AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

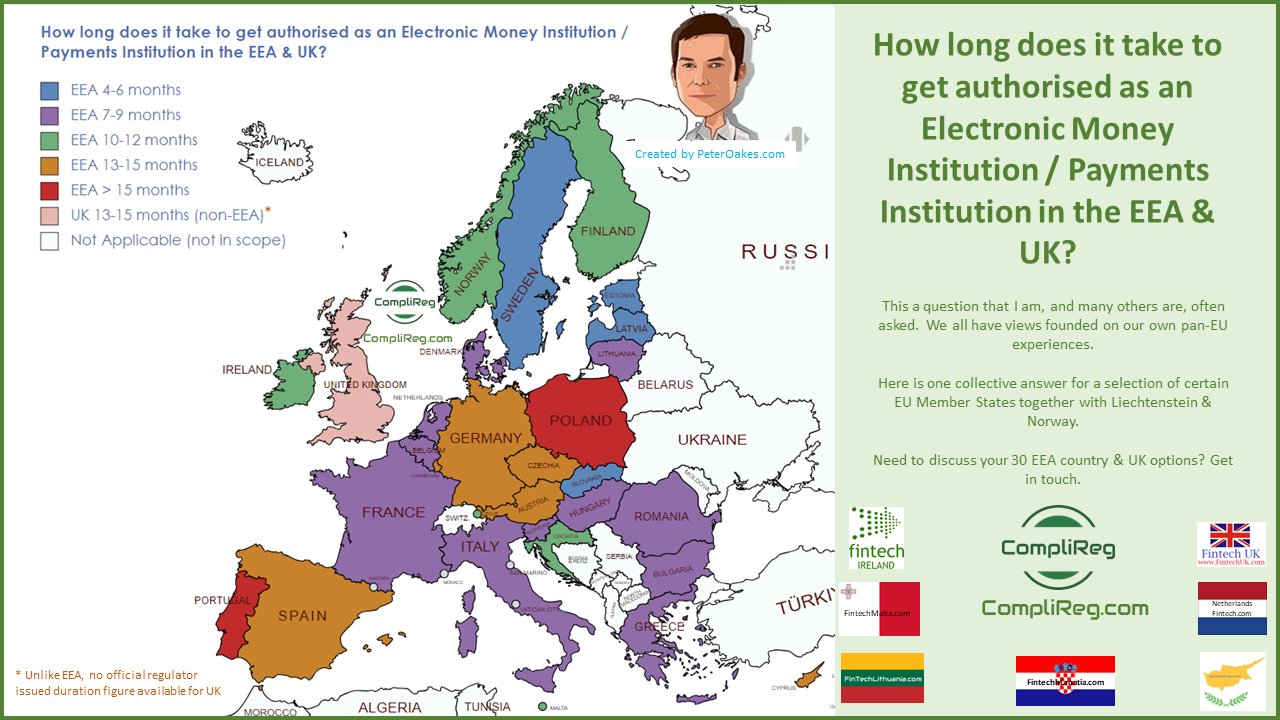

If you are struggling with an application for an electronic money or payments institution authorisation in Europe, contact us here and/or complete the Authorisation/Licence Enquiry Form here. If you are looking at becoming authorised in Ireland as an emoney institution or payments institution check out Fintech Ireland's and CompliReg's authorisation guides here. According to recent figures, it may take as little as 4 months to become authorised as an electronic money or payments institution in the EEA and as long as 15+ months. Whereas in the UK the experience, towards the higher end, is 13-15 months but can be shorter.

The only sure fire way to reduce the amount of time that your application for authorisation takes to be successfully completed is through preparation and the right choice of advisers. Our team is experienced in the authorisation process of EEA and UK regulators and in addition to successfully advancing emoney, payments and MiFID authorisations has also worked on the successful authorisation of an EU bank. Contact us here and follow Peter Oakes and CompliReg on Linkedin.

0 Comments

Read More

Back to Blog

Barclays wins UK Supreme Court case over push payment fraud - but it's not over, yet!Wednesday 12th July 2023 - Barclays wins UK Supreme Court case over push payment fraud - but it is not over until the fat lady sings! Definitely important for Irish banks, #fintech &consumers alike when it comes to #paymentfraud. This is especially so because Ireland doesn't have the exact equivalent of the new UK's FCA 'consumer duty', which to my mind is not detrimentally impacted by the decision. While English court decisions are not binding in Ireland, Irish courts may be persuaded by English (and other jurisdiction's courts) decisions. English decisions are very often cited in Irish courts. Thus this decision by the UK Supreme Court is very important. Details:

Upshot: The UK Supreme Court stated that the order of the judge in previous proceedings granting Barclay's summary judgment stands. Mrs Phiilipp's is done but not out in her attempts to recover the £700,000: Mrs Philipp is permitted to maintain an alternative claim based on the Bank's alleged failure to act promptly to try to recall the payments after the fraud was discovered. In the Court's view, the questions (i) whether the Bank owed such a duty and (ii) whether there was any realistic chance that the money would have been recovered if attempts had been made to recall the payments sooner cannot be decided without a fuller investigation of the facts. This alternative claim should therefore not have been summarily dismissed. Mrs Philipp has an alternative claim that the Bank was in breach of duty in not acting promptly to try to recall the payments made to the UAE after being notified of the fraud. In the Court's view, the questions (i) whether the Bank owed such a duty and (ii) whether there was any realistic chance that the money would have been recovered if attempts had been made to recall the payments sooner cannot be decided without a fuller investigation of the facts. This alternative claim should therefore not have been summarily dismissed. New UK FCA Consumer Duty: By the way, under the UK Consumer Duty, firms must take proactive & reactive steps to avoid causing harm to customers through their conduct, products or services where it is in a firm’s control to do so. The FCA has specifically stated that an example of 'causing harm' is where consumers become victims of scams relating to their financial products for example, due to a firm’s inadequate systems to detect/prevent scams or inadequate processes to design, test, tailor and monitor the effectiveness of scam warning messages presented to customers. In fact on page 99 of its final guidance, the FCA provides a 'good example' of circumstances of how a payments firm should consider how it can best design its processes to help identify suspicious payments and mitigate the risk of poor customer outcomes.

|

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]