AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

Friday 20th January 2023: Central Bank of Ireland (CBI) issued a Dear CEO letter to the fintech industries of electronic money institutions and payments institutions. The purpose is to reaffirm the CBI's supervisory expectations built on its supervisory experiences, both firm specific and sector wide, and enhance transparency around its approach to, and judgements around, regulation and supervision.

If you are looking to get authorised as an electronic money or payments institution in Ireland, contact us. We are working with a number of such applicants and we advise those already authorised on their on-going regulatory obligations, business models and strategy. See our Authorisation Page with links to useful Authorisation Guides. Busy start to the year with enquiries from UK, Asia and the US continuing to roll in about the benefits, opportunities and challenges of establishing a EEA regulated presence in Ireland, particularly for #emoney and #payments. While Ireland is in the top three of the final round, there remains stiff competition (so to speak) from two other leading jurisdictions. Thus it was good to see, , as I am sure others will agree, the Central Bank of Ireland most recent Dear CEO letter issued to emoney and payments institutions on Friday 20 January 2023 by Mary-Elizabeth McMunn, Director of Credit Institutions Supervision. It will help provide greater clarity not only to currently authorised emoney and payments firms, but also those in the authorisation pipeline and those thinking of filing in Ireland. It is a meaty document at 5,168 words across eleven (11) pages. Download a copy of the letter and additional relevant reading material here - https://complireg.com/blogs--insights/2023-dear-ceo-letter-re-supervisory-findings-and-expectations-for-payment-and-electronic-money-e-money-firms If you wish to get a quick understanding of the letter in terms of your regulatory obligations search the words 'we expect'. You will see those appear eleven (11) times too! Right now, best to mark in your calendar and work backwards, that an audit opinion on safeguarding, along with a Board response on the outcome of the audit, is to be submitted to the CBI by 31 July 2023. And it is not just a case of ringing your current external auditors and appointing them.

The purpose of the letter is to reaffirm the CBI's supervisory expectations built on its supervisory experiences, both firm specific and sector wide, and enhance transparency around our approach to, and judgements around, regulation and supervision. The breakdown of the letter is as follows: (1) Supervisory Approach for the Payment and E-Money Sector (provides wider and specific context to our supervisory approach). (2) Supervisory Findings (key findings from supervisory engagements over the last 12 months and actions the CBI expects firms to undertake) ➡ Safeguarding; ➡ Governance, Risk Management, Conduct and Culture; ➡ Business Model, Strategy and Financial Resilience; ➡ Operational Resilience and Outsourcing; ➡ Anti-Money Laundering and Countering the Financing of Terrorism;

(3) Conclusion and Actions Required (CBI's expectation that this letter is provided to and discussed with your Board, and any areas requiring improvement that directly relate to your firm are actioned). Next Steps: Get in contact with Peter Oakes / CompliReg. Founded by the CBI's inaugural Director of Enforcement and AML/CFT Supervision & board director of payments, emoney and MiFID companies. Peter is also a former: FSA (now FCA) enforcement lawyer; senior officer (legal) at ASIC; and adviser to the deputy director of banking at SAMA. Further Reading: 10 December 2021: Authorisation Guidance and Supervisory Expectations for Payment and Electronic Money Firms (Central Bank of Ireland) 09 December 2021: Central Bank of Ireland Dear CEO Letter on Supervisory Expectations for Payment and Electronic Money (E-Money) Firms

0 Comments

Read More

Back to Blog

I am sure there will be opposing views, but delighted for fintech and innovative finserv in both the UK and Ireland being thrown a commonsense method to continue the transfer of personal data between the UK and Ireland with the European Commission giving the green light to data transfers between EU countries and the UK. This happened yesterday via the European Commission adopting two adequacy decisions for the United Kingdom, one under the General Data Protection Regulation and the other under the Law Enforcement Directive. I posted on the previous draft versions a while ago on Linkedin. In summary, this means that personal data can now flow freely between Ireland and the UK, with the Commission guaranteeing citizens that their data in the UK has “essentially the equivalent level of protection to that guaranteed under EU law”. As seems with everything involving dealings between the UK and Europe, the resolution was found at minutes to midnight (so to speak) with the interim bridging mechanism which permitted personal data to be transferred from the EU to the UK following the end of the Brexit transition period, expiring on 30 June 2021. Essentially the Commission has assured citizens that GDPR will be fully respected in the UK. What does this mean for standard contractual clauses (SCCs)? The new adequacy decisions mean that personal data can continue to be transferred from the EU to the UK without additional steps such as the SCCs being put in place. “The UK has left the EU but today its legal regime of protecting personal data is as it was. Because of this, we are adopting these adequacy decisions today. At the same time, we have listened very carefully to the concerns expressed by the Parliament, the Members States and the European Data Protection Board, in particular on the possibility of future divergence from our standards in the UK's privacy framework. We are talking here about a fundamental right of EU citizens that we have a duty to protect. This is why we have significant safeguards and if anything changes on the UK side, we will intervene”. Věra Jourová, EC Vice-President for Values and Transparency, Key elements of the adequacy decisions

The adequacy decisions also facilitate the correct implementation of the EU-UK Trade and Cooperation Agreement, which foresees the exchange of personal information, for example for cooperation on judicial matters. Both adequacy decisions include strong safeguards in case of future divergence such as a ‘sunset clause', which limits the duration of adequacy to four years. “After months of careful assessments, today we can give EU citizens certainty that their personal data will be protected when it is transferred to the UK. This is an essential component of our new relationship with the UK. It is important for smooth trade and the effective fight against crime. The Commission will be closely monitoring how the UK system evolves in the future and we have reinforced our decisions to allow for this and for an intervention if needed. The EU has the highest standards when it comes to personal data protection and these must not be compromised when personal data is transferred abroad.” Didier Reynders, Commissioner for Justice Background

On 19 February, the Commission published two draft adequacy decisions and launched the procedure for their adoption. Over the past months, the Commission has carefully assessed the UK's law and practice on personal data protection, including the rules on access to data by public authorities in the UK. The Commission has been in close contact with the European Data Protection Board, which gave its opinion on 13 April, the European Parliament and the Member States. Following this in-depth process, the European Commission requested the green light on the adequacy decisions from Member States' representatives in the so-called comitology procedure. The adoption of the decisions today, following the agreement from Member States' representatives, is the last step in the procedure. The two adequacy decisions enter into force today (ie 28 June 2021). The EU-UK Trade and Cooperation Agreement (TCA) includes a commitment by the EU and UK to uphold high levels of data protection standards. The TCA also provides that any transfer of data to be carried out in the context of its implementation has to comply with the data protection requirements of the transferring party (for the EU, the requirements of the GDPR and the Law Enforcement Directive). The adoption of the two unilateral and autonomous adequacy decisions is an important element to ensure the proper application and functioning of the TCA. The TCA provides for a conditional interim regime under which data can flow freely from the EU to the UK. This interim period expires on 30 June 2021. Read more here

Back to Blog

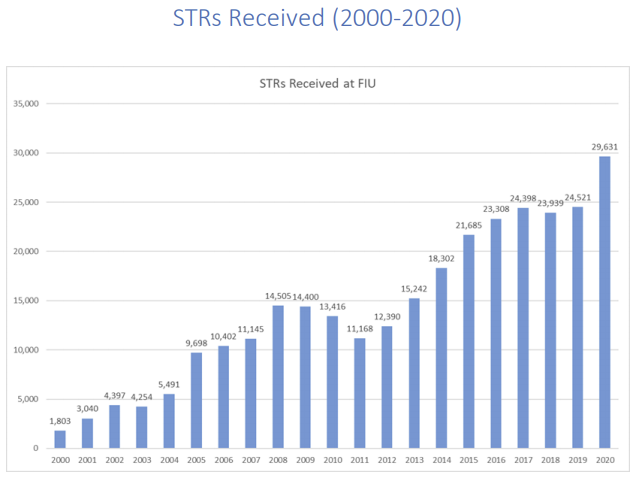

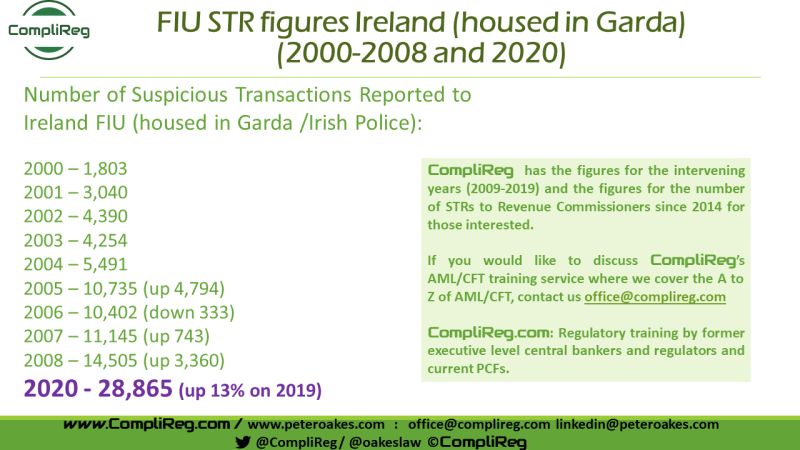

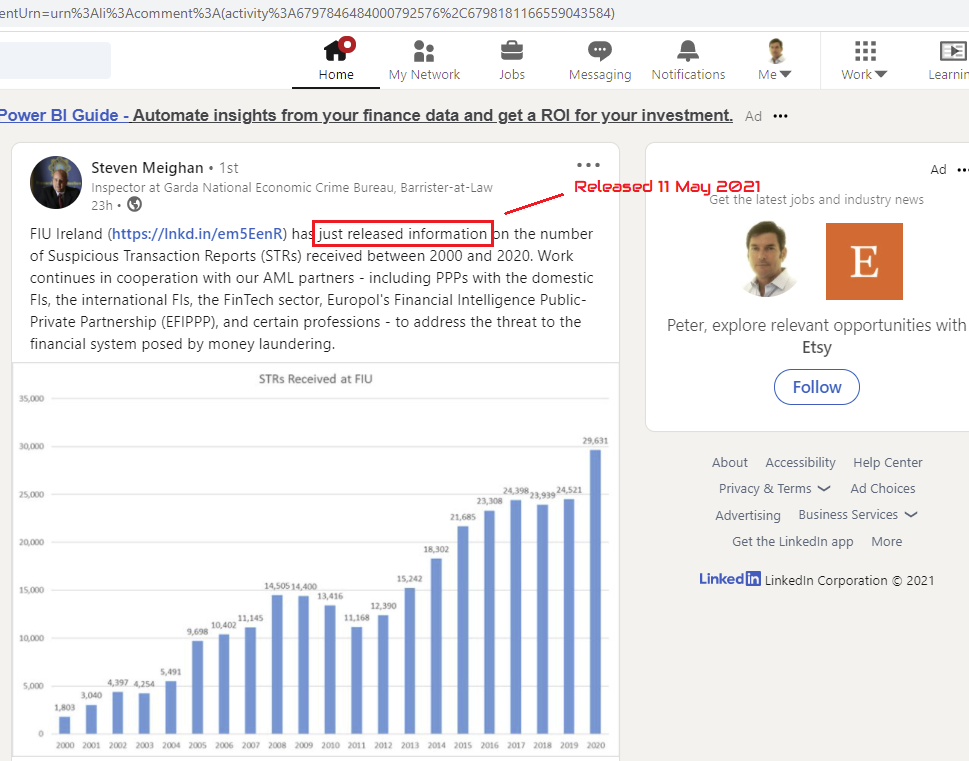

Less than a week ago there was no readily accessible and publicly available data (in one spot) for historic figures on the number of money laundering suspicious transaction reports in Ireland. To assist my GRC network which ask me regularly about such data, I put out a few posts on Linkedin, including this one - https://bit.ly/3o8JvCt. I received some responses and comments politely querying the accuracy of my figures. In reply I posted the underlying sources, being the Garda (Irish Police) / FIU Ireland and Financial Action task force. At the time, the only available data for 2020 was by journalist Conor Lally, at the Irish Times in his article of 4 May 2021. Jump forward to today (or perhaps it was yesterday as there is no date), the Financial Intelligence Unit in Ireland published the above image and a three (3) page report providing details on STRs Received (2000-2020). If you visit that site and the data does not appear, no problem, I have uploaded the file here. I am glad to see that my data and that of the FIU matches for the years 2000, 2001, 2003 & 2004. For 2002 I have 4,390 v FIU figure of 4,397 and in for 2005 I have 10,735 v FIU figure of 9,698 (hardly material). Still I find this strange as my figures were sourced from Garda & FATF reports at the time. When I published the 2020 figure of 28,865, that was based on the above Irish Times article which was published at least 10 days before the FIU publication which reported 29,631 (2.5% difference - or a rounding error!). Thanks to Steven Meighan for his LinkedIN post yesterday (11 May 2021) and previous engagement on money laundering STRs. A good thing about Linkedin is that it gets people engaged & often leads to great outcomes, like the publishing by the FIU / Garda of such comprehensive data for the first time in one consolidated document and easily accessible. We all now have an agreed historical set of facts and figures, and given it is published by FIU Ireland, it's official data. Other areas of the FIU release which caught my eye are:

Back to Blog

The Central Bank of Ireland has released a Dear CEO letter setting out findings under four headings and expected Actions following a Thematic assessment of Algorithmic Trading Firms’ compliance with RTS 6 of MIFID II.

1. Governance – Deficient control and risk management frameworks: Varying levels of maturity were observed with respect to firms’ governance, control and risk management frameworks. Supervisors observed weaknesses with respect to:

The Central Bank considers the maintenance of a robust algorithmic governance and oversight framework to be of paramount importance in enabling firms to identify, monitor and mitigate the risks associated with algorithm trading strategies. Firms are reminded RTS 6 requires that as part of its overall governance framework and decision-making framework, an investment firm should have a clear and formalised governance arrangement, including clear lines of accountability, effective procedures for the communication of information and a separation of tasks and responsibilities. These arrangements should ensure reduced dependency on a single person or unit. 2. Development and Testing - Lack of formal documentation with respect to development, testing and deployment processes: Supervisors observed strong development, testing and deployment controls. However, significant disparities were identified between firms with respect to the level of detail pertaining to documentation on development, testing and deployment processes most notably:

3. Risk Measurement and Control - Lack of clearly defined Three Lines of Defence: While it was evident that certain firms had appropriately skilled and resourced second lines of defence, a number of firms demonstrated an absence of a formalised “Three Lines of Defence model”. It is important that firms have a robust model in place, with clear delineation between each line i.e. the business, the risk management functions and the internal audit function. Supervisors observed:

4. Trade Lifecycle Management – Lack of appropriate documentation with respect to pre and post-trade controls: The presence of extensive pre and post-trade controls was evident during this Thematic Review however:

Firms must have in place appropriate pre and post-trade controls that are commensurate to the nature, scale and complexity of the entity and ensure that these controls are appropriately documented. Actions As a result of the findings of this thematic review, the Central Bank has engaged with the investment firms where specific concerns have been identified, issuing risk mitigation programmes to address these specific issues. The Central Bank requires all firms engaging in algorithmic trading to consider the contents of this letter, where applicable and take all remedial action necessary to ensure that they have the appropriate control and oversight in place with respect to algorithmic trading and that the requirements within RTS 6 of MIFID II are being fully adhered to. This letter should be read in conjunction with the joint ESMA and European Banking Authority (“EBA”) Guidelines on the assessment of suitability of members of the management body and key function holders ; EBA Guidelines on internal governance; and the Central Bank’s Outsourcing: Findings & Issues for Discussion. The Central Bank will continue to assess whether firms have taken sufficient steps to reduce risks arising from algorithmic trading and will have regard to the contents of this letter when conducting future supervisory engagement. Furthermore, in circumstances of non-compliance by any firm with the regulatory requirements associated with algorithmic trading, the Central Bank may, in the course of future supervisory engagement, or when exercising its supervisory and/or enforcement powers in respect of such non-compliance, have regard to the consideration given by a firm to the matters raised in the letter. Background: The Central Bank of Ireland (“Central Bank”) undertook a thematic review to assess how firms undertaking algorithmic trading have incorporated within their risk management and control frameworks the requirements set out in Regulatory Technical Standard C(2016) 4478 (“RTS 6“) supplementing Directive 2014/65/EU (“MIFID II”). The purpose of this letter is to provide background to our assessment, highlight the key findings of this review and outline the expectations of the Central Bank in relation to the governance, testing and controls surrounding algorithmic trading. Algorithmic trading gives rise to significant risks stemming from potential failures of algorithms, information technology (“IT”) systems and processes. In recent years, a number of significant algorithmic trading failures have resulted in substantial losses, fines and reputational damage for firms globally. This demonstrates a clear need for all entities engaging in algorithmic trading to ensure risk management and control frameworks in respect of algorithmic trading are appropriately embedded and are operating to a high standard. RTS 6 provides a framework to mitigate these, and other risks, through the requirement to maintain effective systems, procedures, arrangements and controls. This thematic review focused on the five principal areas underpinned by the requirements set out in RTS 6 of MIFID II: (i) Governance; (ii) Development & Testing; (iii) Risk Measurement and Control; (iv) Processes and Controls; and (v) Trade Lifecycle Management. The Central Bank noted many positive practices, including the presence of experienced, competent professionals across the first and second lines of defence, in addition to a comprehensive suite of controls in terms of monitoring, development, testing and deployment of trading algorithms. Notwithstanding this, supervisors also identified varying levels of maturity and a number of concerns across governance, control and risk management frameworks of in scope entities. A full list of the practices observed are noted in Appendix 1 of this letter. The key concerns arising from the review include: An over-reliance on service providers with a lack of demonstrable autonomy at regulated entity level. This was evidenced through a distinct absence of entity Board oversight in setting or challenging the key controls and in the oversight of the development of trading algorithms. ii. Insufficient formality with respect to key documentation. This was evidenced through a lack of appropriate documentation in relation to algorithmic trading controls and procedures. This speaks to this sector being at the early stages of maturity and also the extent to which firms leverage Group documentation, where relevant, which creates a possibility that entity specific risk may be overlooked. iii. A lack of clearly defined roles and responsibilities, and in particular a lack of appropriate delineation between the “Three Lines of Defence”. This is a consequence of a combination of (i) the scale of certain firms, (ii) the maturity of risk management frameworks and (iii) the non-specific nature for managing risks associated with algorithmic trading in certain firms. These do not align with a comprehensive and effective implementation of the requirements set out in RTS 6.

Back to Blog

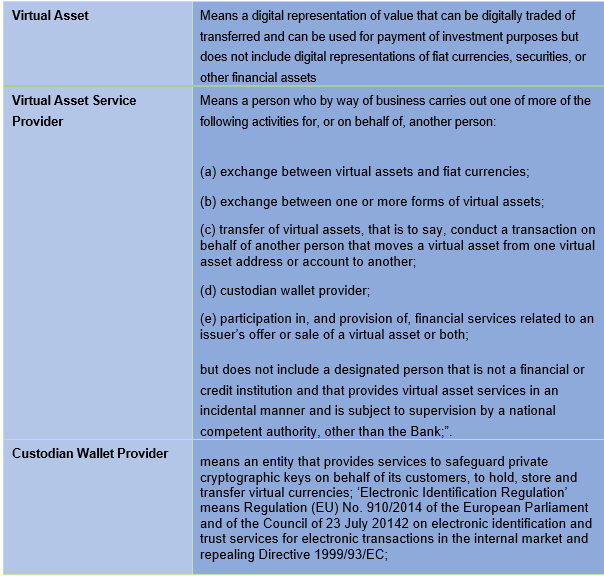

Stephen Fletcher, Consultant, CompliReg Stephen Fletcher, Consultant, CompliReg Summary Virtual Asset Service Providers (VASPs) operating in Ireland now need to demonstrate that they are compliant with the provisions of the 5th Money Laundering Directive (AMLD5) which recently came into effect on Friday 23rd April 2021. Preceding that date CompliReg, together with Fintech Ireland, hosted a webinar for VASPs, e-money and payments firms. Details of that event here. Given the demand from the audience, CompliReg and Fintech Ireland are hosting another Roundtable on the topic on Thursday 6th May - ROUNDTABLE: So, you want to be a Virtual Asset Service Provider? Background AMLD5 aims to remove the anonymity from the process of providing virtual asset based services. This applies to any organisation which provides exchange services between fiat and virtual currencies, as well between virtual assets or custodian wallet providers; bringing them into the scope of the EU’s anti-money laundering and counter-terrorist financing (‘AML/CFT’) framework. The 2021 Act The Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2021 (the "Act") amends the current Irish AML/CTF legislation, which started life a decade ago through the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (as amended). New Definitions relating to Virtual Assets The Act contains the following new definitions: Designated Persons

The Act brings VASPs within the meaning of "designated person" (equivalent to an "obliged entity" under EU anti-money laundering law). The relevant obligations (Relevant Obligations) of designated persons under the Irish AML regime can be summarised as follows:

Requirement to Register The Act requires that a person shall not carry-on business as a Virtual Asset Service Provider unless the person has successfully registered with the Central Bank of Ireland (Central Bank). This is a registration for AML/CFT purposes only. A firm currently authorised by the Central Bank under a different regime which is also acting as a Virtual Asset Service Provider will still be required to register as a VASP. Whilst there is a three-month transitional period for VASPs to conclude the registration process the Act, which commenced operation on Friday 23rd April (commencement date), other than section 8 of the Act which commenced on Saturday 24th April, applies as of the commencement date. This means that regardless of an existing VASP having three months to register, the VASP must comply with the Act on and from the commencement date. This means that VASPs availing of the transition period must comply on and from 23rd April with the Relevant Obligations listed above. The Act sets out the high-level details of the registration process, and the grounds under which the Central Bank may refuse to register a VASP. These grounds include:

Preparation The Central Bank’s website contains useful information for those requiring registration as a VASP, including the Criminal Justice Act* (as at commencement date), Guidelines on Fitness & Probity of Principal Officers/Beneficial Owners, and links to the AML/CFT Registration Form. The Central Bank will not accept a registration application until the applicant has been through the pre-registration and has obtained a Central Bank Institution Number. The Central Bank has also indicated that its current graduated approach to AML/CFT supervision will apply equally to VASPs, meaning that firms which present a higher risk of money laundering and/or terrorist financing will be subject to higher intensity and intrusive supervisory measures than those presenting a lower risk. Next Steps As many VASPs shall become designated persons for the first time, they should review their AML/CTF frameworks, their Relevant Obligations, legislation and guidance now. Given that the Act has now commenced in operation, applicants should submit a Pre-Registration Information Form to the Central Bank to request a Central Bank Institution Number as soon as possible. Being within the AML/CTF framework will surely bring benefits such as greater confidence to end-users (i.e., customers – individuals and corporates) of VASPs and hopefully, more banking partners will consider opening up their services to VASPs particularly ahead of the proposed Markets in Crypto Assets Regulation 2020/0265. Support Available As with any new process, it can appear complex and daunting until you have been through it a few times. Thankfully help is at hand through CompliReg. If you would like to setup an initial discussion to discuss your requirements, please check out our page and complete the enquiry form at https://complireg.com/vasp.html. Stephen Fletcher or Peter Oakes will get back to you ASAP. Our details at https://complireg.com/team.html. This document (and any information accessed through links in this document) is for guidance purposes only and does not constitute legal advice. CompliReg does not provide legal services. Where legal services are required, CompliReg works with a select number of law firms. If you are a law firm and wish to be considered for our panel, please contact [email protected].

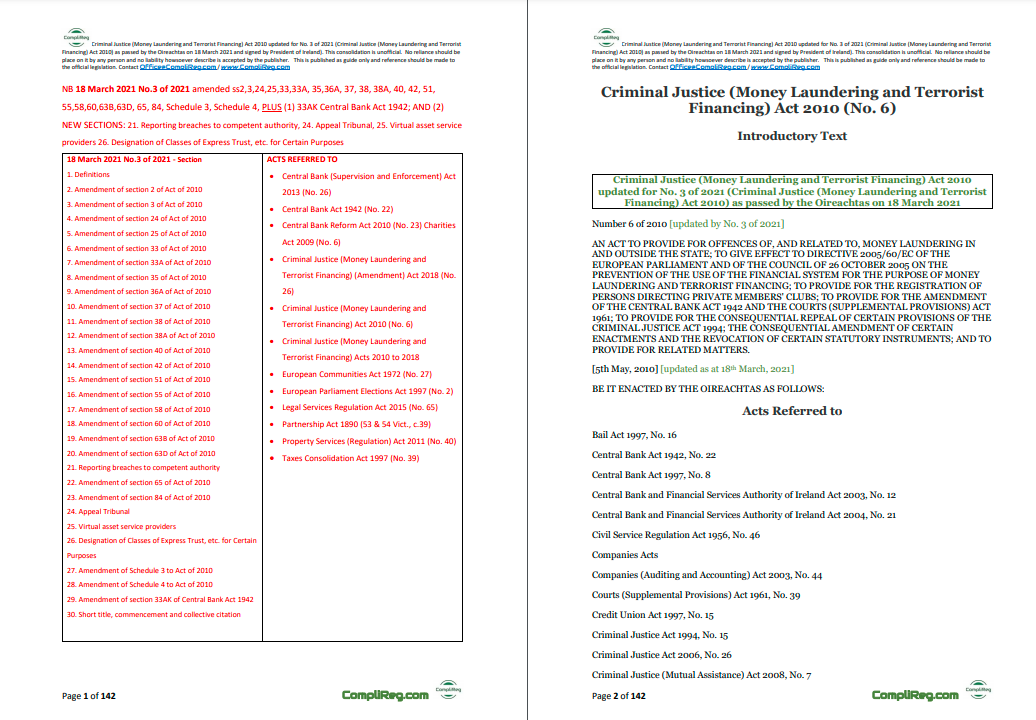

Back to Blog

Peter Oakes, Founder, Complireg Peter Oakes, Founder, Complireg UPDATE: The law commenced operation on Friday 23rd April 2021. See Stephen Fletcher's blog of Saturday 1 May 2021 for further details Below is my linkedin post of 16 April 2021. I have been asked to put a copy of the consolidation online. We spent a lot of time preparing the consolidation and are happy to share the below slideshow. If you would like a copy of the document in pdf which you can copy, paste and search within, please email [email protected] and we will inform of the costs and email. "Some comments on the updated Irish #moneylaundering and #terroristfinancing legislation. Linkedin Post: What: Ireland signed into law the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2021 (the “2021 Act”). The 2021 Act (No. 3 of 2021) makes a number of changes to the 2010 Act (No. 6 of 2010) When: 18 March 2021. Legislation passed by Oireachtas & signed into Law by the President of Ireland Action: It’s time to update your #Compliance & #FinancialCrime Risk Frameworks, Risk Assessments, Policies, Manuals & Procedures. So what areas of the the 2010 Act impacted by the changes in March do you need to know and consider taking into account to update your compliance documents? See the comments section below where I've listed the areas from the 2010 Act impacted by the 2021 Act. How: Contact the team at CompliReg. We are undertaking several reviews of policies, procedures and manuals in light of the recent changes made to Irish AML/CTF law. We have tracked the changes in our consolidation of the 2010 Act up until and including Act No 3 of 2021. Contact the team at [email protected] with your business contact details for a discussion of a review. We'll be sending a copy of our up-to-date consolidated version of the 2010 Act to our clients this week." Post at https://www.linkedin.com/feed/update/urn:li:activity:6788600737791303680/

Back to Blog

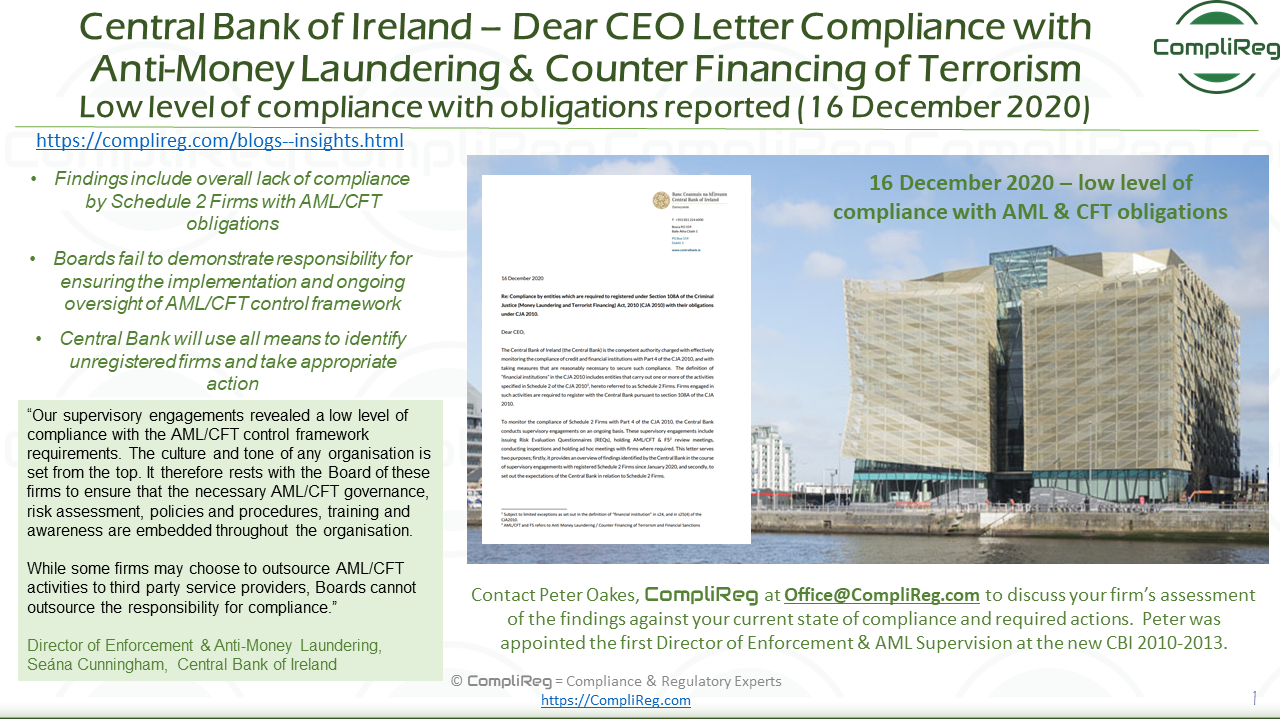

Central Bank publishes “Dear CEO” letter to Schedule 2 firms on low level of compliance with Anti-Money Laundering and Counter Financing of Terrorism obligations

The Central Bank has today (16 December 2020) published the outcome of supervisory engagements undertaken in respect of Schedule 2 Firms to assess compliance with their obligations under Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (CJA 2010). The "Dear CEO" letter*, outlines the Central Bank’s expectations of firms in relation to Anti-Money Laundering/Counter Financing of Terrorism (AML/CFT) and Financial Sanctions (FS) requirements and details follow-up actions to be taken by CEOs and Boards in response to the findings outlined. The examination, which comprised of both inspections and review meetings, found an overall lack of compliance across all areas of the AML/CFT control framework. There is also poor understanding of the requirements from Board and senior management levels, including at those firms who outsourced their AML/CFT and FS activities to third parties. The examination identified a number of failings across Schedule 2 Firms, including:

Director of Enforcement & Anti-Money Laundering, Seána Cunningham said: “The Central Bank expects all firms to be alert to the risks that money laundering and criminal financial activities may pose to their customers and business, and the wider integrity of the Irish financial system. This requires CEOs and Boards to have in-depth knowledge and understanding of their Anti-Money Laundering and Counter Financing of Terrorism obligations. It is also essential to have the necessary control framework in place to ensure protection of their business and customers. “Our supervisory engagements revealed a low level of compliance with the AML/CFT control framework requirements. The culture and tone of any organisation is set from the top. It therefore rests with the Board of these firms to ensure that the necessary AML/CFT governance, risk assessment, policies and procedures, training and awareness are embedded throughout the organisation. While some firms may choose to outsource AML/CFT activities to third party service providers, Boards cannot outsource the responsibility for compliance. “We will continue to engage directly with those firms where compliance weaknesses and failures have been identified to ensure that they are addressed. We also require all firms to review the content of this letter to ensure that they assess their own compliance with the issues identified. “We are also taking this opportunity to remind all firms to assess their activities to determine if they are required to register with us under Schedule 2. Firms who fail to register are at risk of significant criminal and/or administrative sanctions. In 2021, the Central Bank will use all means available to identify those firms not registered and take appropriate action.” ENDS Notes to Editor

Further information Media Relations: [email protected] / 01 224 6299 Ewan Kelly: [email protected] / 01 224 6269

Back to Blog

Here's one for the #moneylaundering typology case studies for #MLROs as part of regulatory training requirements!

Relates to the collapse of major investigation into the Kinahan cartel and more than half a billion euros- particularly €500,000,000 stash of cars, properties & cash handed back to the accused by a Spanish judge after collapse of money laundering case. Can understand that staff and MLROs at financial institutions and other obliged entities which do a lot of the initial legwork in identifying suspicious transactions may feel underwhelmed (to say the least) when a case like this collapses. We should train on all types of cases, regardless if there is a criminal outcome or not. Staff (and boards) need to appreciate that not all suspicious transactions reports will 'result' in a criminal outcome, but that doesn't excuse obliged entities and their staff from complying with the legal requirement to report suspicious transactions. A skill MLROs and trainers need to focus upon is motivating staff, themselves and the senior executive to stay the course. https://www.linkedin.com/posts/peteroakes_moneylaundering-mlros-financialcrime-activity-6719937607700135936-jZUH #antimoneylaundering #financialcrime #mlros #suspicioustransactions #lawenforcement Check out the linkedin post with link to news article.

Back to Blog

"the settlement sends a strong message to industry that AUSTRAC will take action to ensure our financial system remains strong so it cannot be exploited by criminals" AUSTRAC 24 September 2020 Source: AUSTRAC

Press Release 24 September 2020 Westpac and AUSTRAC have today agreed to a AUD$1.3 billion dollar proposed penalty over Westpac’s breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). Westpac and AUSTRAC have agreed that the proposed penalty reflects the seriousness and magnitude of compliance failings by Westpac. The Federal Court of Australia will now consider the proposed settlement and penalty. If the Federal Court determines the proposed penalty is appropriate, the penalty order made will represent the largest ever civil penalty in Australian history. In reaching today’s agreement, Westpac has admitted to contravening the AML/CTF Act on over 23 million occasions, exposing Australia’s financial system to criminal exploitation. In summary, Westpac admitted that it failed to:

In reaching the agreement, Westpac has also admitted to approximately 76,000 additional contraventions which expand the original statement of claim. These new contraventions relate to information that came to light after the civil penalty action was launched last year and relate to additional IFTI reporting failures, failures to reasonably monitor customers for transactions related to possible child exploitation, and two further failures to assess the money laundering and terrorism financing risks associated with correspondent banking relationships. AUSTRAC’s Chief Executive Officer, Nicole Rose PSM said the settlement sends a strong message to industry that AUSTRAC will take action to ensure our financial system remains strong so it cannot be exploited by criminals. “Our role is to harden the financial system against serious crime and terrorism financing and this penalty reflects the serious and systemic nature of Westpac’s non-compliance,” Ms Rose said. “Westpac’s failure to implement effective transaction monitoring programs, and its failure to submit IFTI reports to AUSTRAC and apply enhanced customer due diligence in relation to suspicious transactions, meant AUSTRAC and law enforcement were missing critical intelligence to support police investigations.” Ms Rose said such a large number of breaches over several years was unacceptable and could have been avoided with better assurance and oversight processes to identify ongoing reporting failures. AUSTRAC works in partnership with the businesses we regulate through a comprehensive industry education program. “We have been, and will continue to work collaboratively with Westpac and all businesses we regulate to support them to meet their compliance and reporting obligations to ensure this doesn’t happen again in the future.” Westpac continues to partner with AUSTRAC to assist AUSTRAC and law enforcement agencies to stop financial crime, including as a member of AUSTRAC’s private-public partnership the Fintel Alliance. About AUSTRACAUSTRAC (the Australian Transaction Reports and Analysis Centre) is the Australian Government agency responsible for detecting, deterring and disrupting criminal abuse of the financial system to protect the community from serious and organised crime. Through strong regulation, and enhanced intelligence capabilities, AUSTRAC collects and analyses financial reports and information to generate financial intelligence. Learn more about AUSTRAC: https://www.austrac.gov.au/about-us/austrac-overview Media contactEmail: [email protected] Phone: (02) 9950 0488

Back to Blog

Not long after the European Union’s top court ordered Ireland on 16 July 2020 to pay a lump sum of €2 million to the European Commission for Ireland's failure to implement regulations aimed to prevent money laundering and terrorist financing, a new law aimed at strengthening existing Irish anti-money laundering legislation and giving effect to provisions of the 5th EU Money Laundering Directive has been approved by the Cabinet of the Irish Government.

On Monday 10th August 2020, the Cabinet has approved the publication of the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Bill 2020. This follows the signing into law by the President of Ireland on 5th May 2020 of the earlier Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (Act 6 of 2010) [previously known as the Criminal Justice (Money Laundering and Terrorist Financing) Bill 2009 (Bill 55 of 2009)]. If you need advice on the new Bill or your existing regulatory compliance obligations, get i touch with Peter Oakes here at at CompliReg. Useful Links:

The Minister for Justice and Equality, Helen McEntee T.D., has received Cabinet approval for the publication of the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Bill 2020. The Bill transposes the criminal justice elements of the 5th EU Money Laundering Directive and strengthens existing legislation. Upon announcing the new Bill, the Minister McEntee said, "I look forward to bringing this legislation before my colleagues in both Houses, and anticipate that this Bill will receive broad, cross-party support." What does the Bill contain? The Bill includes provisions to:

The Minister also noted that: "This Bill is an important piece of legislation for tackling money-laundering. The reality is that money laundering is a crime that helps serious criminals and terrorists to function, destroying lives in the process. Criminals seek to exploit the EU’s open borders, and EU-wide measures are vital for that reason. This new legislation also includes a number of technical amendments to other provisions of Acts already in force." While the Bill transposes certain elements of the 5th Anti-Money Laundering Directive, the Department of Finance is also engaged in giving effect to certain provisions of the Directive, including those relating to:

The Minister for Finance (Paschal Donohue, T.D.) has also secured Government Approval to bring forward amendments in respect of the regulation of Virtual Asset Service Providers (VASPs). The amendments will ensure that the necessary registration and fitness and probity regime, required by 5AMLD for virtual asset service providers, become statutory requirements. Amendments will also address Ireland’s international obligations, relating to a robust regulatory framework for new technologies, new products and new practices, as identified by the Financial Action Task Force (FATF). |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]