AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

Which are the Top 5 European Union member states for electronic money institution (#EMI) authorisations? Read on, you may be surprised.

[If you are looking to get authorised as a fintech in the European Economic Area visit our authorisation page ] There are, as of today's records published by the European Banking Authority, 268 EMIs authorised in the European Economic Area. Following the United Kingdom's exit from the European Union, the crown for the home of the largest number of authorised EMIs lands on the head of Lithuania (16.2%), followed in the distance by Malta (5.3%), then both Ireland and France (tied at 3.4% each) and rounding out the Top 5 is Cyprus (3%). It is remarkable, and admirable, that Lithuania has attracted such a large number of these fintech. No wonder CompliReg supports: * https://FintechLithuania.com, * https://FintechMalta.com, * https://FintechIreland.com, * https://FintechCyprus.com, and soon a new Fintech France website! Had the UK not left the European Union, it would be the undisputed king of emoney firms having 2.8 times more authorised EMIs than Lithuania and a mere 4% fewer than the total number of all EEA authorised EMIs. No surprise either that CompliReg supports https://FintechUK.com. In the coming days we will release more #funfintechfacts about the EEA and UK. Having crunched a pile of numbers, I expect that in the not too distant future the number of EMIs, authorised payments institutions and AISPs will equate to approximately half the number of authorised credit institutions in the EEA. But presently these fintech companies have a long way to go to outnumber the banks - being only 35% of the total number of authorised EEA credit institutions. Let us know if this information is interesting and your thoughts. Are you surprised by split? What you may be surprised by is that when it comes to authorised #paymentservices firms, the EMI leader board is not necessarily replicated! And of course, if you need assistance with your fintech authorisation, please get in contact (that's the advertisement piece!). This post appears on LinkedIN - https://www.linkedin.com/posts/peteroakes_electronicmoney-emi-fintech-activity-6874439675864502272-5SiL

0 Comments

Read More

Back to Blog

I am sure there will be opposing views, but delighted for fintech and innovative finserv in both the UK and Ireland being thrown a commonsense method to continue the transfer of personal data between the UK and Ireland with the European Commission giving the green light to data transfers between EU countries and the UK. This happened yesterday via the European Commission adopting two adequacy decisions for the United Kingdom, one under the General Data Protection Regulation and the other under the Law Enforcement Directive. I posted on the previous draft versions a while ago on Linkedin. In summary, this means that personal data can now flow freely between Ireland and the UK, with the Commission guaranteeing citizens that their data in the UK has “essentially the equivalent level of protection to that guaranteed under EU law”. As seems with everything involving dealings between the UK and Europe, the resolution was found at minutes to midnight (so to speak) with the interim bridging mechanism which permitted personal data to be transferred from the EU to the UK following the end of the Brexit transition period, expiring on 30 June 2021. Essentially the Commission has assured citizens that GDPR will be fully respected in the UK. What does this mean for standard contractual clauses (SCCs)? The new adequacy decisions mean that personal data can continue to be transferred from the EU to the UK without additional steps such as the SCCs being put in place. “The UK has left the EU but today its legal regime of protecting personal data is as it was. Because of this, we are adopting these adequacy decisions today. At the same time, we have listened very carefully to the concerns expressed by the Parliament, the Members States and the European Data Protection Board, in particular on the possibility of future divergence from our standards in the UK's privacy framework. We are talking here about a fundamental right of EU citizens that we have a duty to protect. This is why we have significant safeguards and if anything changes on the UK side, we will intervene”. Věra Jourová, EC Vice-President for Values and Transparency, Key elements of the adequacy decisions

The adequacy decisions also facilitate the correct implementation of the EU-UK Trade and Cooperation Agreement, which foresees the exchange of personal information, for example for cooperation on judicial matters. Both adequacy decisions include strong safeguards in case of future divergence such as a ‘sunset clause', which limits the duration of adequacy to four years. “After months of careful assessments, today we can give EU citizens certainty that their personal data will be protected when it is transferred to the UK. This is an essential component of our new relationship with the UK. It is important for smooth trade and the effective fight against crime. The Commission will be closely monitoring how the UK system evolves in the future and we have reinforced our decisions to allow for this and for an intervention if needed. The EU has the highest standards when it comes to personal data protection and these must not be compromised when personal data is transferred abroad.” Didier Reynders, Commissioner for Justice Background

On 19 February, the Commission published two draft adequacy decisions and launched the procedure for their adoption. Over the past months, the Commission has carefully assessed the UK's law and practice on personal data protection, including the rules on access to data by public authorities in the UK. The Commission has been in close contact with the European Data Protection Board, which gave its opinion on 13 April, the European Parliament and the Member States. Following this in-depth process, the European Commission requested the green light on the adequacy decisions from Member States' representatives in the so-called comitology procedure. The adoption of the decisions today, following the agreement from Member States' representatives, is the last step in the procedure. The two adequacy decisions enter into force today (ie 28 June 2021). The EU-UK Trade and Cooperation Agreement (TCA) includes a commitment by the EU and UK to uphold high levels of data protection standards. The TCA also provides that any transfer of data to be carried out in the context of its implementation has to comply with the data protection requirements of the transferring party (for the EU, the requirements of the GDPR and the Law Enforcement Directive). The adoption of the two unilateral and autonomous adequacy decisions is an important element to ensure the proper application and functioning of the TCA. The TCA provides for a conditional interim regime under which data can flow freely from the EU to the UK. This interim period expires on 30 June 2021. Read more here

Back to Blog

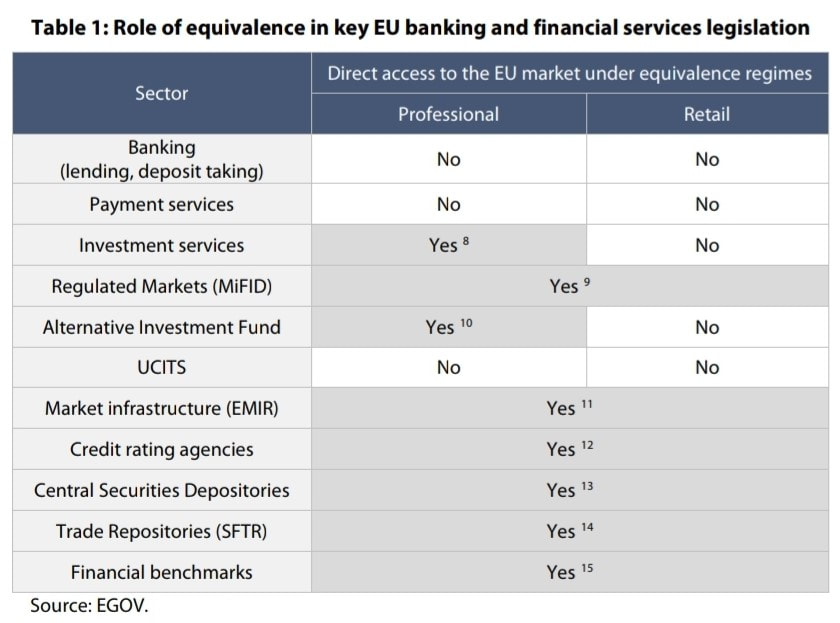

Some choice headlines in the papers about Brexit in the past week as we - according to Brexit Ireland's countdown to Brexit clock - just little more than 33 days before 11p.m. (UK time) on Thursday 31st December 2020 when the Brexit transition period ends with no deal on financial services in sight. This week sees the EU negotiating team returning to London after face-to-face talks came to end more than a week ago after Mr Bariner's team was hit by a case of Covid. They will be greeted by headiness such as: UK dismisses ‘derisory’ EU fishing offer ahead of last-ditch trade talks; Europe’s finance sector hits ‘peak uncertainty’ over Brexit; and The City braces for Brexit. There is no equivalence regime provided for within either EMD2 (electronic money institutions) or PSD2 (payments services institutions)! One thing we are still very surprised by is the many in #fintech, #techfin and indeed #finserv (and scarily their advisers) who think that recent news on 'equivalence' deals are applicable to all UK #finserv which passport across the European Union / EEA. The announcement on Monday 23rd November by the European Commission was simply and specifically about European regulators finalising a late change seeking to avoid chaos in £15tn of derivatives contracts held between UK and EU counterparties. Then on Wednesday 25th, they insisted outposts of EU banks in London would have to trade certain derivatives in the EU. Back in August 2020 the European Parliament reminded that "Equivalence decisions are a unilateral decision by the Commission. The Commission ultimately exercises its discretion as conferred upon it by the “empowerment” given in EU sectoral legislation.'' BUT MORE IMPORTANTLY "The Commission also enjoys discretion to withdraw equivalence decision. The equivalence frameworks in force do not provide as such specific procedures for monitoring, reviewing or amending equivalence decisions." There are no equivalence provisions in EU bank, payments nor electronic money directives, and the equivalence provision in MiFiD doesn't apply to retail investment services. See the below table on the 'Role of equivalence in key EU banking and financial services legislation' for confirmation. The upshot is that if you are a UK authorised payments institution or electronic money intuition, come Thursday 31st December 2020 when your ability to passport across the whole of European Economic Area comes to an end, so too does your business model unless you have obtained an authorisation in an EU/EEA state. There are are other options available but we'll leave that for another article. If you are a regulated fintech looking for a home post #brexit contact https://complireg.com/authorisations.html. Read our Fintech Authorisation Guides published jointly by CompliReg and Fintech Ireland on the authorisation process. And check out the 'Why Ireland for Fintech' brochure. Why Ireland for your regulated fintech?

“From January 1st, EU rules will apply to UK firms wishing to operate in the EU. UK firms will lose their financial passport: it’ll be anything but business as usual for them. This means they will have to adhere to individual home-state rules in each and every member state,” the official said. Further reading:

26 November 2020 - Move to EU or face disruption, City of London is warned

27 August 2019 - "Third country equivalence in EU banking and financial regulation"

29 July 2019 - Financial services: Commission sets out its equivalence policy with non-EU countries 12 July 2017 - "Third-country equivalence in EU banking legislation"

|

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]