy start to the year with enquiries from UK, Asia and the US continuing to roll in about the benefits, opportunities and challenges of establishing a EEA regulated presence in Ireland, particularly for #emoney and #payments. While Ireland is in the top three of the final round, there remains stiff competition (so to speak) from two other leading jurisdictions. Thus it was good to see, , as I am sure others will agree, the Central Bank of Ireland most recent Dear CEO letter issued to emoney and payments institutions on Friday 20 January 2023 by Mary-Elizabeth McMunn, Director of Credit Institutions Supervision. It will help provide greater clarity not only to currently authorised emoney and payments firms, but also those in the authorisation pipeline and those thinking of filing in Ireland. It is a meaty document at 5,168 words across eleven (11) pages. Download a copy of the letter and additional relevant reading material here - https://complireg.com/blogs--insights/2023-dear-ceo-letter-re-supervisory-findings-and-expectations-for-payment-and-electronic-money-e-money-firms If you wish to get a quick understanding of the letter in terms of your regulatory obligations search the words 'we expect'. You will see those appear eleven (11) times too! Right now, best to mark in your calendar and work backwards, that an audit opinion on safeguarding, along with a Board response on the outcome of the audit, is to be submitted to the CBI by 31 July 2023. And it is not just a case of ringing your current external auditors and appointing them.

The purpose of the letter is to reaffirm the CBI's supervisory expectations built on its supervisory experiences, both firm specific and sector wide, and enhance transparency around our approach to, and judgements around, regulation and supervision. The breakdown of the letter is as follows: (1) Supervisory Approach for the Payment and E-Money Sector (provides wider and specific context to our supervisory approach). (2) Supervisory Findings (key findings from supervisory engagements over the last 12 months and actions the CBI expects firms to undertake) ➡ Safeguarding; ➡ Governance, Risk Management, Conduct and Culture; ➡ Business Model, Strategy and Financial Resilience; ➡ Operational Resilience and Outsourcing; ➡ Anti-Money Laundering and Countering the Financing of Terrorism;

(3) Conclusion and Actions Required (CBI's expectation that this letter is provided to and discussed with your Board, and any areas requiring improvement that directly relate to your firm are actioned). Next Steps: Get in contact with Peter Oakes / CompliReg. Founded by the CBI's inaugural Director of Enforcement and AML/CFT Supervision & board director of payments, emoney and MiFID companies. Peter is also a former: FSA (now FCA) enforcement lawyer; senior officer (legal) at ASIC; and adviser to the deputy director of banking at SAMA. Further Reading: 10 December 2021: Authorisation Guidance and Supervisory Expectations for Payment and Electronic Money Firms (Central Bank of Ireland) 09 December 2021: Central Bank of Ireland Dear CEO Letter on Supervisory Expectations for Payment and Electronic Money (E-Money) Firms

Back to Blog

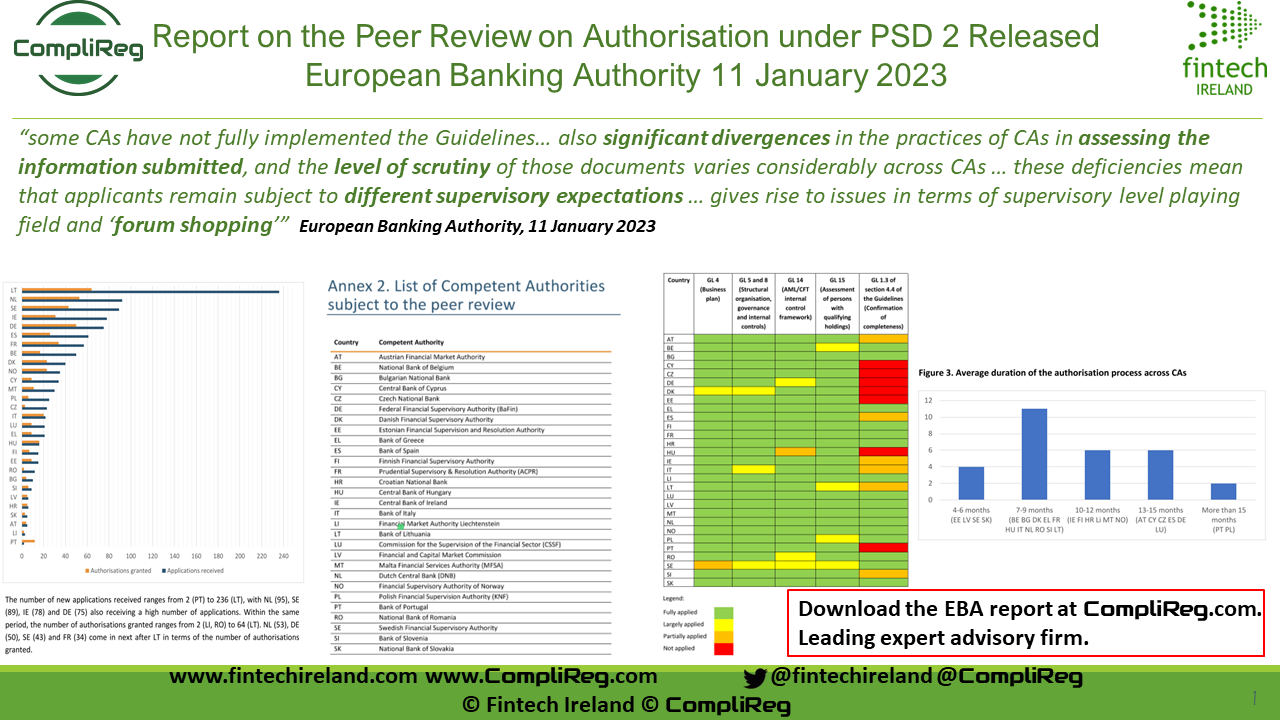

Report on the Peer Review on Authorisation under PSD 2 Released European Banking Authority11/1/2023 Are you looking for the Report on the Peer review on Authorisation under PSD2 released today by the European Banking Authority? Click here or the image above to download it in PDF format. If you are struggling with an application for an electronic money or payments institution authorisation in Europe, contact us here and/or complete the Authorisation/Licence Enquiry Form here. If you are looking at becoming authorised in Ireland as an emoney institution or payments institution check out Fintech Ireland's and CompliReg's authorisation guides here. What does the EBA peer review say?The report sets out the findings of the EBA’s peer review on the authorisation of #Payment Institutions (PIs) and #ElectronicMoney Institutions (EMIs). In executive summary format, the report says:

Some good supervisory practices observed by the EBASome good supervisory practices observed during the analysis that might be of benefit for other CAs to adopt.

Some recommendations identified by the EBAThe report expands on the recommendations included in the EBA’s response to the European Commission on the review of the PSD2 (EBA/Op/2022/06) and recommends that, as part of its ongoing PSD2 review process, the European Commission:

What are the objectives of the EBA report?The objectives of this report are to:

This report is also a partial fulfilment of the mandate conferred by the PSD2 on the EBA to review the Guidelines “on a regular basis and in any event at least every 3 years” (Article 5(5) PSD2). Which competent authorities are in scope?The peer review was performed by a Peer Review Committee of EBA and CA staff (see Annex 1 for the composition) and covered the CAs from all EU Member States and from two EEA States, as detailed in Annex 2. One EEA CA (IS) was not reviewed because it has only recently implemented the PSD2 and did not receive any application for the authorisation of PIs and EMIs in the period analysed (2019-2021). [CompliReg - not sure if IS is a typo, and should be 'SI' for Slovenia?] The Self-Assessment model adopted by the EBAThe analysis has been conducted based on the CAs’ responses to a self-assessment questionnaire (SAQ), which covered a three-year period from 1 January 2019 to 31 December 2021. Where necessary, the PRC followed up with the CAs in writing seeking further clarifications and explanations. The PRC also conducted interviews with a subset of 10 CAs (BG, DK, ES, PL, PT, MT, NL, IT, LT and SE) to gain a better understanding of their supervisory practices. EBA Conclusion on timeliness of the authorisation processPage 51, para 171 "5. Conclusions and recommendations" sates: "With regard to the timeliness of the authorisation process, the review found that, while all CAs comply with the requirement in Article 12 PSD2 to take a decision on an application within 3 months from receiving a complete application, the average duration of the authorisation process varies significantly across MS, ranging from 4-6 months to +20 months. The main reason for this is the quality of applications and applicants’ timeliness in addressing the issues identified with the application. The PRC also identified a number of other reasons for these variations in duration across CAs, which include different timelines set out in national law and different procedural approaches adopted by CAs in the acceptance and assessment of applications." [CompliReg - no doubt, and there is merit here, many firms will struggle with the EBA's finding that "all CAs comply with the requirement in Article 12 PSD2 to take a decision on an application within 3 months from receiving a complete application".] The constitution of the 'peer review committee'?The Peer reviews were carried out by ad hoc peer review committees composed of staff from the EBA and members of competent authorities, and chaired by the EBA staff. This peer review was carried out by:

List of Competent Authorities subject to the peer review

Back to Blog

CompliReg, your first choice for regualtory authorisations, licences and registrations is proud to support Fintech UK and its endeavours to Map the FCA registered cryptoasset market in the UK. Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Hope you like the Map (Version 4.0)! Welcome to the second edition (version 4.0) of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map.

There are now 37 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at Tuesday 16th August 2022. Welcome to Crypto.com. The FCA register records Foris DAX UK LTD (aka Crypto.com) registration effective 16th August 2022. At the time Version 1.0 was released there were 218 (thereabouts) unregistered cryptoasset business listed on the UK FCA's website that appear, to the FCA, to be carrying on cryptoasset activity, that are not registered with the FCA for anti-money laundering purposes. As of today (20 September 2022), that number has decreased by one to 247. On both 18th and 28th July 2022 the figure was 248. Read more at Fintech UK on facts and figures about the cryptoasset firms appearing on Version 4.0.

Back to Blog

Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information

If you are are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Hope you like the Map (Version 2.0)! Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. Welcome to the second edition (version 2.0) of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map. There are now 35 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at Monday 18th July 2022. The first 5 of these firms were registered in 2020. According to the FCA's records, the first registered Cryptoasset firm was Archax on 18 August 2020. Then in 2021, the FCA registered 22 crypto firms. Thus far in 2022, the FCA has registered 8 crypto firms. The most recent to be registered is DRW (7 June 2021). As we pointed out when we released Version 1.0 of the Map, 2021 saw a flurry of activity and especially in the last quarter of 2021 when 16 firms received their Cryptoasset registration from the FCA - that was a whopping 60% of the total pool of registered firms at that time. At the current rate, the number of firms registered in 2022 may be less than that in 2021, unless the FCA registers a large pile of crypto firms in the second half of 2022. As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. At the time we released Version 1, there were 218 (thereabouts) unregistered cryptoasset business listed on the UK FCA's website that appear, to the FCA, to be carrying on cryptoasset activity, that are not registered with the FCA for anti-money laundering purposes. As of today, that number has increased to 248. The firms thus far registered by the FCA include: 2020: Archax Ltd, Gemini Europe Ltd, Gemini Europe Services Ltd, Ziglu Limited, Digivault Limited, 2021: Fibermode Limited, Zodia Custody Limited, Ramp Swaps Limited, Solidi Ltd, Coinpass Limited, CoinJar UK Limited, Trustology Limited, Commercial Rapid Payment Technologies Limited, Iconomi Ltd, Skrill Limited, Paysafe Financial Services Limited, Crypto Facilities Ltd, Fidelity Digital Assets LTD, Payward Limited, Galaxy Digital UK Limited, BABB Platform Ltd, BCP Technologies Limited, Zumo Financial Services Limited, Baanx.com Ltd, Bottlepay Ltd, Genesis Custody Limited, Altalix Ltd, 2022: X Capital Group Limited, Enigma Securities Ltd, Light Technology Limited, eToro (UK) Ltd, Uphold Europe Limited, Wintermute Trading LTD, Rubicon Digital UK Limited and DRW Global Markets Ltd When we released Version 1 we noted that there were 37 firms Cryptoasset firms with Temporary Registration. You will see 39 on the previous list, but two of those firms were in fact registered - thus there seemed to be a timing issue of the records at the FCA. Regardless, some of the 37 achieved FCA registration in 2022 and others have dropped of the current list. Revolut Ltd, as of today, is the only firm listed on the Temporary Registration list and it was listed on December 2021 list too. Interestingly, in addition to a cryptoasset registration, the Revolut group hasn't achieved the obtaining of its much talked about bank authorisation in the UK either. We are looking forward to seeing how many more will be registered before the end of the year. This post also appears at:

Back to Blog

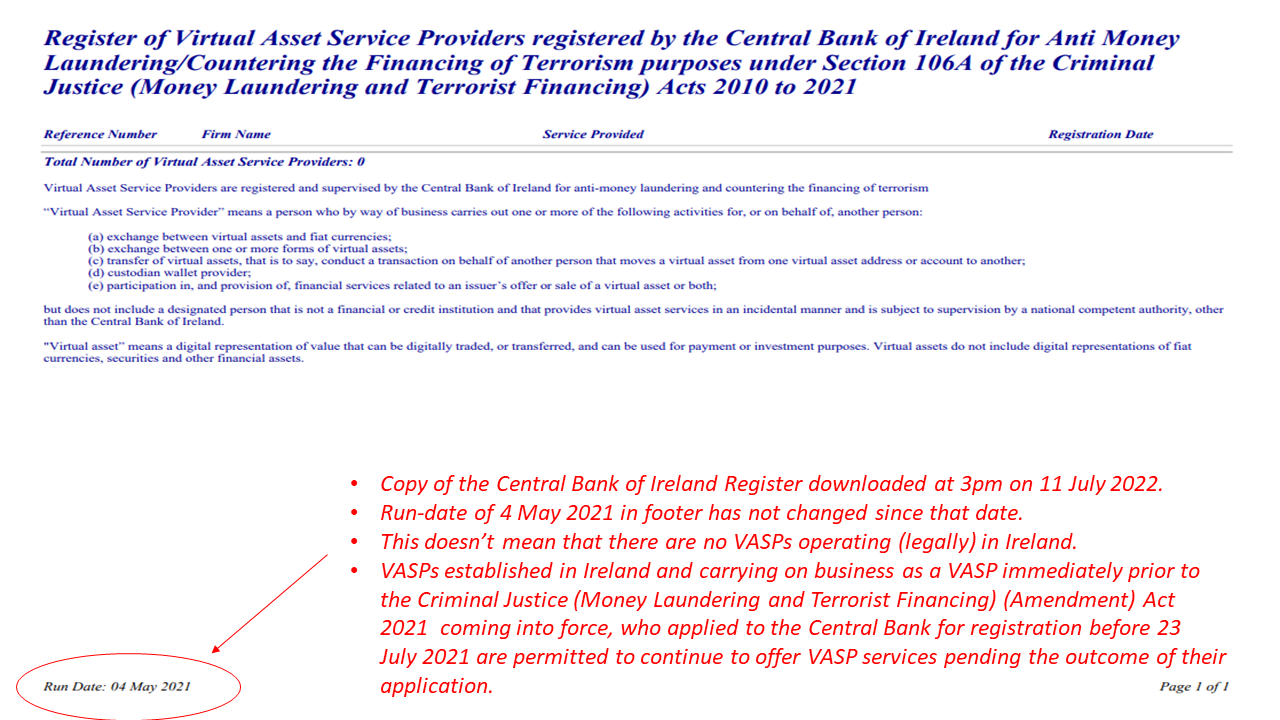

“All current and potential VASP applicants should review the content of the bulletin and take actions to rectify weaknesses, as relevant. Firms undertaking VASP activities are also reminded that a failure to register may result in significant criminal and/or administrative sanctions." Central Bank of Ireland If you need assistance with your Virtual Asset Service Provider registration application, or other regulatory authorisation application such as emoney, payment services or MiFID, get in touch with Peter Oakes at CompliReg by CLICKING HERE. Read more about the Virtual Asset Service Provider registration, emoney authorisation, payment institution authorisation and MiFID authorisation CLICK HERE. Today (Monday 11 July 2022) the Central Bank of Ireland issued a press release highlighting weaknesses in Virtual Asset Service Providers’ (VASP) AML/CFT Frameworks. As of today, according to the Central Bank's website, the total number of VASPs registered in Ireland is ZERO. See image below. Question: If there are no firms appearing on the register, does that mean that there are no VASPs operating lawfully in Ireland? Answer: No. VASPs established in Ireland and carrying on business as a VASP immediately prior to the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2021 coming into force, who applied to the Central Bank for registration before 23 July 2021 are permitted to continue to offer VASP services pending the outcome of their application ('transitional period'). While we have heard stories of firms operating as VASPs in Ireland in circumstances where they do not fall under the transitional period, such firms should be subject - if they came to the attention of the Central Bank - to criminal and/or regulatory investigation. Accompanying today's press release is a bulletin in relation to Virtual Asset Service Providers (VASPs), seeking to assist applicant firms to strengthen both their applications for registration and their Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Frameworks. The Central Bank says while it seeks to anticipate and support innovation in the financial services industry, firms operating in novel areas must ensure their businesses will not be used to launder the proceeds of crime or to finance terrorism. The Central Bank issued the bulletin to VASPs to assist them in strengthening their applications and frameworks. Background: Since 23 April 2021, VASPs are required to comply with the relevant AML/CFT obligations under the Criminal Justice Act 2010 to 2021. Any firm wishing to conduct business as a VASP must apply to the Central Bank for registration. The Central Bank says it is currently progressing the assessment of registration applications, and has provided feedback to 90% of applicants on their proposed AML/CFT frameworks. Findings: The Central Bank identified, in the vast majority of applications:

See below for further details on the Central Bank's 'findings' observations. The Central Bank reported that the lack of compliance, coupled with control weaknesses, resulted in a significant number of the applicant firms not being able to demonstrate that they could meet their AML/CFT obligations. Actions: The Central Bank has reconfirmed that it will only register a firm when it is satisfied that the firm can meet its AML/CFT obligations on an ongoing basis. It has said that all current and potential VASP applicants should:

The Central Bank also too the opportunity to remind that:

Key Central Bank observations on registrations received and assessed to dateIncomplete Applications: A number of registration applications did not contain the required information and documentation and consequently such applications did not progress to the assessment phase.

Assessment Phase: In undertaking its assessment of registration applications, the Central Bank noted recurring fundamental issues preventing approving of registration applications as the applicants could not meet their AML/CFT legislative obligations or the Central Bank’s expectations. The Central Bank communicated its concerns and expectations to the applicants for further consideration. The Central Bank helpfully provided a couple of pages in its bulletin (pages 4 - 6) giving an overview of recurring issues identified during the assessment of VASP registration applications. These are repeated below. Money Laundering and Terrorist Financing (ML/TF) Risk Assessment: An effective AML/CFT control framework is built on an appropriate ML/TF risk assessment that focuses on the specific ML/TF risks arising from the firm’s business model. This risk assessment should drive the firm’s AML/CFT control framework such that it ensures there are robust controls in place to mitigate and manage the specific risks identified through the risk assessment. The Central Bank identified a significant number of issues with the ML/TF risk assessments conducted by VASP applicant firms, including:

Policies and Procedures: When developing AML/CFT policies, controls and procedures (“AML/CFT P&Ps”), firms should maintain a detailed documented suite of AML/CFT P&Ps, which are:

The Central Bank identified a number of recurring issues with the AML/CFT P&Ps submitted by applicant firms including;

Customer Due Diligence (“CDD”): CDD involves more than just verifying the identity of a customer. Firms should collect and assess all relevant information in order to ensure that the firm:

The Central Bank identified a number of recurring issues with the CDD AML/CFT P&Ps submitted by applicant firms including;

Financial Sanctions Screening: The Central Bank’s expectation is that firms have an effective screening system in place, appropriate to the nature, size and risk of their business. In addition to this, firms should have clear escalation procedures in place to be followed in the event of a positive match.

Outsourcing: A firm can outsource certain AML/CFT Functions, but are reminded that the firm remains ultimately responsible for compliance with its obligations under CJA 2010 to 2021. It is expected that, where firms outsource AML/CFT functions, a documented agreement is in place that clearly defines the obligations of the outsource service provider. Firms should also evidence that sufficient oversight is conducted on the outsourced activity. A number of VASP applicant firms outsource certain AML/CFT functions to group-related parties and/or non-group related parties.

Individual Questionnaires for proposed Pre-Approval Controlled Function role holders: A number of firms have failed to or delayed in submitting Individual Questionnaires (IQs) for each of their proposed Pre-Approval Controlled Function (PCF) role holders. IQs should be submitted for each individual proposed to hold a PCF role as soon as practical. The Central Bank’s expectation on a firm’s presence in Ireland. In line with the principle of territoriality enshrined in the EU AML Directives and Section 25 of the CJA 2010 to 2021, the Central Bank expects a physical presence located in Ireland and for there to be at least one employee in a senior management role located physically in Ireland, to act as the contact person for engagement with the Central Bank. In addition, in accordance with Section 106 H of the CJA 2010 to 20212 , the Central Bank may refuse an application where the applicant is so structured, or the business of the applicant is so organised, that the applicant is not capable of being regulated to the satisfaction of the Central Bank. Further Reading: Press Release - Central Bank highlights weaknesses in Virtual Asset Service Providers’ AML/CFT Frameworks 11 July 2022

Back to Blog

This blog by Peter Oakes, Founder of Fintech Ireland and CompliReg. Peter qualified as a lawyer in Australia, the UK and Ireland. He is a director of a number of regulated innovative fintech and adviser to fintech and crypto firms and their professional service providers. Contact him here and follow him on Linkedin and Twitter (Fintech Ireland Twitter). A summary of this material appears at Linkedin here The first Irish regulated funds to take exposure to crypto-assets have been approved by the Central Bank of Ireland (CBI). The funds, both Qualifying Investor AIFs (QIAIF), will obtain indirect exposure to Bitcoin, by acquiring cash-settled Bitcoin Futures traded on the Chicago Mercantile Exchange (CME). Before you get too excited looking to by some of the digital asset via the QIAIFs note that this channel of exposure is RESTRICTED TO PROFESSIONAL INVESTORS. [NB: As recently as March 2022 the the Central Bank has issued a warning on the risks of investing in crypto assets]. We have provided further details about the regulatory crypto investing landscape in Ireland under 'Further Reading' below. Last month the CBI informed industry bodies that it had approved in principle at least one QIAIF with a low level of exposure to cash settled Bitcoin futures traded on the CME. The two unnamed QIAIFs are the first type of such funds to provide indirect crypto exposure and approved by the CBI. If you want your existing QIAIFs or you wish to establish a new QIAIF to obtain exposure to crypto assets, get in touch (details above). I am asked on a regular basis by institutional investors and professional investors how they can get exposure to cryptocurrencies and other digitalassets via regulated products. Unless you are able to gain direct exposure via a virtual asset service provider (VASP), the Irish QIAIF model (non-UCITS) might be your avenue. Note however that the CBI has said it is highly unlikely to approve a UCITS proposing any exposure (either direct or indirect) to crypto assets. Thus retail investors wanting crypto exposure in Ireland need to turn to VASPs/Exchanges direct. Through Fintech Ireland, CompliReg and the industry experts network, we know the lawyers, ManCos and depositories / custodians who can assist institutional/professional firms and funds promoters looking to gain exposure to the crypto markets. Further, if you are seeking a registration as a virtual service asset provider or authorisation as a MiFID, emoney institution or payments institution to provide services to institutional, professional and retail clients, check out our Authorisation Page. Further reading:

Question. Can a RIAIF or a QIAIF invest either directly or indirectly in crypto-assets? Answer. Crypto-assets are generally considered to be private digital assets that depend primarily on cryptography and distributed ledger or similar technology. However, the nature and characteristics of crypto-assets vary considerably. For example, crypto-assets that are tokenised traditional assets (whose value is linked to an underlying traditional asset or a pool of traditional assets (such as financial instruments or commodities)) may have a different risk profile when compared to other crypto-assets that are based on an intangible or non-traditional underlying. For the purposes of this Q&A “crypto-asset” is used to refer to the latter type of crypto-asset. The Central Bank must be satisfied that direct or indirect exposure to crypto-assets is capable of being appropriately risk managed. As of the date of publication of this Q&A, the Central Bank has not seen information which would satisfy it that direct or indirect exposure to crypto-assets is capable of being appropriately risk managed. Though crypto-assets do not all have uniform characteristics, the Central Bank has noted that they can present significant risks, including liquidity risk; credit risk; market risk; operational risk (including fraud and cyber risks); money laundering / terrorist financing risk; and legal and reputation risks. Taking into account the specific risks attached to crypto-assets and the potential that retail investors will not be able to appropriately assess the risks of making an investment in a fund which gives such exposures, the Central Bank is highly unlikely to approve a RIAIF proposing any exposure (either direct or indirect) to crypto assets. In the case of a QIAIF seeking to gain exposure to crypto-assets, the relevant QIAIF would need to make a submission to the Central Bank outlining how the risks associated with such exposures could be managed effectively by the AIFM. The Central Bank’s approach in relation to crypto-assets will be kept under review, continue to be informed by European regulatory discussions on the topic and may change should new information or developments emerge in the future.

Question. Can a UCITS invest either directly or indirectly in crypto-assets? Answer. Crypto-assets are generally considered to be private digital assets that depend primarily on cryptography and distributed ledger or similar technology. However, the nature and characteristics of crypto-assets vary considerably. For example, crypto-assets that are tokenised traditional assets (whose value is linked to an underlying traditional asset or a pool of traditional assets (such as financial instruments or commodities)) may have a different risk profile when compared to other crypto-assets that are based on an intangible or non-traditional underlying. For the purposes of this Q&A “crypto-asset” is used to refer to the latter type of crypto-asset. The Central Bank must be satisfied that assets in which a UCITS invests are capable of meeting the eligible asset criteria for UCITS and that indirect exposure to the assets is capable of being appropriately risk managed. As of the date of publication of this Q&A, the Central Bank has not seen information which would satisfy it that crypto-assets are capable of meeting the eligible asset criteria for UCITS or that indirect exposure to crypto-assets is capable of being appropriately risk managed. Though crypto-assets do not all have uniform characteristics, the Central Bank has noted that they can present significant risks, including liquidity risk; credit risk; market risk; operational risk (including fraud and cyber risks); money laundering / terrorist financing risk; and legal and reputation risks. Taking into account the specific risks attached to crypto-assets and the potential that retail investors will not be able to appropriately assess the risks of making an investment in a fund which gives such exposures, the Central Bank is highly unlikely to approve a UCITS proposing any exposure (either direct or indirect) to crypto assets. The Central Bank’s approach in relation to crypto-assets will be kept under review, continue to be informed by European regulatory discussions on the topic and may change should new information or developments emerge in the future.

|

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]