AuthorPeter Oakes is an experienced anti-financial crime, fintech and board director professional. Archives

January 2025

Categories

All

|

Back to Blog

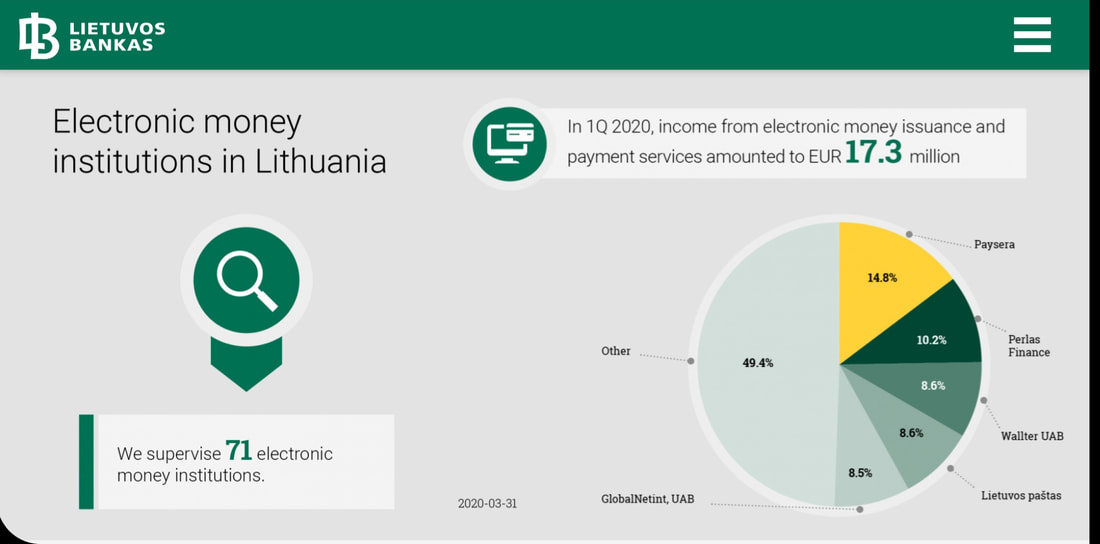

If you use all or any part of this blog, please ensure you cite and credit CompliReg and Peter Oakes in your re-use of this blog. Another electronic money institution (EMI) fined and sanctioned in Lithuania for anti-money laundering regulatory requirements and in this case also for an equity capital requirement failure. While the case is worth noting for both aspects, it is particularly so because across Europe, following the collapse of Wirecard, there will be continuing heightened awareness of both safeguarding and capitalisation of regulated EMIs and payment institutions (PIs). The case also makes known that the BoL is conducting targeted inspections of EMIs across a range of themes. In our previous blog, 2 June 2020, on the Lithuanian Central Bank (Bank of Lithuania / BoL) giving banks guidelines on opening accounts for electronic money institutions (EMIs) and payment institutions (PIs) Peter Oakes noted recent examples of fines against EMIs/PIs including failures to comply with requirements for: (i) anti-money laundering; (ii) safeguarding of customer funds; and (iii) segregation of customer funds and; execution of payment transactions. The Bank of Lithuania, which supervises 71 EMIs - which is the largest number of EMIs supervised by an EU financial regulator national competent authority* - has announced that it has taken regulatory action against Via Payments UAB for both: (1) violations of the requirements for prevention of money laundering and terrorist financing (sanctioned with a fine of €120,000 and publicity); and (2) failure to meet the equity capital requirement (sanctioned with publicity only). Via Payments UAB holds an electronic money institution licence, issued on 10 October 2017. As you will see from the graphic below, in addition to BoL supervising 71 EMIs we also learn that Q1 2020 income from EMI and payment services amounted to €17.3 million. Keep reading below for the background to the facts of the Via Payments UAB enforcement action. (1) Background to the money laundering law violations:

The regulatory actions were taken on foot of a "targeted inspection of the electronic money institution Via Payments UAB". During the course of the inspection, the Supervision Service of the BoL identified breaches of the Republic of Lithuania Law on the Prevention of Money Laundering and Terrorist Financing. In addition to a fine of €120,000, the BoL obligated Via Payments to remedy the deficiencies. BoL says that Via Payments has confirmed that all deficiencies have been remediated. With respect to the money laundering violations, the inspection revealed that:

BoL imposed a fine of €120,000 on Via Payments UAB. As part of its mitigation Via Payments informed the BoL’s Supervision Service that it had already taken measures to strengthen its AML compliance by increasing the number of specialists and improving technological solutions. (2) background to the equity capital requirement failure This regulatory failure came to the attention of the BoL through a separate analysis of the activities of EMIs. Here the Supervision Service of the BoL recorded that Via Payments violated legal acts because as at 31 March 2020 the company “failed to meet the equity capital requirement”. The BoL appears to have place a lot of reliance on the institution having “eliminated the indicated shortcomings without further delay, no interests of their clients have been violated” and therefore BoL “decided to impose a mild enforcement measure by making these infringements public”. * Note that notwithstanding that the UK is in a post-Brexit transition period, it left the European Union on 31 January 2020. Accordingly, Lithuania although it may have fewer EMIs than the UK, it records the largest number of EMIs in the European Union. Sources:

This blog written by Peter Oakes. Peter advises on Lithuanian EMI/PI issues and advised on the authorisation of one Lithuania's first special bank authorisations. If you require a licence to operate in Lithuania, Ireland, Cyprus, Malta or the UK, see our Authorisation Page. We have a great network of experts in each country too, from lawyers, to accountants to technical experts. And get in contact if you have a question about this blog.

0 Comments

Read More

Back to Blog

This post first appeared on Peter Oakes's Linkedin Page on 3 July 2020. Given the high level of interest in the post, we have published further information here about the details of the case.

One for the money laundering typologies. This is a useful example to demonstrate how a corrupt solicitor can launder money for clients. ow many times has the compliance department been told "Hey its OK, the client is being vouched for by his / it's lawyer. We don't need proof of source of funds or wealth". Well here's the story of the gangsters' 'go to' solicitor.

Read more at: 2 July 2020 - Solicitor jailed over money laundering links is now struck off 8 January 2019 - 'Go to' solicitor for dodgy property deals jailed for seven years 7 January 2019 - Corrupt lawyer, 39, linked to police killer Dale Cregan is jailed for seven years after he helped a buy-to-let landlord use dirty money to fraudulently build a £10.8m property empire - For advice and training on anti-money laundering and counter-terrorist financing contact Peter Oakes at CompliReg.

Back to Blog

Australian Bank giant Westpac is expecting to fork out more than $1 billion as a result of its money laundering scandal and admitting to 23 million anti-money laundering breaches.

It's not just story about culture, conduct risk and financial crime risks. Far more importantly, it is a story of shame, leadership failure and financial pain for Westpac and relief for another Aussie bank. The fine would be the biggest corporate fine in Australian history. Westpac has revealed it expects the ongoing AUSTRAC investigation will cost it $1.03 billion. Such a fine will represent about 15% of the bank's 2019 profit. Shame: In November last year AUSTRAC, the entity responsible for preventing financial crimes, said the bank had violated anti-money laundering and counter-terrorism laws more than 23 million times (which the bank admits), allowing money tied to child exploitation in south-east Asia to flow freely. For example, Westpac's system was used by paedophiles to send money to the Philippines to pay for child abuse material without raising any red flags. Notwithstanding Westpac's admission, the bank is not going down without a fight. In the 57-page defence document filed with the court, Westpac denied AUSTRAC'S accusation that it failed to identify activity indicative of child exploitation risks. Leadership Failure: The scandal brought down Westpac's leadership, forcing the resignation of chief executive Brian Hartzer and the early retirement of chairman Lindsay Maxsted. Financial Pain: Last year Australian financial press reported that a penalty or settlement of $2 billion or $3 billion would see its CET1 ratio falling below 10.5% meaning the bank would be forced into another equity raising. And the trouble doesn't stop there for Westpac as the corporate regulator, ASIC, is probing into Westpac's previous $2.5 billion equity raise. Relief: Commonwealth Bank will be delighted to pass the mantle of the indignity of Australia's current money laundering record fine of $700 million to Westpac (Commonwealth Bank was fined for systemically failing to report around 54,000 suspicious transactions made through its "intelligent deposit machines"). If you want more on the story from the media, there are updates on an almost weekly basis - soon I guess daily basis. Just use this link to keep track of the story: "Westpac Austrac money laundering fine". And add case to your case studies and typologies in your AML / CTF training for everything from CDD, transaction monitoring, risk assessment, culture, condusct risk and (lack of) crisis management. Peter Oakes, Founder, CompliReg Peter Oakes is an experience anti-financial crime, fintech and board director professional. He served as Ireland's first Director of Enforcement and Financial Crime Supervision at the Central Bank of Ireland (2010-2013) in the aftermath of the financial crisis, leading the investigation and enforcement efforts into the Irish banking industry. Peter is a regular contributor to, and moderator and panel member at, ACAMS events. |

© CompliReg.com Dublin 2, Ireland ph +353 1 639 2971

| www.complireg.com | officeATcomplireg.com [replace AT with @]

| www.complireg.com | officeATcomplireg.com [replace AT with @]