AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

CompliReg is a leading provider of consultancy services to MiFID, Payments and Emoney firms. Our founder, Peter Oakes is an independent non-executive director of two Central Bank regulated MiFID firms, an emoney firm and a payments firm. Peter is a member of the Audit, Risk, Nomination, Remuneration and Internal Audit Committees of a number of firms. Read more about Peter's NED services and CompliReg's services. If below post on the marketing of complex investment products is of interest, then you should also look at our post of 1 December 2021 on the Central Bank's review findings on firms providing investment services. The Central Bank's found that there is a need to improve suitability assessments. Central Bank reviews identify issues in marketing of complex investment productsCentral Bank reviews identify issues in marketing of complex investment products

The Central Bank of Ireland has written to MiFID investment firms, outlining the findings from a series of targeted reviews of Structured Retail Products (SRPs). These reviews examined SRPs manufactured and distributed by investment firms in the MiFID investment sector. A number of areas were identified where further action is needed by firms to ensure their governance and oversight of SRPs keeps pace with an increasingly complex retail investment market, so that investors are appropriately protected. The reviews found a number of poor practices and weaknesses in firms’ processes, which increase risks to investors. This includes failure by firms to consider potential difficulties investors may have in understanding the complex features involved in some SRPs; failing to present past performance information in a fair and balanced manner; and not including prominent capital at risk warnings in marketing materials. Director of Consumer Protection, Colm Kincaid, said: “The retail investment market is changing rapidly, with an increasing shift away from traditional, capital protected products to more complex, capital at risk products. As complexity increases, so too do the risks to investors and the responsibilities regulated firms have to protect those investors’ best interests. Our recently published Outlook Report highlighted a number of risks for consumers from changing business practices and ineffective disclosures on investment products, as well as what we expect regulated firms to do to deal with those risks. The work we are publishing today builds on that Report. “We carried out these reviews because we want to see that regulated firms meet high standards in how they design, manufacture and distribute complex investment products to retail investors. In particular, we want to see that complex investment products are designed with real investment needs in mind, that they are targeted only at investors with those needs and that the risks are properly explained. We are requiring firms to take action to improve their performance on each of these fronts, as well as highlighting good practices which we want to see emulated across the sector.” The letter requires regulated firms to take action to identify a sufficiently granular target market for SRPs and to drive improvements in the quality and transparency of disclosures to investors of the risks relating to these products. In particular:

The Central Bank expects firms to adhere to high standards of investor protection, acting in the best interests of investors at all times. We continue to monitor developments in the retail investment market, and the findings of these reviews and the expectations set out in today’s letter will be considered as part of future supervisory engagements. ENDS Notes to Editors

Source: Central Bank of Ireland, 22 April 2022

0 Comments

Read More

Back to Blog

CompliReg is a leading provider of consultancy services to MiFID, Payments and Emoney firms. Our founder, Peter Oakes is an independent non-executive director of two Central Bank regulated MiFID firms, an emoney firm and a payments firm. Peter is a member of the Audit, Risk, Nomination, Remuneration and Internal Audit Committees of a number of firms. Read more about his NED services and CompliReg's services. UPDATE 22/04/2022: If below below on suitability requirements is of interest, then you should also look at our post of 22 April 2022 on the Central Bank's review findings on issues in marketing of complex investment products. Central Bank review finds firms providing investment services need to improve suitability assessments

The Central Bank of Ireland has published a Dear CEO letter outlining the findings of a review of investment firms’ compliance with the suitability requirements under MiFID II. The review was conducted as part of a Common Supervisory Action (CSA) coordinated by the European Securities and Markets Authority (ESMA). The purpose of the review was to assess firms’ compliance with the suitability requirements under MiFID II by simultaneously conducting supervisory activities throughout the EU/EEA. The findings, which are highlighted in ESMA’s recent public statement, incorporate the findings from the Central Bank’s own supervisory analysis, and engagement with other National Competent Authorities (NCAs). When providing investment advice and/or portfolio management, Firms are required to take all reasonable steps to ensure that a client’s investments align to their objectives and personal circumstances. This is a key measure to protect investors from the risk of purchasing unsuitable products. The review identified evidence of positive practices, particularly where firms took a personalised and comprehensive approach to suitability assessments for their clients. However, it also identified instances where further action is required by firms. For example:

The Central Bank will continue to engage with firms where specific supervisory actions have been imposed, which require firms to take specific action on foot of our findings. In addition, the Central Bank is requiring all Irish authorised MiFID firms and credit institutions, who provide portfolio management and advisory services to retail clients, to conduct a thorough review of their individual sales practices and suitability arrangements. This review must be documented and must include details of actions taken to address findings in the ESMA public statement and this letter. This review should be completed, and an action plan discussed and approved by the board of each firm, by end of Q1 2022. Director of Consumer Protection, Colm Kincaid, said: “Investing in an unsuitable investment product can lead to unexpected losses, which can have devastating consequences for individual investors and their families. Regulated firms play a key role in protecting consumers against this risk. “However, the findings from this review show that regulated firms need to improve their performance when it comes to assessing the suitability of investment products they recommend or advise consumers to purchase. These assessments must be of high quality, based on a good understanding of the customer’s circumstances and capacity for financial loss, and properly documented.” Source: Central Bank of Ireland, 01 December 2021

Back to Blog

The Central Bank of Ireland has released a Dear CEO letter setting out findings under four headings and expected Actions following a Thematic assessment of Algorithmic Trading Firms’ compliance with RTS 6 of MIFID II.

1. Governance – Deficient control and risk management frameworks: Varying levels of maturity were observed with respect to firms’ governance, control and risk management frameworks. Supervisors observed weaknesses with respect to:

The Central Bank considers the maintenance of a robust algorithmic governance and oversight framework to be of paramount importance in enabling firms to identify, monitor and mitigate the risks associated with algorithm trading strategies. Firms are reminded RTS 6 requires that as part of its overall governance framework and decision-making framework, an investment firm should have a clear and formalised governance arrangement, including clear lines of accountability, effective procedures for the communication of information and a separation of tasks and responsibilities. These arrangements should ensure reduced dependency on a single person or unit. 2. Development and Testing - Lack of formal documentation with respect to development, testing and deployment processes: Supervisors observed strong development, testing and deployment controls. However, significant disparities were identified between firms with respect to the level of detail pertaining to documentation on development, testing and deployment processes most notably:

3. Risk Measurement and Control - Lack of clearly defined Three Lines of Defence: While it was evident that certain firms had appropriately skilled and resourced second lines of defence, a number of firms demonstrated an absence of a formalised “Three Lines of Defence model”. It is important that firms have a robust model in place, with clear delineation between each line i.e. the business, the risk management functions and the internal audit function. Supervisors observed:

4. Trade Lifecycle Management – Lack of appropriate documentation with respect to pre and post-trade controls: The presence of extensive pre and post-trade controls was evident during this Thematic Review however:

Firms must have in place appropriate pre and post-trade controls that are commensurate to the nature, scale and complexity of the entity and ensure that these controls are appropriately documented. Actions As a result of the findings of this thematic review, the Central Bank has engaged with the investment firms where specific concerns have been identified, issuing risk mitigation programmes to address these specific issues. The Central Bank requires all firms engaging in algorithmic trading to consider the contents of this letter, where applicable and take all remedial action necessary to ensure that they have the appropriate control and oversight in place with respect to algorithmic trading and that the requirements within RTS 6 of MIFID II are being fully adhered to. This letter should be read in conjunction with the joint ESMA and European Banking Authority (“EBA”) Guidelines on the assessment of suitability of members of the management body and key function holders ; EBA Guidelines on internal governance; and the Central Bank’s Outsourcing: Findings & Issues for Discussion. The Central Bank will continue to assess whether firms have taken sufficient steps to reduce risks arising from algorithmic trading and will have regard to the contents of this letter when conducting future supervisory engagement. Furthermore, in circumstances of non-compliance by any firm with the regulatory requirements associated with algorithmic trading, the Central Bank may, in the course of future supervisory engagement, or when exercising its supervisory and/or enforcement powers in respect of such non-compliance, have regard to the consideration given by a firm to the matters raised in the letter. Background: The Central Bank of Ireland (“Central Bank”) undertook a thematic review to assess how firms undertaking algorithmic trading have incorporated within their risk management and control frameworks the requirements set out in Regulatory Technical Standard C(2016) 4478 (“RTS 6“) supplementing Directive 2014/65/EU (“MIFID II”). The purpose of this letter is to provide background to our assessment, highlight the key findings of this review and outline the expectations of the Central Bank in relation to the governance, testing and controls surrounding algorithmic trading. Algorithmic trading gives rise to significant risks stemming from potential failures of algorithms, information technology (“IT”) systems and processes. In recent years, a number of significant algorithmic trading failures have resulted in substantial losses, fines and reputational damage for firms globally. This demonstrates a clear need for all entities engaging in algorithmic trading to ensure risk management and control frameworks in respect of algorithmic trading are appropriately embedded and are operating to a high standard. RTS 6 provides a framework to mitigate these, and other risks, through the requirement to maintain effective systems, procedures, arrangements and controls. This thematic review focused on the five principal areas underpinned by the requirements set out in RTS 6 of MIFID II: (i) Governance; (ii) Development & Testing; (iii) Risk Measurement and Control; (iv) Processes and Controls; and (v) Trade Lifecycle Management. The Central Bank noted many positive practices, including the presence of experienced, competent professionals across the first and second lines of defence, in addition to a comprehensive suite of controls in terms of monitoring, development, testing and deployment of trading algorithms. Notwithstanding this, supervisors also identified varying levels of maturity and a number of concerns across governance, control and risk management frameworks of in scope entities. A full list of the practices observed are noted in Appendix 1 of this letter. The key concerns arising from the review include: An over-reliance on service providers with a lack of demonstrable autonomy at regulated entity level. This was evidenced through a distinct absence of entity Board oversight in setting or challenging the key controls and in the oversight of the development of trading algorithms. ii. Insufficient formality with respect to key documentation. This was evidenced through a lack of appropriate documentation in relation to algorithmic trading controls and procedures. This speaks to this sector being at the early stages of maturity and also the extent to which firms leverage Group documentation, where relevant, which creates a possibility that entity specific risk may be overlooked. iii. A lack of clearly defined roles and responsibilities, and in particular a lack of appropriate delineation between the “Three Lines of Defence”. This is a consequence of a combination of (i) the scale of certain firms, (ii) the maturity of risk management frameworks and (iii) the non-specific nature for managing risks associated with algorithmic trading in certain firms. These do not align with a comprehensive and effective implementation of the requirements set out in RTS 6.

Back to Blog

Irish Bank, Bank of Ireland, fined €1,660,000 over cyber-fraud and misleading the Irish Regulator28/7/2020 Enforcement Action Notice: The Governor and Company of the Bank of Ireland fined €1,660,000 and reprimanded by the Central Bank of Ireland for regulatory breaches causing loss to a client and for misleading the Central Bank in the Central Bank in the course of the investigationSummary:Here's a blueprint for inviting an enforcement action for cyber-fraud & misleading your regulator arising from Bank of Ireland's fine €1,660,000 announced today. [Linkedin Post Here] What did Bank of Ireland do wrong?: 1) failed to implement sound administrative procedures & internal control mechanisms in respect of third party payments. 2) failed to introduce adequate organisational arrangements around third party payments to minimise the risk of loss of client assets as a result of fraud. 3) failed to establish, implement & maintain systems & procedures adequate to safeguard the security, integrity & confidentiality of client bank account details. 4) failed to establish, implement & maintain adequate internal control mechanisms designed to secure compliance with its reporting obligations pursuant to Sec. 19 of the Criminal Justice Act 2011. 5) failed to monitor adequacy & effectiveness of the measures & procedures put in place & the actions taken to address any deficiencies in respect of third party payments. 6) failed to be open & transparent, having the effect of misleading the Central Bank in the course of the investigation. Facts of Matter according to Central Bank of Ireland:On 27 July 2020, the Central Bank of Ireland (the Central Bank) reprimanded and fined The Governor and Company of the Bank of Ireland (BOI) for five breaches of the European Communities (Markets in Financial Instruments) Regulations 2007 (the MiFID Regulations) committed by its former subsidiary, Bank of Ireland Private Banking Limited (BOIPB). BOI has admitted the breaches, which vary in length from one to ten years.

In line with its published Sanctions Guidance, the Central Bank has determined the appropriate fine to be €2,370,000, which has been reduced by 30% in accordance with the settlement discount scheme provided for in the Central Bank’s Administrative Sanctions Procedure. The Central Bank’s investigation arose from a cyber-fraud incident that occurred in September 2014 (the Incident). Acting on instructions from a fraudster impersonating a client, BOIPB made two payments to a third party account totalling €106,430: one from a client’s personal current account, the other from BOIPB’s own funds. BOIPB immediately reimbursed the client. During a Full Risk Assessment of BOIPB in 2015, the Central Bank discovered a reference to the Incident in an operational incident log. BOIPB had not reported the cyber-fraud to An Garda Síochána, and only did so at the request of the Central Bank over one year after the Incident. The Central Bank’s investigation found serious deficiencies in respect of third party payments, including:

BOIPB’s failure to be open and transparent had the effect of misleading the Central Bank in the course of the investigation. BOIPB failed for a period of 19 months to disclose to the Central Bank an internal report, commissioned following the Incident, which identified ongoing systemic control failings in the processing of third party payments. During that same period, BOIPB strenuously denied the existence of any such failings to the Central Bank in response to the investigation. BOIPB’s conduct materially added to the time it took to investigate this case. This is one of two aggravating factors in this case; the other being the excessive amount of time it took BOIPB to fully remediate the relevant deficiencies. Remediation in relation to third party payment processes took place in February 2016, 17 months after the Incident, and then only following the Central Bank’s intervention. In August 2016, the Central Bank determined that a Risk Mitigation Programme (RMP) relating to third party payment processes was completed. The Central Bank’s Director of Enforcement and Anti-Money Laundering, Seána Cunningham, said: “The Central Bank has a clear expectation that firms are alert to the real and increasing risks from cyber-fraud to the security of their clients’ deposits and confidentiality of their clients’ financial information, and put in place appropriate safeguards to protect their clients accordingly. This is the second time the Central Bank has imposed a sanction on a firm where a client has suffered a loss from cyber-fraud as a direct result of the firm’s regulatory failings. BOIPB’s failure to put appropriate safeguards in place exposed BOIPB and its clients to the serious and avoidable risk of cyber-fraud. That risk crystallised twice. BOIPB then failed to report the cyber-fraud to An Garda Síochána, which is a serious matter. Reporting illegal activity is essential in the fight against financial crime. This case should serve to highlight to all firms the importance of ongoing vigilance in the area of cyber security. The Central Bank expects all firms to consider, identify and manage operational and cyber risks and ensure that their staff receive appropriate training tailored to the risks associated with their duties and responsibilities. The Central Bank expects pro-active engagement from regulated entities – that extends from self-reporting through remediation and full cooperation with the investigation. The excessive time taken by BOIPB to remediate identified deficiencies and the failure to be fully transparent and open in the context of the Central Bank’s investigation were aggravating features in this case.” BACKGROUND Founded in 1989, BOIPB was first authorised as a “section 10 investment business firm” under the Investment Intermediaries Act, 1995 (the 1995 Act) on 26 May 2000. This authorisation was subsequently transferred to an authorisation under the MiFID Regulations on 1 November 2007. At the time of the cyber-fraud, BOIPB was an independently regulated MiFID firm and its primary activity was to provide investment services to high net worth individuals who had investable assets in excess of €1,000,000. In addition, BOIPB provided a full range of banking services to its clients (lending, deposit taking and day-to-day current account banking) as a deposit agent of BOI. Since 1 September 2017, BOIPB is no longer a MiFID firm and is now a business unit within the Retail Division of BOI. The unit retains the name Bank of Ireland Private Banking as a trading name of the Governor and Company of the Bank of Ireland. Its services are authorised by the Central Bank of Ireland under the licence of BOI, a regulated financial service provider for the purposes of the Central Bank Act 1942. BOIPB’s audited financial statements for the year ended 31 December 2016, the last year it existed as a separate entity, reported operating income of €19,867,000. THE CYBER-FRAUD Third party payment instructions were processed by BOIPB with particular reference to a procedure called the Third Party Payments Procedure (the TPPP), which outlined steps to be followed to verify a client’s identity before processing a third party payment instruction. BOIPB processed two separate payment instructions received in September 2014, purportedly from a client (the Client), which in fact were sent by a cyber-fraudster (the Fraudster) who had hacked the Client’s e-mail account. This led to two transfers totalling €106,430 to be transmitted to a corporate bank account at a UK bank. The first transfer was drawn from the Client’s current account, and the second transfer was drawn, at the instigation and authorisation of BOIPB, from BOIPB’s suspense account because the payment from the Client’s deposit account was rejected due to insufficient funds. The Client made contact with BOIPB and notified it of the fraud on 30 September 2014, on receipt of an e-mail from BOIPB indicating recent communications (which were unfamiliar to the Client). The Client was immediately reimbursed by BOIPB. To facilitate the instructions received from the Fraudster, BOIPB staff, in breach of BOIPB’s policies and procedures:

The Fraudster used the following tactics:

PRESCRIBED CONTRAVENTIONS The Central Bank investigation identified the following contraventions: Contravention 1 BOIPB breached Regulation 33(1)(f)(i) of the MiFID Regulations between 1 November 2007 and August 2016 by failing to implement sound administrative procedures and internal control mechanisms in respect of third party payments. The Central Bank’s investigation found that the TPPP was wholly inadequate for the purposes of safeguarding client deposits when processing third party payments. In particular, key procedural, security and authorisation steps were not outlined in the document. Staff did not receive adequate training on the processing of third party payments to ensure they were fully aware of how to safely process these payments. Contravention 2 BOIPB breached Regulation 160(2)(f) of the MiFID Regulations between 1 November 2007 and August 2016 by failing to introduce adequate organisational arrangements around third party payments to minimise the risk of loss of client assets as a result of fraud. The serious weaknesses in the process around third party payments, which had existed for some time, should have been known to management through proper governance, oversight and monitoring. There was no monitoring of third party payments by the first or second lines of defence. Furthermore, the recommendations of the first internal report commissioned by BOIPB in relation to this matter, dated December 2014, were not acted on. Similar weaknesses were identified in a second internal report in January 2016. Remediation of the issues identified in both reports did not take place until February 2016. Contravention 3 BOIPB breached Regulation 34(3)(a) of the MiFID Regulations between 1 November 2007 and 2 January 2018 by failing to establish, implement and maintain systems and procedures adequate to safeguard the security, integrity and confidentiality of client bank account details. The investigation found that for the purposes of customer service, BOIPB staff frequently engaged with private clients through e-mail. E-mail communication, because it is more vulnerable to infiltration by fraudsters than other forms of communication, needs to incorporate additional checks before being acted upon. By failing to identify and provide for this, BOIPB failed to safeguard the security, integrity and confidentiality of information relating to client bank accounts. Contravention 4 BOIPB breached Regulation 34(1)(c) of the MiFID Regulations between 30 September 2014 and 16 December 2015 by failing to establish, implement and maintain adequate internal control mechanisms designed to secure compliance with its reporting obligations pursuant to Section 19 of the Criminal Justice Act 2011. BOIPB reported the Incident to its Group Financial Crime Unit (GFCU) on 1 October 2014. GFCU, on behalf of BOIPB, did not report the Incident to An Garda Síochána until December 2015, on the instigation of the Central Bank. Contravention 5 BOIPB breached Regulation 35(2)(c) of the MiFID Regulations by failing to comply with Regulation 34(4) between November 2013 and December 2016 because, for that period, BOIPB’s Compliance function failed to monitor, and on a regular basis to assess the adequacy and effectiveness of the measures and procedures put in place and the actions taken to address any deficiencies in respect of third party payments. The TPPP included a requirement that ad-hoc monitoring of third party payments be carried out by the Compliance function. The investigation found that throughout the period November 2013 to May 2016, no ad-hoc monitoring of third party payments was in fact carried out. This failure persisted despite two internal reports highlighting the absence of monitoring and the systemic non-adherence to the TPPP. BOIPB’S RESPONSE TO THE CYBER-FRAUD AND REMEDIATION The Central Bank expects firms to promptly remediate known deficiencies in their procedures and internal control mechanisms. BOIPB failed to do so. Following the Incident, BOI Group Internal Audit function (GIA) investigated how it had occurred. GIA produced their findings in a report in December 2014, which pointed to systemic failings in the processing of third party payments. GIA strongly recommended that BOIPB carry out sampling to verify the authenticity of other “high-value interpays”. BOIPB failed to do this. GIA further recommended, that, at a minimum, the procedure in place relating to third party payments should be enhanced to clarify roles and responsibilities for authenticating and approving third party payments. Again, BOIPB failed to do this. The procedure remained unchanged until February 2016. In March 2015, BOIPB commissioned a further internal review, this time by BOI Retail Business Assurance (RBA) centred on BOIPB’s procedures for processing third party payments. Separately, following the Full Risk Assessment (the FRA) conducted in 2015, the Central Bank informed BOIPB that improvements in relation to third party payment processes would be part of the subsequent RMP arising from the FRA as the process in place was “not robust enough”. The RMP was issued in February 2016, which set out the Central Bank’s expectations in relation to the actions needed to improve the third party payment process. RBA issued its findings in draft to BOIPB in January 2016 (the RBA Report). Following an assessment of a sample of third party payment records, RBA concluded that the same issues identified in December 2014 persisted, namely that client identification questions were not consistently being asked of clients as well as other deficiencies in the third party payment process. BOIPB updated and revised the TPPP in February 2016. The RBA Report was signed-off in June 2016. In August 2016, the Central Bank determined that the full RMP was completed. BOIPB’S COOPERATION WITH THE CENTRAL BANK The Central Bank expects regulated entities to cooperate in an open manner at all times and to respond to requests promptly, effectively and accurately. When the Central Bank’s investigation commenced in February 2016, BOIPB possessed the RBA Report which contained highly critical findings in relation to the processing of third party payments. As such, it was highly probative to the Central Bank’s investigation. The Central Bank issued a request for records in February 2016. BOIPB should have provided a copy of the RBA Report when it responded to this request in April 2016. BOIPB failed to do so, instead it included one vague narrative reference to a risk assessment of banking activities (making no reference to a “report” or the fact that it related to third party payments specifically) within a document accompanying the records it supplied in response to the Central Bank’s request. BOIPB disclosed the RBA Report to the Central Bank 19 months after the commencement of its investigation in response to a Central Bank statutory request explicitly requiring production of the record BOIPB had described as a “risk assessment”. It was only when the document was disclosed and reviewed that its true nature and content became apparent to the Central Bank. The Central Bank conducted lengthy enquiries as to the circumstances around BOIPB’s failure to promptly disclose the RBA Report and the following arose:

SANCTIONING FACTORS In deciding the appropriate penalty to impose, the Central Bank considered the ASP Sanctions Guidance issued in November 2019. The following particular factors are highlighted in this case. The Nature, Seriousness and Impact of the Contravention

The Conduct of the Regulated Entity after the Contravention Aggravating

Other Considerations

The Central Bank confirms that the investigation is now closed. NOTES

Further information: Media Relations: [email protected] / 01 224 6299 Ewan Kelly: [email protected] / 086 463 9652

Back to Blog

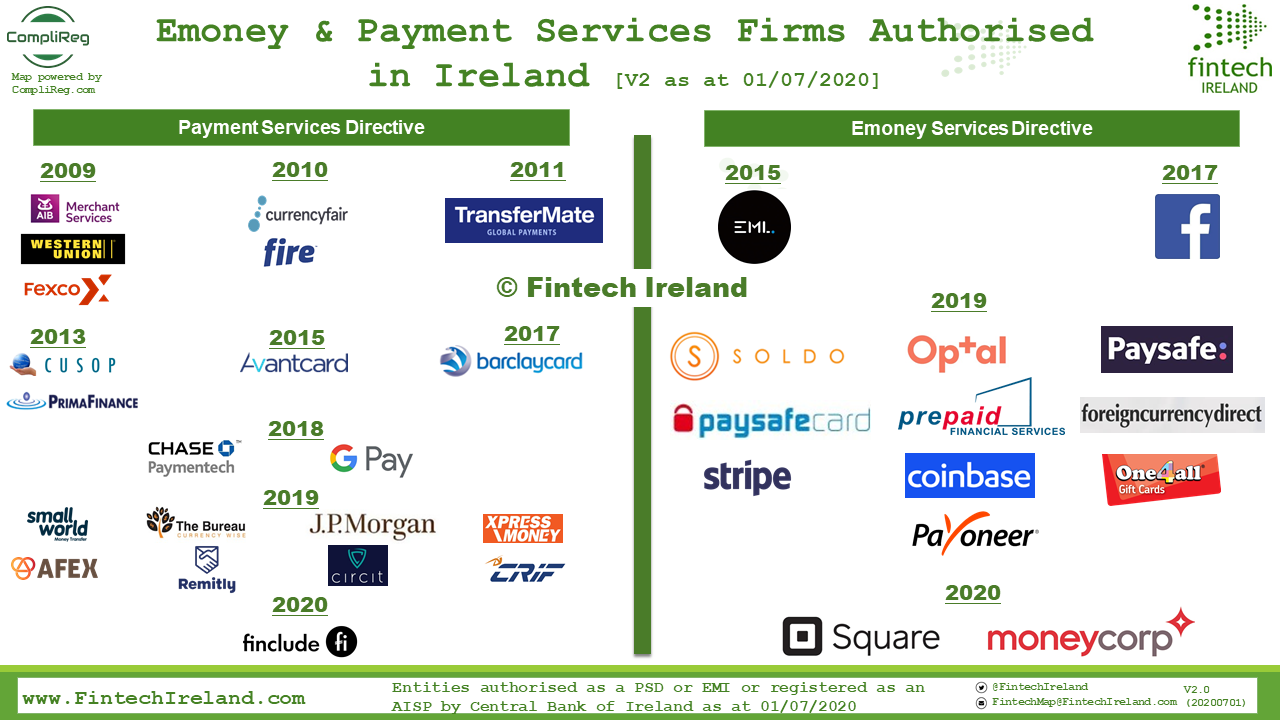

CompliReg is proud to power the Official Fintech Ireland Map 2020. We are now powering the Regulated Fintech Ireland Map version 2 which showcases the regulated payment services directive and electronic money directive firms authorised by the Central Bank of Ireland. Joining this Map in 2020 are the first of two - hopefully many more to come - e-money firms, Squareup International Limited ("Square") and MoneyCorp. Ireland now has:

In addition to issuing emoney, Square is authorised to provide payment services number 3b (execution of payment transactions through a payment card or a similar device) and number 5 (issuing of payment instruments and/or acquiring of payment transactions). Although Moneycorp is yet to appear on the Central Bank of Ireland register, Moneycorp confirmed to us that it is also authorised to provide payment services 3b, 5 and in addition 3c (execution of credit transfers, including standing orders). Moneycorp has been fairly busy. In addition to its emoney authorisation, it also secured a MiFID authorisation. By the way, AFEX which was authorised as payments institution in 2019 also secured a MiFID licence. Expect to see more firms seek both an emoney/payments authorisation together with a MiFID one. Moneycorp’s Dublin office, which opened in 2013, has operated as a branch of its UK regulated entities, saying that as part of Moneycorp’s strategic response to Brexit and wider market developments, it has now secured its e-money and MiFID licences from the Central Bank of Ireland for a newly established Irish company. Bryan McSharry, chief executive of Moneycorp’s European business, said the licences ensured it could “continue to support our existing customer base, continue to grow our business in Ireland and expand our business across the EU in a post-Brexit environment”. They are: Payments Firms: AIB Merchant Services, Western Union, Fexco, CurrencyFair.com, TransferMate Global Payments, #Fire, CUSOP (Payments) Ltd, #PrimaFinance, Avantcard, Barclaycard, #Chasepaymentech, Google Pay, #smallworld, AFEX, BUREAU BUTTERCRANE LTD, Remitly, J.P. Morgan, Circit.io, Xpress Money, CRIF & Finclude (fka. Verge.Capital) Emoney Firms: EML, Facebook, Soldo, Optal, Paysafe Group, paysafecard.com, Prepaid Financial Services Limited (PFS), #foreigncurrencydirect, Stripe, Coinbase. One4all Group, Payoneer, Square and Moneycorp. Congratulations Moneycorp and Square and welcome to the thriving regulated Irish fintech ecosystem. If you are looking to get authorised in Ireland as an emoney or payments firm, see these Authorisation Guides. Read Moneycorp's press release below. Moneycorp secures its E-Money and MiFID licences in Ireland

New Irish entity, licenced by Central Bank of Ireland, to drive expansion across EU Moneycorp to build on €3 billion of transactions executed for Irish clients in 2019 Dublin, 1 July 2020 | Moneycorp Group, the global foreign exchange and payments business has been granted its Electronic Money Institution (E-Money) and MiFID licences by the Central Bank of Ireland (CBI), further bolstering its offering and expansion in the European Union (EU). Moneycorp is one of the world’s largest specialist foreign exchange companies, serving corporates and individuals across multiple channels since 1979. Headquartered in London, Moneycorp opened its Dublin office in 2013 to provide corporate clients with foreign exchange and payment services over its market leading on-line platform as well as directly from its Dublin dealing room. Since launch, the Dublin office has operated as a branch of the Group’s UK regulated entities, however, as part of Moneycorp’s strategic response to Brexit and wider market developments, it has now secured its E-money and MiFID licences from the CBI for a newly established Irish company; Moneycorp Technologies Limited (MTL). Bryan McSharry, CEO of Moneycorp’s European business, said: “We are delighted to have secured both E-money and MiFID licences from the Central Bank of Ireland. This ensures we can continue to support our existing customer base; continue to grow our business in Ireland; and expand our business across the EU in a post Brexit environment.” “Since launching in Dublin in 2013, we have built a strong corporate and individual customer base of Irish clients – based on our ability to provide best in class foreign exchange services across our market-leading technology platform. We completed €3 billion of transactions for Irish clients in 2019 and we will build on that in 2020 and beyond. Our CBI licences will enable us to continue to expand our business and headcount in Ireland and offer our market-leading service to a vastly increased customer base across the EU.” About Moneycorp Group Moneycorp Group is a global foreign exchange and payments business with offices in the UK, USA, Brazil, Hong Kong, Spain, Gibraltar, Romania, Australia, the UAE and Ireland. With a forty year record of outstanding customer service, today the Moneycorp group serves the growing foreign exchange and payments needs of global businesses, importers and exporters as well as personal clients. W: www.moneycorp.com L: linkedin.com/company/moneycorp/ T: @moneycorp I: instagram.com/moneycorp/ |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]