AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

Which are the Top 5 European Union member states for electronic money institution (#EMI) authorisations? Read on, you may be surprised.

[If you are looking to get authorised as a fintech in the European Economic Area visit our authorisation page ] There are, as of today's records published by the European Banking Authority, 268 EMIs authorised in the European Economic Area. Following the United Kingdom's exit from the European Union, the crown for the home of the largest number of authorised EMIs lands on the head of Lithuania (16.2%), followed in the distance by Malta (5.3%), then both Ireland and France (tied at 3.4% each) and rounding out the Top 5 is Cyprus (3%). It is remarkable, and admirable, that Lithuania has attracted such a large number of these fintech. No wonder CompliReg supports: * https://FintechLithuania.com, * https://FintechMalta.com, * https://FintechIreland.com, * https://FintechCyprus.com, and soon a new Fintech France website! Had the UK not left the European Union, it would be the undisputed king of emoney firms having 2.8 times more authorised EMIs than Lithuania and a mere 4% fewer than the total number of all EEA authorised EMIs. No surprise either that CompliReg supports https://FintechUK.com. In the coming days we will release more #funfintechfacts about the EEA and UK. Having crunched a pile of numbers, I expect that in the not too distant future the number of EMIs, authorised payments institutions and AISPs will equate to approximately half the number of authorised credit institutions in the EEA. But presently these fintech companies have a long way to go to outnumber the banks - being only 35% of the total number of authorised EEA credit institutions. Let us know if this information is interesting and your thoughts. Are you surprised by split? What you may be surprised by is that when it comes to authorised #paymentservices firms, the EMI leader board is not necessarily replicated! And of course, if you need assistance with your fintech authorisation, please get in contact (that's the advertisement piece!). This post appears on LinkedIN - https://www.linkedin.com/posts/peteroakes_electronicmoney-emi-fintech-activity-6874439675864502272-5SiL

0 Comments

Read More

Back to Blog

Ireland's Finance Minister, Paschal Donohue, Speech on blockchain, crypto, fintech & innovation24/5/2021 A few short interesting extracts from a speech by Minister of Finance Paschal Donohoe to Blockchain Ireland audience yesterday (24 May 2021), covering fintech, payments, blockchain and crypto. Download the speech in PDF here

Full speech: Speech to Blockchain Ireland Week 2021 (Department of Finance)Published on 24 May 2021 Last updated on 24 May 2021 From Department of Finance Published on 24 May 2021 Last updated on 24 May 2021 Check Against Delivery Good morning everyone. I am delighted to be speaking to you today, albeit virtually, as part of Blockchain Ireland Week. First of all, I would like to acknowledge the commitment of Dave Feenan to blockchain; accepting the role as the new Chair of Blockchain Ireland, a challenge that few could have met. I would also like to acknowledge the tenacity and perseverance of Lory Kehoe, being one of the original founders of Blockchain Ireland, over 5 years ago. Thank you also Toomas Ilves for sharing your experience in the digitalisation of your country, and your expert understanding of blockchain technology. An inspiration for us all here, as this week we explore how we can create our present, and our future, working with this technology. It is hard to believe it is two years ago since I had the opportunity to meet many of you personally at the Iveagh Garden hotel. A lot has changed since, even the price of Bitcoin. Or should I say Dogecoin? Advances in the sector Blockchain Ireland Week is taking place at a crucial moment. The last year has been extremely difficult for everyone and the impact of Covid19 on our economy and society has been immense. Now, as our country begins to re-open and we continue to accelerate the vaccination programme, there is a sense of collective relief; we can allow ourselves to look forward more positively. Necessity is the mother of invention. You could say, necessity is the mother if innovation. And this is the moment to dare conceive new business models, engage with disruptive technologies and challenge ourselves to change and adapt. Because we need to change: as citizens, as customers, as businesses. We have all felt the need to adapt to the extreme circumstances of the pandemic. And we must continue to adjust; not to survive, but to thrive. The series of events that you, Blockchain Ireland, have scheduled for this week, offer an ample opportunity to learn more and explore how blockchain technology can improve our business, and our lives. Not only in Ireland, but within the EU, and globally. I wished I had the time to attend most of the events lined up for this week: the breadth and depth of topics being discussed is a testament to the leadership of Blockchain Ireland. International speakers from Africa, Asia, Australia, Europe and the United States will share their respective views and experiences. An extended thanks to all those speakers for bringing their expertise to our shores. From within Ireland, it’s fantastic to see how this technology is being used in initiatives such as: – Provenance in craft-beer, food and agricultural products – Making investing in bloodstock more affordable and transparent; – Providing integrity and trust to health data; – Exploring education and training choices. Right now, I would like to share with you two thoughts that struck me as I read about Blockchain Ireland week. The Benefits of Blockchain First, the discussion is no longer about “What is Blockchain?”, “Blockchain vs Crypto” or “Risks and benefits of Blockchain”. To me, this is a very encouraging sign. It demonstrates that the technology is maturing. We are increasingly seeing more instances of how the technology can benefit the economy and society; more enterprises are funding pilots; more private sector consortia are being created; we also see mainstream adoption starting to take off. The technology’s broad market applicability and the relevance to specific sectors is becoming clearer. It also demonstrates that in Ireland we are keeping abreast with changes in the technology. We have moved from 50 companies in Ireland working with blockchain back in May 2019 (when I last spoke to you), to almost 100 today: a sure sign that the Blockchain sector in Ireland is becoming more embedded in our ecosystem. My question for you all is: is that enough though? Could we do more? Could we do better? If so, what do we need to do? One of Ireland’s strengths is our ability to innovate and adapt to emerging trends across finance and technology and I have spoken before about the importance of nurturing Ireland’s knowledge economy. As a Government, we have tried to ensure that Ireland is prepared to take the advantages of technological opportunities though a number of interconnected initiatives. These objectives underpinned the Government’s Future Jobs Ireland strategy. Our vision, as set out in the Ireland for Finance Strategy to 2025, is for Ireland to remain internationally competitive and a top-tier location of choice for specialist IFS. We have a track record in this country for building globally recognised payment companies and innovative financial services businesses. As you will discuss this week, blockchain can transform the way in which many financial services sectors currently operate and deliver services to customers. The digital asset sector is becoming an increasingly competitive environment, while creating challenges for existing legal and supervisory frameworks, trying to match market and client requirements. We are actively monitoring developments in the technology and regulations globally, so that any potential policy changes will be crafted from a balanced, measured and carefully laid out review of risks and opportunities, both to consumers and to the economy. However, the pace of development is fast and the consequences of change might be difficult to comprehend early on. Thus, whether it is through the provision of digital assets or innovative ways of providing micro-insurance, I encourage you all to raise any concerns that would impede Ireland’s ability to remain competitive and a destination of choice for financial services. It is also encouraging to see how applications of the technology are being explored across the spectrum of our society. FutureNeuro, the Science Foundation Ireland Research Centre for Chronic and Rarer Neurological Diseases, is using blockchain to match sick patients to clinical trials based on their clinical and genomic data. It received €3.9 million in funding from the recent Disruptive Technology Innovation Fund award under Project Ireland 2040. Blockchain is also enabling innovative approaches to educational credentialing in the Irish banking sector. Earlier this year I was delighted to mark the launch of the EdQ Platform, a collaboration of the Institute of Banking alongside Bank of Ireland, AIB, Ulster Bank and Deloitte. This unique blockchain-based education credentialing platform for financial services is the first of its kind Ireland – and perhaps the world. Finally, there are 12 educational institutions across Ireland that are supporting and researching blockchain, whether that is in the form of ongoing research, study programmes or partnerships with other companies. Another heartening sign that Ireland is collectively working towards strengthening its knowledge economy credentials, anchoring on blockchain technology. To summarise, it is very inspiring to see evidence in the Irish blockchain sector that we are moving at pace with the maturity stages of the technology. As Minister for Finance, I would add that I am very reassured to see my Department has closely followed the pace and continues to be an integral participant of the Irish Blockchain Ecosystem. Trust in a Global Pandemic My second thought, is inspired by the central theme of this week’s event, “Blockchain: Foundation of Trust”. The pandemic has certainly accelerated the move to transacting and living in a digital world: what might have taken 10 years has been achieved in 10 months. We have all adapted to a large part of our lives being carried out online. However, necessity to do so may have trumped “trust”. Perhaps the most visible example of this was people being forced to drop the use of cash and become proficient in digital payments. The necessity to transact a payment online forced many to implicitly “trust” in the process, without considering who the company offering such services is or what consumer protection safeguards are in place if something goes wrong. And this was the case for everyone, irrespective of age or digital proficiency. As people became more comfortable with making financial transactions online, the 24/7 availability and convenient access made the purchasing of cryptocurrencies more accessible to the public than ever. As Minister for Finance, I’m conscious that investing in cryptocurrencies continues to involve risks and that there must be adequate regulation to protect consumers in this regard. Equally, I recognise that the blockchain technology that underpins these currencies is being a catalyst for innovation in the financial services sector, particularly payments and capital markets. Not only has the pandemic upended many of our constructs of a “normal” society, it has also challenged our trust in everything around us. Fake news should not be the new normal. Online scams should not be the new normal. Unverifiable scientific data should not be the new normal. As Finance Minister, and as President of the Eurogroup, I take the issue of trust in our banking and payment system very seriously. This is why we are closely monitoring developments into the review of a potential Digital Euro and follow the ECB’s ongoing research into Central Bank Digital Currencies. At the same time, my Department is working with the EU Commission and the Presidency to bring forth a general agreement on the draft proposal for regulation for a Market in Crypto Assets. Discussions are progressing at pace, particularly considering the technicality and complexity of the proposal. Why is this important? Because I believe that clarity of the legal and regulatory perimeter applicable to cryptoassets will bring trust for consumers and companies to deliver and use such products and services, which in turn will generate trust in our governing institutions. Conclusion As Minister for Finance, I welcome you all to Blockchain Ireland Week and I really look forward to exploring the key outcomes of this week’s discussions. I am sure it is going to be a terrific week of events. ENDS Source: https://www.gov.ie/en/speech/50cac-speech-to-blockchain-ireland-week-2021/

Back to Blog

UK FCA Dear CEO Letter - Emoney Firms ensure customers understand how their money is protected18/5/2021 On Tuesday 18th May 2021, the UK Financial Conduct Authority issued a Dear CEO Letter to Electronic Money Institutions headed "Please act: ensure your customers understand how their money is protected."

You can read a copy of the letter here. Some interesting excerpts from the letter below: What is the UK FCA concerned about?:

Action expected of emoney firms by the FCA:

Note the FCA point that the communication to customer be separate from any other messaging or promotional activity. And that the FCA expects emoney firms to consider the appropriate method(s) of communication based on their business model and customer base, including any vulnerable customers. Why should emoney action the letter?: Because the FCA intend to follow up, with a sample of firms, to assess the actions taken. Contact the team at CompliReg if you require assistance. You can read a copy of the letter here.

Back to Blog

CompliReg's Peter Oakes has again being recognised as a leading fintech consultant for 2021 following his listing in 2020.

Chambers and Partners released its Fintech Rankings for Ireland in January 2021. Peter is the only individual / boutique professional services firm (CompliReg) to be ranked along side some of Ireland's largest consulting firms. In research carried out by Chambers and Partners, Peter's clients and fintech industry experts informed the researchers that:

Reach to Peter for assistance and advice via the details on our contact page. Further reading:

Back to Blog

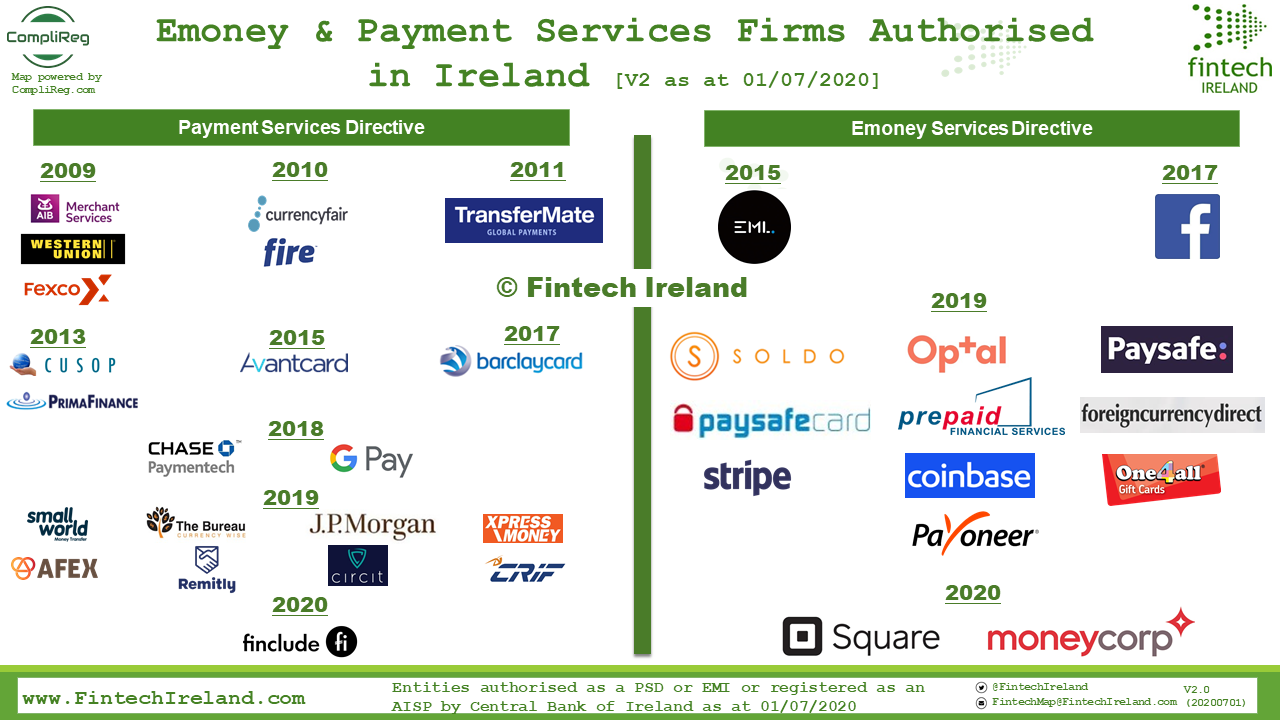

CompliReg is proud to power the Official Fintech Ireland Map 2020. We are now powering the Regulated Fintech Ireland Map version 2 which showcases the regulated payment services directive and electronic money directive firms authorised by the Central Bank of Ireland. Joining this Map in 2020 are the first of two - hopefully many more to come - e-money firms, Squareup International Limited ("Square") and MoneyCorp. Ireland now has:

In addition to issuing emoney, Square is authorised to provide payment services number 3b (execution of payment transactions through a payment card or a similar device) and number 5 (issuing of payment instruments and/or acquiring of payment transactions). Although Moneycorp is yet to appear on the Central Bank of Ireland register, Moneycorp confirmed to us that it is also authorised to provide payment services 3b, 5 and in addition 3c (execution of credit transfers, including standing orders). Moneycorp has been fairly busy. In addition to its emoney authorisation, it also secured a MiFID authorisation. By the way, AFEX which was authorised as payments institution in 2019 also secured a MiFID licence. Expect to see more firms seek both an emoney/payments authorisation together with a MiFID one. Moneycorp’s Dublin office, which opened in 2013, has operated as a branch of its UK regulated entities, saying that as part of Moneycorp’s strategic response to Brexit and wider market developments, it has now secured its e-money and MiFID licences from the Central Bank of Ireland for a newly established Irish company. Bryan McSharry, chief executive of Moneycorp’s European business, said the licences ensured it could “continue to support our existing customer base, continue to grow our business in Ireland and expand our business across the EU in a post-Brexit environment”. They are: Payments Firms: AIB Merchant Services, Western Union, Fexco, CurrencyFair.com, TransferMate Global Payments, #Fire, CUSOP (Payments) Ltd, #PrimaFinance, Avantcard, Barclaycard, #Chasepaymentech, Google Pay, #smallworld, AFEX, BUREAU BUTTERCRANE LTD, Remitly, J.P. Morgan, Circit.io, Xpress Money, CRIF & Finclude (fka. Verge.Capital) Emoney Firms: EML, Facebook, Soldo, Optal, Paysafe Group, paysafecard.com, Prepaid Financial Services Limited (PFS), #foreigncurrencydirect, Stripe, Coinbase. One4all Group, Payoneer, Square and Moneycorp. Congratulations Moneycorp and Square and welcome to the thriving regulated Irish fintech ecosystem. If you are looking to get authorised in Ireland as an emoney or payments firm, see these Authorisation Guides. Read Moneycorp's press release below. Moneycorp secures its E-Money and MiFID licences in Ireland

New Irish entity, licenced by Central Bank of Ireland, to drive expansion across EU Moneycorp to build on €3 billion of transactions executed for Irish clients in 2019 Dublin, 1 July 2020 | Moneycorp Group, the global foreign exchange and payments business has been granted its Electronic Money Institution (E-Money) and MiFID licences by the Central Bank of Ireland (CBI), further bolstering its offering and expansion in the European Union (EU). Moneycorp is one of the world’s largest specialist foreign exchange companies, serving corporates and individuals across multiple channels since 1979. Headquartered in London, Moneycorp opened its Dublin office in 2013 to provide corporate clients with foreign exchange and payment services over its market leading on-line platform as well as directly from its Dublin dealing room. Since launch, the Dublin office has operated as a branch of the Group’s UK regulated entities, however, as part of Moneycorp’s strategic response to Brexit and wider market developments, it has now secured its E-money and MiFID licences from the CBI for a newly established Irish company; Moneycorp Technologies Limited (MTL). Bryan McSharry, CEO of Moneycorp’s European business, said: “We are delighted to have secured both E-money and MiFID licences from the Central Bank of Ireland. This ensures we can continue to support our existing customer base; continue to grow our business in Ireland; and expand our business across the EU in a post Brexit environment.” “Since launching in Dublin in 2013, we have built a strong corporate and individual customer base of Irish clients – based on our ability to provide best in class foreign exchange services across our market-leading technology platform. We completed €3 billion of transactions for Irish clients in 2019 and we will build on that in 2020 and beyond. Our CBI licences will enable us to continue to expand our business and headcount in Ireland and offer our market-leading service to a vastly increased customer base across the EU.” About Moneycorp Group Moneycorp Group is a global foreign exchange and payments business with offices in the UK, USA, Brazil, Hong Kong, Spain, Gibraltar, Romania, Australia, the UAE and Ireland. With a forty year record of outstanding customer service, today the Moneycorp group serves the growing foreign exchange and payments needs of global businesses, importers and exporters as well as personal clients. W: www.moneycorp.com L: linkedin.com/company/moneycorp/ T: @moneycorp I: instagram.com/moneycorp/

Back to Blog

[first posted by Fintech UK]

Panel: Has the crisis helped companies shift from being product-centric to customer centric, are they ready for consumer of 2021? What: Fintech Week Lithuania: Panel: Has the crisis helped companies shift from being product-centric to customer-centric, are they ready for consumer of 2021? When: Tuesday 16th June 2020. Start time 9:55am (Irish/UK time) / 11:55am (Lithuania time). Where: Online Event. Cost: Free Registration: See registration link at https://fintechuk.com/events/covid19-fintech-shift-from-product-to-customer-centric Details: Fintech UK's Peter Oakes* (Board Director at global fintech / payments business TransferMate) joins an excellent line up of fellow panel members Agnė Selemonaitė, Deputy CEO & Board Member at ConnectPay and Anastasija Oleinika, CEO of TWINO Group in a lively session moderated by Nick Price, Chief Executive of Bright Purple. *Peter is also founder of Fintech Ireland, US Fintech, Fintech Cyprus, leading fintech advisory firm CompliReg and a director of several regulated fintech companies including Susquehanna International, Optal Financial Europe and AWM Wealth Advisers)

Back to Blog

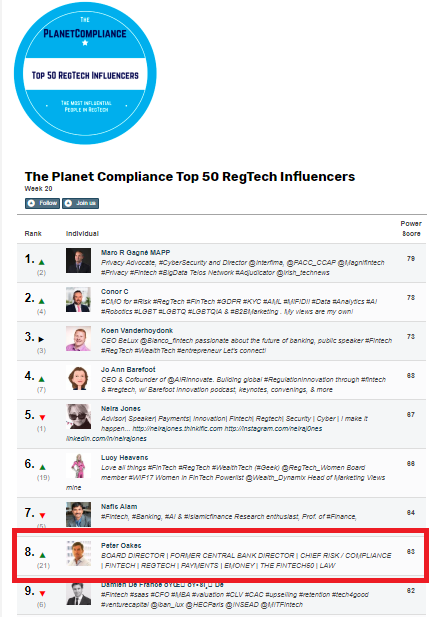

Yet again, our Peter Oakes, Non-Executive Director FinTech & FinServ and Founder of CompliReg and Fintech Ireland ranked in Top 10 of of the Top 50 RegTech Influencers. Planet Compliance updates a list of people that it finds are the key influencers in the field of RegTech. You'll find Peter Oakes featured almost every week in this list of RegTech influencers.

Peter was identified by the prestigious Chambers & Partners in January 2020 as leading band 1 FinTech advisor too.

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events.

Back to Blog

16 January 2020: Peter Oakes, Founder of CompliReg (and Founder of Fintech Ireland, Fintech UK, Fintech NI and US Fintech / USTechFin) has been recognised as a Leading Band 1 Consultant in Chambers & Partners’ 2020 Professional Advisers guide for FinTech – the premier ranking of professional advisers to the financial services industry.

Peter secured a nationwide Ireland Band 1 ranking – Chambers’ top-tier ranking – where it was noted that: Peter Oakes, who has vast international regulatory experience as a former director of the Central Bank of Ireland. A source says: ‘Peter is high-profile, he has very strong governance capabilities and is very good for a regulated FinTech company.' Peter is a non-executive director of regulated fintech companies in the payments, e-money and MiFID sectors and is an adviser and mentor to fintech and regtech startups and scaleups. In Ireland he is a consultant to Clark Hill and in the UK he is a consultant to Kerman & Co, which is supporting the Fintech UK project. Learn more about Peter Oakes’s rankings in the Chambers FinTech guide here: https://chambers.com/department/peter-oakes-consulting-fintech-49:2743:114:1:23173986 |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]