AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

Which are the Top 5 European Union member states for electronic money institution (#EMI) authorisations? Read on, you may be surprised.

[If you are looking to get authorised as a fintech in the European Economic Area visit our authorisation page ] There are, as of today's records published by the European Banking Authority, 268 EMIs authorised in the European Economic Area. Following the United Kingdom's exit from the European Union, the crown for the home of the largest number of authorised EMIs lands on the head of Lithuania (16.2%), followed in the distance by Malta (5.3%), then both Ireland and France (tied at 3.4% each) and rounding out the Top 5 is Cyprus (3%). It is remarkable, and admirable, that Lithuania has attracted such a large number of these fintech. No wonder CompliReg supports: * https://FintechLithuania.com, * https://FintechMalta.com, * https://FintechIreland.com, * https://FintechCyprus.com, and soon a new Fintech France website! Had the UK not left the European Union, it would be the undisputed king of emoney firms having 2.8 times more authorised EMIs than Lithuania and a mere 4% fewer than the total number of all EEA authorised EMIs. No surprise either that CompliReg supports https://FintechUK.com. In the coming days we will release more #funfintechfacts about the EEA and UK. Having crunched a pile of numbers, I expect that in the not too distant future the number of EMIs, authorised payments institutions and AISPs will equate to approximately half the number of authorised credit institutions in the EEA. But presently these fintech companies have a long way to go to outnumber the banks - being only 35% of the total number of authorised EEA credit institutions. Let us know if this information is interesting and your thoughts. Are you surprised by split? What you may be surprised by is that when it comes to authorised #paymentservices firms, the EMI leader board is not necessarily replicated! And of course, if you need assistance with your fintech authorisation, please get in contact (that's the advertisement piece!). This post appears on LinkedIN - https://www.linkedin.com/posts/peteroakes_electronicmoney-emi-fintech-activity-6874439675864502272-5SiL

0 Comments

Read More

Back to Blog

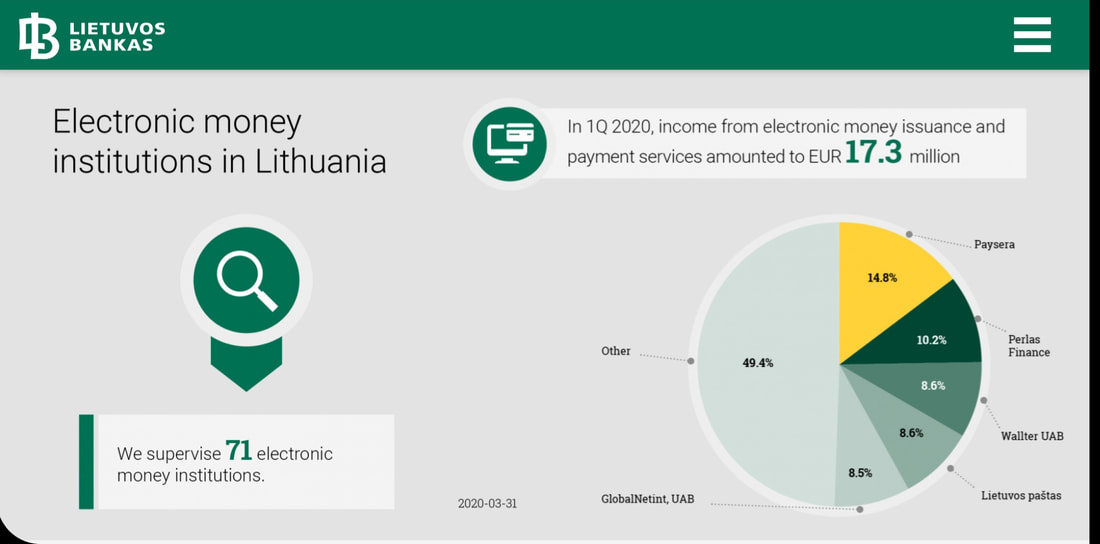

If you use all or any part of this blog, please ensure you cite and credit CompliReg and Peter Oakes in your re-use of this blog. Another electronic money institution (EMI) fined and sanctioned in Lithuania for anti-money laundering regulatory requirements and in this case also for an equity capital requirement failure. While the case is worth noting for both aspects, it is particularly so because across Europe, following the collapse of Wirecard, there will be continuing heightened awareness of both safeguarding and capitalisation of regulated EMIs and payment institutions (PIs). The case also makes known that the BoL is conducting targeted inspections of EMIs across a range of themes. In our previous blog, 2 June 2020, on the Lithuanian Central Bank (Bank of Lithuania / BoL) giving banks guidelines on opening accounts for electronic money institutions (EMIs) and payment institutions (PIs) Peter Oakes noted recent examples of fines against EMIs/PIs including failures to comply with requirements for: (i) anti-money laundering; (ii) safeguarding of customer funds; and (iii) segregation of customer funds and; execution of payment transactions. The Bank of Lithuania, which supervises 71 EMIs - which is the largest number of EMIs supervised by an EU financial regulator national competent authority* - has announced that it has taken regulatory action against Via Payments UAB for both: (1) violations of the requirements for prevention of money laundering and terrorist financing (sanctioned with a fine of €120,000 and publicity); and (2) failure to meet the equity capital requirement (sanctioned with publicity only). Via Payments UAB holds an electronic money institution licence, issued on 10 October 2017. As you will see from the graphic below, in addition to BoL supervising 71 EMIs we also learn that Q1 2020 income from EMI and payment services amounted to €17.3 million. Keep reading below for the background to the facts of the Via Payments UAB enforcement action. (1) Background to the money laundering law violations:

The regulatory actions were taken on foot of a "targeted inspection of the electronic money institution Via Payments UAB". During the course of the inspection, the Supervision Service of the BoL identified breaches of the Republic of Lithuania Law on the Prevention of Money Laundering and Terrorist Financing. In addition to a fine of €120,000, the BoL obligated Via Payments to remedy the deficiencies. BoL says that Via Payments has confirmed that all deficiencies have been remediated. With respect to the money laundering violations, the inspection revealed that:

BoL imposed a fine of €120,000 on Via Payments UAB. As part of its mitigation Via Payments informed the BoL’s Supervision Service that it had already taken measures to strengthen its AML compliance by increasing the number of specialists and improving technological solutions. (2) background to the equity capital requirement failure This regulatory failure came to the attention of the BoL through a separate analysis of the activities of EMIs. Here the Supervision Service of the BoL recorded that Via Payments violated legal acts because as at 31 March 2020 the company “failed to meet the equity capital requirement”. The BoL appears to have place a lot of reliance on the institution having “eliminated the indicated shortcomings without further delay, no interests of their clients have been violated” and therefore BoL “decided to impose a mild enforcement measure by making these infringements public”. * Note that notwithstanding that the UK is in a post-Brexit transition period, it left the European Union on 31 January 2020. Accordingly, Lithuania although it may have fewer EMIs than the UK, it records the largest number of EMIs in the European Union. Sources:

This blog written by Peter Oakes. Peter advises on Lithuanian EMI/PI issues and advised on the authorisation of one Lithuania's first special bank authorisations. If you require a licence to operate in Lithuania, Ireland, Cyprus, Malta or the UK, see our Authorisation Page. We have a great network of experts in each country too, from lawyers, to accountants to technical experts. And get in contact if you have a question about this blog.

Back to Blog

[first posted by Fintech UK]

Panel: Has the crisis helped companies shift from being product-centric to customer centric, are they ready for consumer of 2021? What: Fintech Week Lithuania: Panel: Has the crisis helped companies shift from being product-centric to customer-centric, are they ready for consumer of 2021? When: Tuesday 16th June 2020. Start time 9:55am (Irish/UK time) / 11:55am (Lithuania time). Where: Online Event. Cost: Free Registration: See registration link at https://fintechuk.com/events/covid19-fintech-shift-from-product-to-customer-centric Details: Fintech UK's Peter Oakes* (Board Director at global fintech / payments business TransferMate) joins an excellent line up of fellow panel members Agnė Selemonaitė, Deputy CEO & Board Member at ConnectPay and Anastasija Oleinika, CEO of TWINO Group in a lively session moderated by Nick Price, Chief Executive of Bright Purple. *Peter is also founder of Fintech Ireland, US Fintech, Fintech Cyprus, leading fintech advisory firm CompliReg and a director of several regulated fintech companies including Susquehanna International, Optal Financial Europe and AWM Wealth Advisers) |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]